Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

uildings and water supply. The $38.16 milli<strong>on</strong> capital expenditure for 2014 mainly relates to plant and<br />

infrastructure costs incurred in establishing the mine for the six m<strong>on</strong>ths to 31 December 2014. The cash<br />

inflow <strong>of</strong> $0.88 milli<strong>on</strong> for 2019 in Case 1 and 2021 in Case 2 relates to the sale <strong>of</strong> plant and equipment <strong>of</strong><br />

$2.08 milli<strong>on</strong>, <strong>of</strong>fset by mine closure costs <strong>of</strong> $1.2 milli<strong>on</strong>.<br />

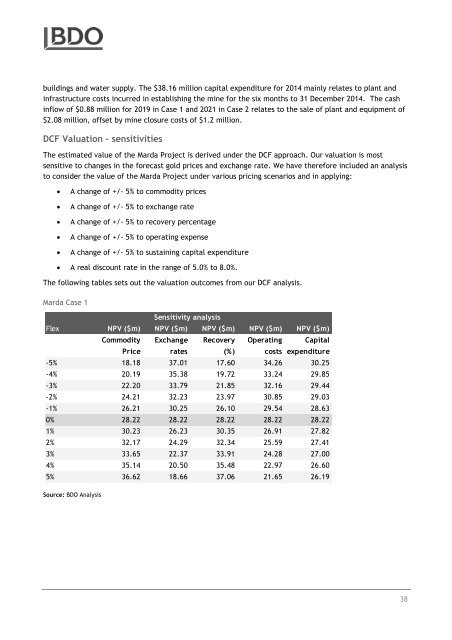

DCF Valuati<strong>on</strong> – sensitivities<br />

The estimated value <strong>of</strong> the Marda Project is derived under the DCF approach. Our valuati<strong>on</strong> is most<br />

sensitive to changes in the forecast gold prices and exchange rate. We have therefore included an analysis<br />

to c<strong>on</strong>sider the value <strong>of</strong> the Marda Project under various pricing scenarios and in applying:<br />

• A change <strong>of</strong> +/- 5% to commodity prices<br />

• A change <strong>of</strong> +/- 5% to exchange rate<br />

• A change <strong>of</strong> +/- 5% to recovery percentage<br />

• A change <strong>of</strong> +/- 5% to operating expense<br />

• A change <strong>of</strong> +/- 5% to sustaining capital expenditure<br />

• A real discount rate in the range <strong>of</strong> 5.0% to 8.0%.<br />

The following tables sets out the valuati<strong>on</strong> outcomes from our DCF analysis.<br />

Marda Case 1<br />

Flex NPV ($m) NPV ($m) NPV ($m) NPV ($m) NPV ($m)<br />

Commodity<br />

Price<br />

Sensitivity analysis<br />

Exchange<br />

rates<br />

Recovery<br />

(%)<br />

Operating<br />

costs<br />

Capital<br />

expenditure<br />

-5% 18.18 37.01 17.60 34.26 30.25<br />

-4% 20.19 35.38 19.72 33.24 29.85<br />

-3% 22.20 33.79 21.85 32.16 29.44<br />

-2% 24.21 32.23 23.97 30.85 29.03<br />

-1% 26.21 30.25 26.10 29.54 28.63<br />

0% 28.22 28.22 28.22 28.22 28.22<br />

1% 30.23 26.23 30.35 26.91 27.82<br />

2% 32.17 24.29 32.34 25.59 27.41<br />

3% 33.65 22.37 33.91 24.28 27.00<br />

4% 35.14 20.50 35.48 22.97 26.60<br />

5% 36.62 18.66 37.06 21.65 26.19<br />

Source: BDO Analysis<br />

38