Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

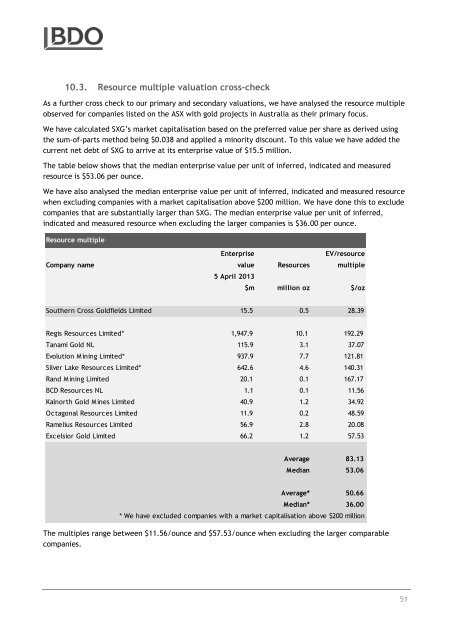

10.3. Resource multiple valuati<strong>on</strong> cross-check<br />

As a further cross check to our primary and sec<strong>on</strong>dary valuati<strong>on</strong>s, we have analysed the resource multiple<br />

observed for companies listed <strong>on</strong> the ASX <strong>with</strong> gold projects in Australia as their primary focus.<br />

We have calculated SXG’s market capitalisati<strong>on</strong> based <strong>on</strong> the preferred value per share as derived using<br />

the sum-<strong>of</strong>-parts method being $0.038 and applied a minority discount. To this value we have added the<br />

current net debt <strong>of</strong> SXG to arrive at its enterprise value <strong>of</strong> $15.5 milli<strong>on</strong>.<br />

The table below shows that the median enterprise value per unit <strong>of</strong> inferred, indicated and measured<br />

resource is $53.06 per ounce.<br />

We have also analysed the median enterprise value per unit <strong>of</strong> inferred, indicated and measured resource<br />

when excluding companies <strong>with</strong> a market capitalisati<strong>on</strong> above $200 milli<strong>on</strong>. We have d<strong>on</strong>e this to exclude<br />

companies that are substantially larger than SXG. The median enterprise value per unit <strong>of</strong> inferred,<br />

indicated and measured resource when excluding the larger companies is $36.00 per ounce.<br />

Resource multiple<br />

Company name<br />

Enterprise<br />

value Resources<br />

EV/resource<br />

multiple<br />

5 April 2013<br />

$m milli<strong>on</strong> oz $/oz<br />

Southern Cross Goldfields Limited 15.5 0.5 28.39<br />

Regis Resources Limited* 1,947.9 10.1 192.29<br />

Tanami Gold NL 115.9 3.1 37.07<br />

Evoluti<strong>on</strong> M ining Limited* 937.9 7.7 121.81<br />

Silver Lake Resources Limited* 642.6 4.6 140.31<br />

Rand Mining Limited 20.1 0.1 167.17<br />

BCD Resources NL 1.1 0.1 11.56<br />

Kalnorth Gold Mines Limited 40.9 1.2 34.92<br />

Octag<strong>on</strong>al Resources Limited 11.9 0.2 48.59<br />

Ramelius Resources Limited 56.9 2.8 20.08<br />

Excelsior Gold Limited 66.2 1.2 57.53<br />

Average 83.13<br />

Median 53.06<br />

Average*<br />

Median*<br />

50.66<br />

36.00<br />

* We have excluded companies <strong>with</strong> a market capitalisati<strong>on</strong> above $200 milli<strong>on</strong><br />

The multiples range between $11.56/ounce and $57.53/ounce when excluding the larger comparable<br />

companies.<br />

51