01 - Department of Education and Communities - NSW Government

01 - Department of Education and Communities - NSW Government

01 - Department of Education and Communities - NSW Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

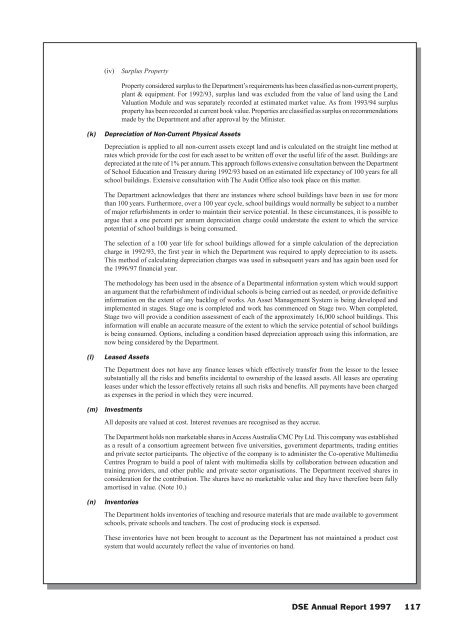

(iv)Surplus PropertyProperty considered surplus to the <strong>Department</strong>’s requirements has been classified as non-current property,plant & equipment. For 1992/93, surplus l<strong>and</strong> was excluded from the value <strong>of</strong> l<strong>and</strong> using the L<strong>and</strong>Valuation Module <strong>and</strong> was separately recorded at estimated market value. As from 1993/94 surplusproperty has been recorded at current book value. Properties are classified as surplus on recommendationsmade by the <strong>Department</strong> <strong>and</strong> after approval by the Minister.(k)Depreciation <strong>of</strong> Non-Current Physical AssetsDepreciation is applied to all non-current assets except l<strong>and</strong> <strong>and</strong> is calculated on the straight line method atrates which provide for the cost for each asset to be written <strong>of</strong>f over the useful life <strong>of</strong> the asset. Buildings aredepreciated at the rate <strong>of</strong> 1% per annum. This approach follows extensive consultation between the <strong>Department</strong><strong>of</strong> School <strong>Education</strong> <strong>and</strong> Treasury during 1992/93 based on an estimated life expectancy <strong>of</strong> 100 years for allschool buildings. Extensive consultation with The Audit Office also took place on this matter.The <strong>Department</strong> acknowledges that there are instances where school buildings have been in use for morethan 100 years. Furthermore, over a 100 year cycle, school buildings would normally be subject to a number<strong>of</strong> major refurbishments in order to maintain their service potential. In these circumstances, it is possible toargue that a one percent per annum depreciation charge could understate the extent to which the servicepotential <strong>of</strong> school buildings is being consumed.The selection <strong>of</strong> a 100 year life for school buildings allowed for a simple calculation <strong>of</strong> the depreciationcharge in 1992/93, the first year in which the <strong>Department</strong> was required to apply depreciation to its assets.This method <strong>of</strong> calculating depreciation charges was used in subsequent years <strong>and</strong> has again been used forthe 1996/97 financial year.The methodology has been used in the absence <strong>of</strong> a <strong>Department</strong>al information system which would supportan argument that the refurbishment <strong>of</strong> individual schools is being carried out as needed, or provide definitiveinformation on the extent <strong>of</strong> any backlog <strong>of</strong> works. An Asset Management System is being developed <strong>and</strong>implemented in stages. Stage one is completed <strong>and</strong> work has commenced on Stage two. When completed,Stage two will provide a condition assessment <strong>of</strong> each <strong>of</strong> the approximately 16,000 school buildings. Thisinformation will enable an accurate measure <strong>of</strong> the extent to which the service potential <strong>of</strong> school buildingsis being consumed. Options, including a condition based depreciation approach using this information, arenow being considered by the <strong>Department</strong>.(l)(m)Leased AssetsThe <strong>Department</strong> does not have any finance leases which effectively transfer from the lessor to the lesseesubstantially all the risks <strong>and</strong> benefits incidental to ownership <strong>of</strong> the leased assets. All leases are operatingleases under which the lessor effectively retains all such risks <strong>and</strong> benefits. All payments have been chargedas expenses in the period in which they were incurred.InvestmentsAll deposits are valued at cost. Interest revenues are recognised as they accrue.The <strong>Department</strong> holds non marketable shares in Access Australia CMC Pty Ltd. This company was establishedas a result <strong>of</strong> a consortium agreement between five universities, government departments, trading entities<strong>and</strong> private sector participants. The objective <strong>of</strong> the company is to administer the Co-operative MultimediaCentres Program to build a pool <strong>of</strong> talent with multimedia skills by collaboration between education <strong>and</strong>training providers, <strong>and</strong> other public <strong>and</strong> private sector organisations. The <strong>Department</strong> received shares inconsideration for the contribution. The shares have no marketable value <strong>and</strong> they have therefore been fullyamortised in value. (Note 10.)(n)InventoriesThe <strong>Department</strong> holds inventories <strong>of</strong> teaching <strong>and</strong> resource materials that are made available to governmentschools, private schools <strong>and</strong> teachers. The cost <strong>of</strong> producing stock is expensed.These inventories have not been brought to account as the <strong>Department</strong> has not maintained a product costsystem that would accurately reflect the value <strong>of</strong> inventories on h<strong>and</strong>.DSE Annual Report 1997 117