Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

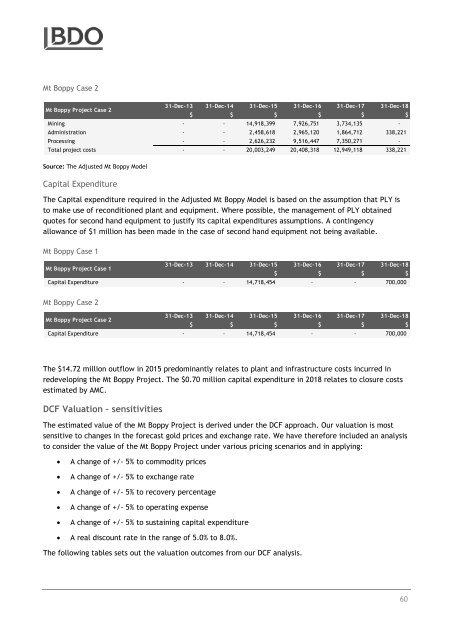

Mt Boppy Case 2<br />

Mt Boppy Project Case 2<br />

31-Dec-13 31-Dec-14 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18<br />

$ $ $ $ $ $<br />

Mining - - 14,918,399 7,926,751 3,734,135 -<br />

Administrati<strong>on</strong> - - 2,458,618 2,965,120 1,864,712 338,221<br />

Processing - - 2,626,232 9,516,447 7,350,271 -<br />

Total project costs - - 20,003,249 20,408,318 12,949,118 338,221<br />

Source: The Adjusted Mt Boppy Model<br />

Capital Expenditure<br />

The Capital expenditure required in the Adjusted Mt Boppy Model is based <strong>on</strong> the assumpti<strong>on</strong> that PLY is<br />

to make use <strong>of</strong> rec<strong>on</strong>diti<strong>on</strong>ed plant and equipment. Where possible, the management <strong>of</strong> PLY obtained<br />

quotes for sec<strong>on</strong>d hand equipment to justify its capital expenditures assumpti<strong>on</strong>s. A c<strong>on</strong>tingency<br />

allowance <strong>of</strong> $1 milli<strong>on</strong> has been made in the case <strong>of</strong> sec<strong>on</strong>d hand equipment not being available.<br />

Mt Boppy Case 1<br />

31-Dec-13 31-Dec-14 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18<br />

Mt Boppy Project Case 1<br />

$ $ $ $<br />

Capital Expenditure - - 14,718,454 - - 700,000<br />

Mt Boppy Case 2<br />

31-Dec-13 31-Dec-14 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18<br />

Mt Boppy Project Case 2<br />

$ $ $ $ $ $<br />

Capital Expenditure - - 14,718,454 - - 700,000<br />

The $14.72 milli<strong>on</strong> outflow in 2015 predominantly relates to plant and infrastructure costs incurred in<br />

redeveloping the Mt Boppy Project. The $0.70 milli<strong>on</strong> capital expenditure in 2018 relates to closure costs<br />

estimated by AMC.<br />

DCF Valuati<strong>on</strong> – sensitivities<br />

The estimated value <strong>of</strong> the Mt Boppy Project is derived under the DCF approach. Our valuati<strong>on</strong> is most<br />

sensitive to changes in the forecast gold prices and exchange rate. We have therefore included an analysis<br />

to c<strong>on</strong>sider the value <strong>of</strong> the Mt Boppy Project under various pricing scenarios and in applying:<br />

• A change <strong>of</strong> +/- 5% to commodity prices<br />

• A change <strong>of</strong> +/- 5% to exchange rate<br />

• A change <strong>of</strong> +/- 5% to recovery percentage<br />

• A change <strong>of</strong> +/- 5% to operating expense<br />

• A change <strong>of</strong> +/- 5% to sustaining capital expenditure<br />

• A real discount rate in the range <strong>of</strong> 5.0% to 8.0%.<br />

The following tables sets out the valuati<strong>on</strong> outcomes from our DCF analysis.<br />

60