Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

Update on Merger with Polymetals - Notice of Meeting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

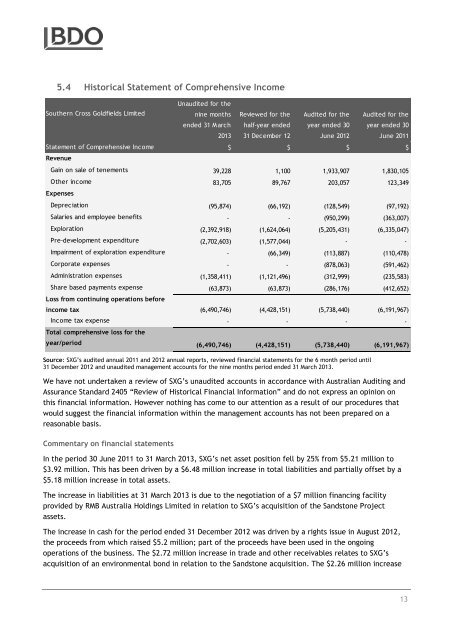

5.4 Historical Statement <strong>of</strong> Comprehensive Income<br />

Southern Cross Goldfields Limited<br />

Unaudited for the<br />

nine m<strong>on</strong>ths<br />

ended 31 M arch<br />

2013<br />

Reviewed for the<br />

half-year ended<br />

31 December 12<br />

Audited for the<br />

year ended 30<br />

June 2012<br />

Audited for the<br />

year ended 30<br />

June 2011<br />

Statement <strong>of</strong> Comprehensive Income $ $ $ $<br />

Revenue<br />

Gain <strong>on</strong> sale <strong>of</strong> tenements 39,228 1,100 1,933,907 1,830,105<br />

Other income 83,705 89,767 203,057 123,349<br />

Expenses<br />

Depreciati<strong>on</strong> (95,874) (66,192) (128,549) (97,192)<br />

Salaries and employee benefits - - (950,299) (363,007)<br />

Explorati<strong>on</strong> (2,392,918) (1,624,064) (5,205,431) (6,335,047)<br />

Pre-development expenditure (2,702,603) (1,577,044) - -<br />

Impairment <strong>of</strong> explorati<strong>on</strong> expenditure - (66,349) (113,887) (110,478)<br />

Corporate expenses - - (878,063) (591,462)<br />

Administrati<strong>on</strong> expenses (1,358,411) (1,121,496) (312,999) (235,583)<br />

Share based payments expense (63,873) (63,873) (286,176) (412,652)<br />

Loss from c<strong>on</strong>tinuing operati<strong>on</strong>s before<br />

income tax (6,490,746) (4,428,151) (5,738,440) (6,191,967)<br />

Income tax expense - - - -<br />

Total comprehensive loss for the<br />

year/period (6,490,746) (4,428,151) (5,738,440) (6,191,967)<br />

Source: SXG’s audited annual 2011 and 2012 annual reports, reviewed financial statements for the 6 m<strong>on</strong>th period until<br />

31 December 2012 and unaudited management accounts for the nine m<strong>on</strong>ths period ended 31 March 2013.<br />

We have not undertaken a review <strong>of</strong> SXG’s unaudited accounts in accordance <strong>with</strong> Australian Auditing and<br />

Assurance Standard 2405 “Review <strong>of</strong> Historical Financial Informati<strong>on</strong>” and do not express an opini<strong>on</strong> <strong>on</strong><br />

this financial informati<strong>on</strong>. However nothing has come to our attenti<strong>on</strong> as a result <strong>of</strong> our procedures that<br />

would suggest the financial informati<strong>on</strong> <strong>with</strong>in the management accounts has not been prepared <strong>on</strong> a<br />

reas<strong>on</strong>able basis.<br />

Commentary <strong>on</strong> financial statements<br />

In the period 30 June 2011 to 31 March 2013, SXG’s net asset positi<strong>on</strong> fell by 25% from $5.21 milli<strong>on</strong> to<br />

$3.92 milli<strong>on</strong>. This has been driven by a $6.48 milli<strong>on</strong> increase in total liabilities and partially <strong>of</strong>fset by a<br />

$5.18 milli<strong>on</strong> increase in total assets.<br />

The increase in liabilities at 31 March 2013 is due to the negotiati<strong>on</strong> <strong>of</strong> a $7 milli<strong>on</strong> financing facility<br />

provided by RMB Australia Holdings Limited in relati<strong>on</strong> to SXG’s acquisiti<strong>on</strong> <strong>of</strong> the Sandst<strong>on</strong>e Project<br />

assets.<br />

The increase in cash for the period ended 31 December 2012 was driven by a rights issue in August 2012,<br />

the proceeds from which raised $5.2 milli<strong>on</strong>; part <strong>of</strong> the proceeds have been used in the <strong>on</strong>going<br />

operati<strong>on</strong>s <strong>of</strong> the business. The $2.72 milli<strong>on</strong> increase in trade and other receivables relates to SXG’s<br />

acquisiti<strong>on</strong> <strong>of</strong> an envir<strong>on</strong>mental b<strong>on</strong>d in relati<strong>on</strong> to the Sandst<strong>on</strong>e acquisiti<strong>on</strong>. The $2.26 milli<strong>on</strong> increase<br />

13