UNDERGRADUATE CATALOG - Mercy College

UNDERGRADUATE CATALOG - Mercy College

UNDERGRADUATE CATALOG - Mercy College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

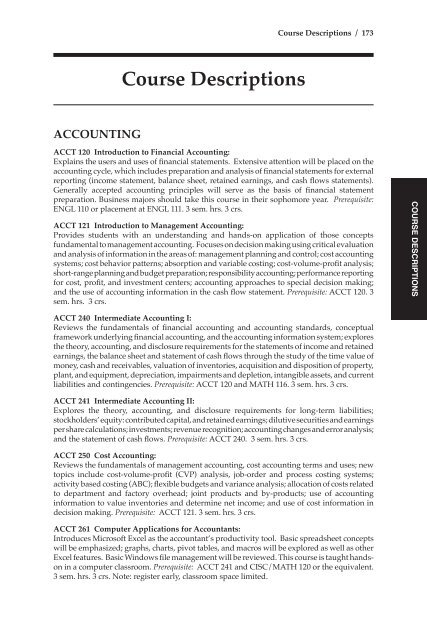

Course Descriptions / 173<br />

Course Descriptions<br />

Accounting<br />

ACCT 120 Introduction to Financial Accounting:<br />

Explains the users and uses of financial statements. Extensive attention will be placed on the<br />

accounting cycle, which includes preparation and analysis of financial statements for external<br />

reporting (income statement, balance sheet, retained earnings, and cash flows statements).<br />

Generally accepted accounting principles will serve as the basis of financial statement<br />

preparation. Business majors should take this course in their sophomore year. Prerequisite:<br />

ENGL 110 or placement at ENGL 111. 3 sem. hrs. 3 crs.<br />

ACCT 121 Introduction to Management Accounting:<br />

Provides students with an understanding and hands-on application of those concepts<br />

fundamental to management accounting. Focuses on decision making using critical evaluation<br />

and analysis of information in the areas of: management planning and control; cost accounting<br />

systems; cost behavior patterns; absorption and variable costing; cost-volume-profit analysis;<br />

short-range planning and budget preparation; responsibility accounting; performance reporting<br />

for cost, profit, and investment centers; accounting approaches to special decision making;<br />

and the use of accounting information in the cash flow statement. Prerequisite: ACCT 120. 3<br />

sem. hrs. 3 crs.<br />

COURSE DESCRIPTIONS<br />

ACCT 240 Intermediate Accounting I:<br />

Reviews the fundamentals of financial accounting and accounting standards, conceptual<br />

framework underlying financial accounting, and the accounting information system; explores<br />

the theory, accounting, and disclosure requirements for the statements of income and retained<br />

earnings, the balance sheet and statement of cash flows through the study of the time value of<br />

money, cash and receivables, valuation of inventories, acquisition and disposition of property,<br />

plant, and equipment, depreciation, impairments and depletion, intangible assets, and current<br />

liabilities and contingencies. Prerequisite: ACCT 120 and MATH 116. 3 sem. hrs. 3 crs.<br />

ACCT 241 Intermediate Accounting II:<br />

Explores the theory, accounting, and disclosure requirements for long-term liabilities;<br />

stockholders’ equity: contributed capital, and retained earnings; dilutive securities and earnings<br />

per share calculations; investments; revenue recognition; accounting changes and error analysis;<br />

and the statement of cash flows. Prerequisite: ACCT 240. 3 sem. hrs. 3 crs.<br />

ACCT 250 Cost Accounting:<br />

Reviews the fundamentals of management accounting, cost accounting terms and uses; new<br />

topics include cost-volume-profit (CVP) analysis, job-order and process costing systems;<br />

activity based costing (ABC); flexible budgets and variance analysis; allocation of costs related<br />

to department and factory overhead; joint products and by-products; use of accounting<br />

information to value inventories and determine net income; and use of cost information in<br />

decision making. Prerequisite: ACCT 121. 3 sem. hrs. 3 crs.<br />

ACCT 261 Computer Applications for Accountants:<br />

Introduces Microsoft Excel as the accountant’s productivity tool. Basic spreadsheet concepts<br />

will be emphasized; graphs, charts, pivot tables, and macros will be explored as well as other<br />

Excel features. Basic Windows file management will be reviewed. This course is taught handson<br />

in a computer classroom. Prerequisite: ACCT 241 and CISC/MATH 120 or the equivalent.<br />

3 sem. hrs. 3 crs. Note: register early, classroom space limited.