01 - Department of Education and Communities - NSW Government

01 - Department of Education and Communities - NSW Government

01 - Department of Education and Communities - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

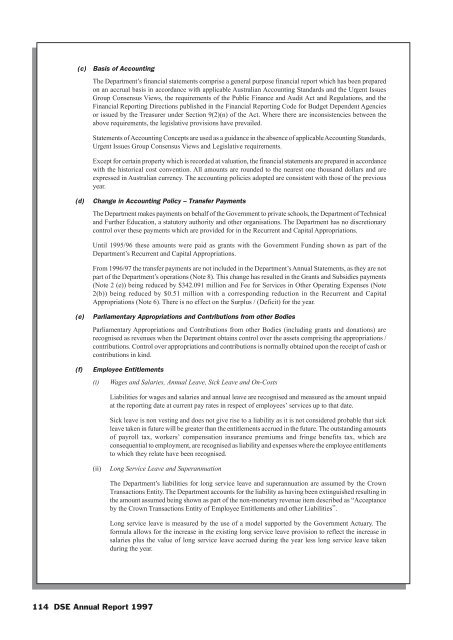

(c)Basis <strong>of</strong> AccountingThe <strong>Department</strong>’s financial statements comprise a general purpose financial report which has been preparedon an accrual basis in accordance with applicable Australian Accounting St<strong>and</strong>ards <strong>and</strong> the Urgent IssuesGroup Consensus Views, the requirements <strong>of</strong> the Public Finance <strong>and</strong> Audit Act <strong>and</strong> Regulations, <strong>and</strong> theFinancial Reporting Directions published in the Financial Reporting Code for Budget Dependent Agenciesor issued by the Treasurer under Section 9(2)(n) <strong>of</strong> the Act. Where there are inconsistencies between theabove requirements, the legislative provisions have prevailed.Statements <strong>of</strong> Accounting Concepts are used as a guidance in the absence <strong>of</strong> applicable Accounting St<strong>and</strong>ards,Urgent Issues Group Consensus Views <strong>and</strong> Legislative requirements.Except for certain property which is recorded at valuation, the financial statements are prepared in accordancewith the historical cost convention. All amounts are rounded to the nearest one thous<strong>and</strong> dollars <strong>and</strong> areexpressed in Australian currency. The accounting policies adopted are consistent with those <strong>of</strong> the previousyear.(d)Change in Accounting Policy – Transfer PaymentsThe <strong>Department</strong> makes payments on behalf <strong>of</strong> the <strong>Government</strong> to private schools, the <strong>Department</strong> <strong>of</strong> Technical<strong>and</strong> Further <strong>Education</strong>, a statutory authority <strong>and</strong> other organisations. The <strong>Department</strong> has no discretionarycontrol over these payments which are provided for in the Recurrent <strong>and</strong> Capital Appropriations.Until 1995/96 these amounts were paid as grants with the <strong>Government</strong> Funding shown as part <strong>of</strong> the<strong>Department</strong>’s Recurrent <strong>and</strong> Capital Appropriations.From 1996/97 the transfer payments are not included in the <strong>Department</strong>’s Annual Statements, as they are notpart <strong>of</strong> the <strong>Department</strong>’s operations (Note 8). This change has resulted in the Grants <strong>and</strong> Subsidies payments(Note 2 (e)) being reduced by $342.091 million <strong>and</strong> Fee for Services in Other Operating Expenses (Note2(b)) being reduced by $0.51 million with a corresponding reduction in the Recurrent <strong>and</strong> CapitalAppropriations (Note 6). There is no effect on the Surplus / (Deficit) for the year.(e)(f)Parliamentary Appropriations <strong>and</strong> Contributions from other BodiesParliamentary Appropriations <strong>and</strong> Contributions from other Bodies (including grants <strong>and</strong> donations) arerecognised as revenues when the <strong>Department</strong> obtains control over the assets comprising the appropriations /contributions. Control over appropriations <strong>and</strong> contributions is normally obtained upon the receipt <strong>of</strong> cash orcontributions in kind.Employee Entitlements(i)Wages <strong>and</strong> Salaries, Annual Leave, Sick Leave <strong>and</strong> On-CostsLiabilities for wages <strong>and</strong> salaries <strong>and</strong> annual leave are recognised <strong>and</strong> measured as the amount unpaidat the reporting date at current pay rates in respect <strong>of</strong> employees’ services up to that date.Sick leave is non vesting <strong>and</strong> does not give rise to a liability as it is not considered probable that sickleave taken in future will be greater than the entitlements accrued in the future. The outst<strong>and</strong>ing amounts<strong>of</strong> payroll tax, workers’ compensation insurance premiums <strong>and</strong> fringe benefits tax, which areconsequential to employment, are recognised as liability <strong>and</strong> expenses where the employee entitlementsto which they relate have been recognised.(ii)Long Service Leave <strong>and</strong> SuperannuationThe <strong>Department</strong>’s liabilities for long service leave <strong>and</strong> superannuation are assumed by the CrownTransactions Entity. The <strong>Department</strong> accounts for the liability as having been extinguished resulting inthe amount assumed being shown as part <strong>of</strong> the non-monetary revenue item described as “Acceptanceby the Crown Transactions Entity <strong>of</strong> Employee Entitlements <strong>and</strong> other Liabilities”.Long service leave is measured by the use <strong>of</strong> a model supported by the <strong>Government</strong> Actuary. Theformula allows for the increase in the existing long service leave provision to reflect the increase insalaries plus the value <strong>of</strong> long service leave accrued during the year less long service leave takenduring the year.114 DSE Annual Report 1997