CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

NOTE 2. BASIS <strong>OF</strong> PRESENTATION <strong>OF</strong> CONSOLIDATED FINANCIAL STATEMENTS (continued)<br />

2.2 Functional and Presentation Currency (continued)<br />

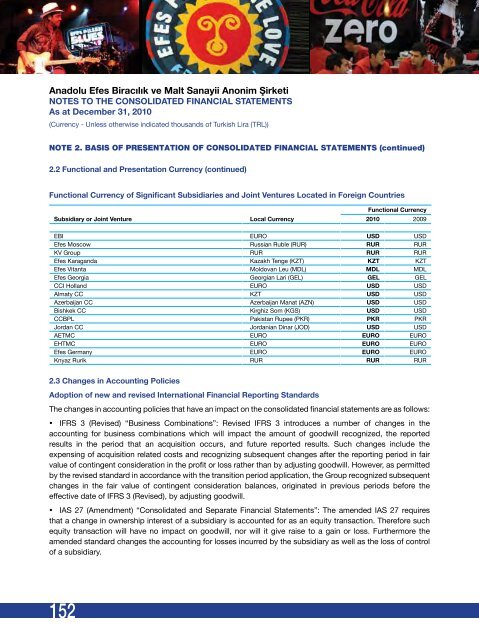

Functional Currency of Significant Subsidiaries and Joint Ventures Located in Foreign Countries<br />

Subsidiary or Joint Venture Local Currency<br />

152<br />

Functional Currency<br />

2010 2009<br />

EBI EURO USD USD<br />

Efes Moscow Russian Ruble (RUR) RUR RUR<br />

KV Group RUR RUR RUR<br />

Efes Karaganda Kazakh Tenge (KZT) KZT KZT<br />

Efes Vitanta Moldovan Leu (MDL) MDL MDL<br />

Efes Georgia Georgian Lari (GEL) GEL GEL<br />

CCI Holland EURO USD USD<br />

Almaty CC KZT USD USD<br />

Azerbaijan CC Azerbaijan Manat (AZN) USD USD<br />

Bishkek CC Kirghiz Som (KGS) USD USD<br />

CCBPL Pakistan Rupee (PKR) PKR PKR<br />

Jordan CC Jordanian Dinar (JOD) USD USD<br />

AETMC EURO EURO EURO<br />

EHTMC EURO EURO EURO<br />

Efes Germany EURO EURO EURO<br />

Knyaz Rurik RUR RUR RUR<br />

2.3 Changes in Accounting Policies<br />

Adoption of new and revised International Financial Reporting Standards<br />

The changes in accounting policies that have an impact on the consolidated financial statements are as follows:<br />

• IFRS 3 (Revised) “Business Combinations”: Revised IFRS 3 introduces a number of changes in the<br />

accounting for business combinations which will impact the amount of goodwill recognized, the reported<br />

results in the period that an acquisition occurs, and future reported results. Such changes include the<br />

expensing of acquisition related costs and recognizing subsequent changes after the reporting period in fair<br />

value of contingent consideration in the profit or loss rather than by adjusting goodwill. However, as permitted<br />

by the revised standard in accordance with the transition period application, the Group recognized subsequent<br />

changes in the fair value of contingent consideration balances, originated in previous periods before the<br />

effective date of IFRS 3 (Revised), by adjusting goodwill.<br />

• IAS 27 (Amendment) “Consolidated and Separate Financial Statements”: The amended IAS 27 requires<br />

that a change in ownership interest of a subsidiary is accounted for as an equity transaction. Therefore such<br />

equity transaction will have no impact on goodwill, nor will it give raise to a gain or loss. Furthermore the<br />

amended standard changes the accounting for losses incurred by the subsidiary as well as the loss of control<br />

of a subsidiary.