CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

NOTE 34. NON-CURRENT ASSETS AVAILABLE FOR SALE AND DISCONTINUING OPERATIONS<br />

None (December 31, 2009 - None).<br />

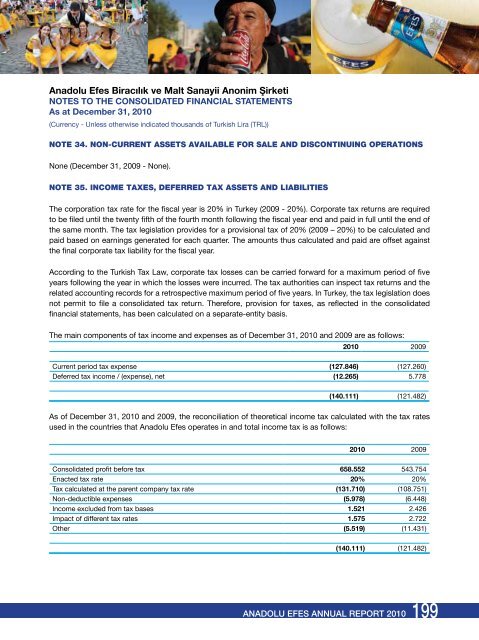

NOTE 35. INCOME TAXES, DEFERRED TAX ASSETS AND LIABILITIES<br />

The corporation tax rate for the fiscal year is 20% in Turkey (2009 - 20%). Corporate tax returns are required<br />

to be filed until the twenty fifth of the fourth month following the fiscal year end and paid in full until the end of<br />

the same month. The tax legislation provides for a provisional tax of 20% (2009 – 20%) to be calculated and<br />

paid based on earnings generated for each quarter. The amounts thus calculated and paid are offset against<br />

the final corporate tax liability for the fiscal year.<br />

According to the Turkish Tax Law, corporate tax losses can be carried forward for a maximum period of five<br />

years following the year in which the losses were incurred. The tax authorities can inspect tax returns and the<br />

related accounting records for a retrospective maximum period of five years. In Turkey, the tax legislation does<br />

not permit to file a consolidated tax return. Therefore, provision for taxes, as reflected in the consolidated<br />

financial statements, has been calculated on a separate-entity basis.<br />

The main components of tax income and expenses as of December 31, 2010 and 2009 are as follows:<br />

2010 2009<br />

Current period tax expense (127.846) (127.260)<br />

Deferred tax income / (expense), net (12.265) 5.778<br />

(140.111) (121.482)<br />

As of December 31, 2010 and 2009, the reconciliation of theoretical income tax calculated with the tax rates<br />

used in the countries that Anadolu Efes operates in and total income tax is as follows:<br />

2010 2009<br />

Consolidated profit before tax 658.552 543.754<br />

Enacted tax rate 20% 20%<br />

Tax calculated at the parent company tax rate (131.710) (108.751)<br />

Non-deductible expenses (5.978) (6.448)<br />

Income excluded from tax bases 1.521 2.426<br />

Impact of different tax rates 1.575 2.722<br />

Other (5.519) (11.431)<br />

(140.111) (121.482)<br />

<strong>ANADOLU</strong> <strong>EFES</strong> ANNUAL REPORT 2010<br />

199