Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

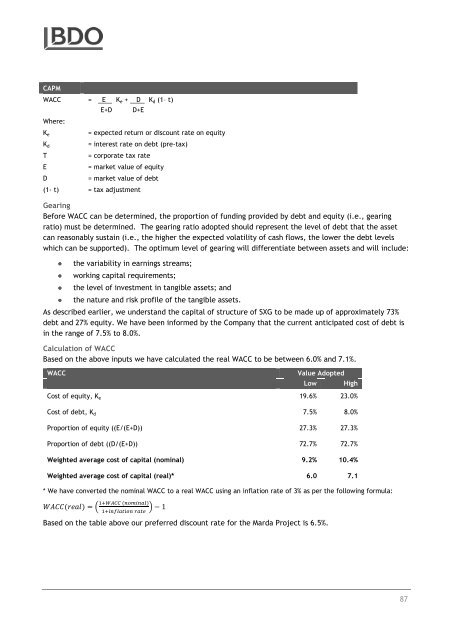

CAPM<br />

WACC = E K e + D K d (1– t)<br />

Where:<br />

K e<br />

K d<br />

T<br />

E<br />

D<br />

E+D<br />

D+E<br />

= expected return or discount rate <strong>on</strong> equity<br />

= interest rate <strong>on</strong> debt (pre-tax)<br />

= corporate tax rate<br />

= market value <strong>of</strong> equity<br />

= market value <strong>of</strong> debt<br />

(1- t) = tax adjustment<br />

Gearing<br />

Before WACC can be determined, the proporti<strong>on</strong> <strong>of</strong> funding provided by debt and equity (i.e., gearing<br />

ratio) must be determined. The gearing ratio adopted should represent the level <strong>of</strong> debt that the asset<br />

can reas<strong>on</strong>ably sustain (i.e., the higher the expected volatility <strong>of</strong> cash flows, the lower the debt levels<br />

which can be supported). The optimum level <strong>of</strong> gearing will differentiate between assets and will include:<br />

• the variability in earnings streams;<br />

• working capital requirements;<br />

• the level <strong>of</strong> investment in tangible assets; and<br />

• the nature and risk pr<strong>of</strong>ile <strong>of</strong> the tangible assets.<br />

As described earlier, we understand the capital <strong>of</strong> structure <strong>of</strong> SXG to be made up <strong>of</strong> approximately 73%<br />

debt and 27% equity. We have been informed by the Company that the current anticipated cost <strong>of</strong> debt is<br />

in the range <strong>of</strong> 7.5% to 8.0%.<br />

Calculati<strong>on</strong> <strong>of</strong> WACC<br />

Based <strong>on</strong> the above inputs we have calculated the real WACC to be between 6.0% and 7.1%.<br />

WACC<br />

Value Adopted<br />

Low<br />

High<br />

Cost <strong>of</strong> equity, K e 19.6% 23.0%<br />

Cost <strong>of</strong> debt, K d 7.5% 8.0%<br />

Proporti<strong>on</strong> <strong>of</strong> equity ((E/(E+D)) 27.3% 27.3%<br />

Proporti<strong>on</strong> <strong>of</strong> debt ((D/(E+D)) 72.7% 72.7%<br />

Weighted average cost <strong>of</strong> capital (nominal) 9.2% 10.4%<br />

Weighted average cost <strong>of</strong> capital (real)* 6.0 7.1<br />

* We have c<strong>on</strong>verted the nominal WACC to a real WACC using an inflati<strong>on</strong> rate <strong>of</strong> 3% as per the following formula:<br />

()<br />

( ) = − 1<br />

<br />

Based <strong>on</strong> the table above our preferred discount rate for the Marda Project is 6.5%.<br />

87