- Page 1 and 2:

ANADOLU EFES ANNUAL REPORT 2010

- Page 3 and 4:

Commencing its operations in 1969 w

- Page 5 and 6:

An International Powerhouse… Reac

- Page 7 and 8:

owned. The majority shareholders, Y

- Page 9 and 10:

Soft Drinks Group Anadolu Efes cond

- Page 11 and 12:

ANADOLU EFES ANNUAL REPORT 2010 09

- Page 13 and 14:

Turkey Syria Jordan Georgia Iraq Az

- Page 15 and 16:

CAPItAL AND ShAREhOLDING StRUCtURE

- Page 17 and 18:

A pioneer in the beverage industry

- Page 19 and 20:

(1996). • Assets of Toros Biracı

- Page 21 and 22:

• CCİ reached an agreement to un

- Page 23 and 24:

• Kazakhstan’s first bottled dr

- Page 25 and 26:

ANADOLU EFES ANNUAL REPORT 2010 23

- Page 27 and 28:

ANADOLU EFES ANNUAL REPORT 2010 25

- Page 29 and 30:

We strengthened our position furthe

- Page 31 and 32:

guidance we forecasted that our 201

- Page 33 and 34:

cases in 2010. While we realized st

- Page 35 and 36:

Tuncay Özilhan - Chairman (1) Born

- Page 37 and 38:

authored more than 20 books and hun

- Page 39 and 40:

Chief Financial officer N. orhun K

- Page 41 and 42:

Ömer Öğün - Efes Kazakhstan Gen

- Page 43 and 44:

Berke Kardeş - Commercial Director

- Page 45 and 46:

N. orhun Köstem - Chief Financial

- Page 47 and 48:

Özlem Aykaç İğdelipınar - Chie

- Page 49 and 50:

We completed another successful yea

- Page 51 and 52:

While responding to changing consum

- Page 53 and 54:

Anadolu Efes has a 28 percent stake

- Page 55 and 56:

eer “Gusta”; the aromatized bee

- Page 57 and 58:

herlands-based EBI, which conducts

- Page 59 and 60:

to a beer market that has quadruple

- Page 61 and 62:

Expanding its market share and stre

- Page 63 and 64:

SOFt DRINKS - International All ope

- Page 65 and 66:

We add value to life… Anadolu Efe

- Page 67 and 68:

contemporary enterprises that ident

- Page 69 and 70:

economic and ethical priorities and

- Page 71 and 72:

the Arabia CSR Network, was given t

- Page 73 and 74:

developments and industrialization

- Page 75 and 76:

environment and its contributions t

- Page 77 and 78:

informed about the risks associated

- Page 79 and 80:

first and only Turkish team to win

- Page 81 and 82:

Anadolu Efes launched initiatives i

- Page 83 and 84:

• does not feature content claimi

- Page 85 and 86:

The Company does not employ child l

- Page 87 and 88:

Continued rise in profitability in

- Page 89 and 90:

sales and distribution of beer prod

- Page 91 and 92:

5 percent extra price increase to c

- Page 93 and 94:

In such a challenging year, Turkey

- Page 95 and 96:

two Turkish banks; USD 100 million

- Page 97 and 98:

Turkey Operation’s full year volu

- Page 99 and 100:

TRL 435.0 million and EBITDA margin

- Page 101 and 102:

Summary Tables Anadolu Efes Consoli

- Page 103 and 104:

turkey Beer Operations Highlighted

- Page 105 and 106:

Soft Drink operations (CCİ) Highli

- Page 107 and 108:

The official website of the Company

- Page 109 and 110:

ANADOLU EFES ANNUAL REPORT 2010 107

- Page 111 and 112:

We believe in Corporate Governance

- Page 113 and 114:

Our Company complies with and has i

- Page 115 and 116:

Our Company’s Annual Report and A

- Page 117 and 118:

Investor Relations Manager under th

- Page 119 and 120:

section, when the date of the finan

- Page 121 and 122:

12. Disclosure of the Persons Entit

- Page 123 and 124:

stakeholders is one of the key poli

- Page 125 and 126:

career and financial means granted,

- Page 127 and 128:

of the Company’s management. In a

- Page 129 and 130:

systems are being made against any

- Page 131 and 132:

conducts studies for building up a

- Page 133 and 134:

C. NET REVENUES Turkey Beer Interna

- Page 135 and 136:

at Anadolu Efes. Mr. Cüceloğlu ap

- Page 137 and 138:

REPORT OF THE BOARD OF AUDITORS Com

- Page 139 and 140:

ANADOLU EFES BİRACILIK VE MALT SAN

- Page 141 and 142:

Opinion 4. In our opinion, the acco

- Page 143 and 144:

Anadolu Efes Biracılık ve Malt Sa

- Page 145 and 146:

Anadolu Efes Biracılık ve Malt Sa

- Page 147 and 148:

Anadolu Efes Biracılık ve Malt Sa

- Page 149 and 150:

Anadolu Efes Biracılık ve Malt Sa

- Page 151 and 152:

Anadolu Efes Biracılık ve Malt Sa

- Page 153 and 154:

Anadolu Efes Biracılık ve Malt Sa

- Page 155 and 156:

Anadolu Efes Biracılık ve Malt Sa

- Page 157 and 158:

Anadolu Efes Biracılık ve Malt Sa

- Page 159 and 160:

Anadolu Efes Biracılık ve Malt Sa

- Page 161 and 162: Anadolu Efes Biracılık ve Malt Sa

- Page 163 and 164: Anadolu Efes Biracılık ve Malt Sa

- Page 165 and 166: Anadolu Efes Biracılık ve Malt Sa

- Page 167 and 168: Anadolu Efes Biracılık ve Malt Sa

- Page 169 and 170: Anadolu Efes Biracılık ve Malt Sa

- Page 171 and 172: Anadolu Efes Biracılık ve Malt Sa

- Page 173 and 174: Anadolu Efes Biracılık ve Malt Sa

- Page 175 and 176: Anadolu Efes Biracılık ve Malt Sa

- Page 177 and 178: Anadolu Efes Biracılık ve Malt Sa

- Page 179 and 180: Anadolu Efes Biracılık ve Malt Sa

- Page 181 and 182: Anadolu Efes Biracılık ve Malt Sa

- Page 183 and 184: Anadolu Efes Biracılık ve Malt Sa

- Page 185 and 186: Anadolu Efes Biracılık ve Malt Sa

- Page 187 and 188: Anadolu Efes Biracılık ve Malt Sa

- Page 189 and 190: Anadolu Efes Biracılık ve Malt Sa

- Page 191 and 192: Anadolu Efes Biracılık ve Malt Sa

- Page 193 and 194: Anadolu Efes Biracılık ve Malt Sa

- Page 195 and 196: Anadolu Efes Biracılık ve Malt Sa

- Page 197 and 198: Anadolu Efes Biracılık ve Malt Sa

- Page 199 and 200: Anadolu Efes Biracılık ve Malt Sa

- Page 201 and 202: Anadolu Efes Biracılık ve Malt Sa

- Page 203 and 204: Anadolu Efes Biracılık ve Malt Sa

- Page 205 and 206: Anadolu Efes Biracılık ve Malt Sa

- Page 207 and 208: Anadolu Efes Biracılık ve Malt Sa

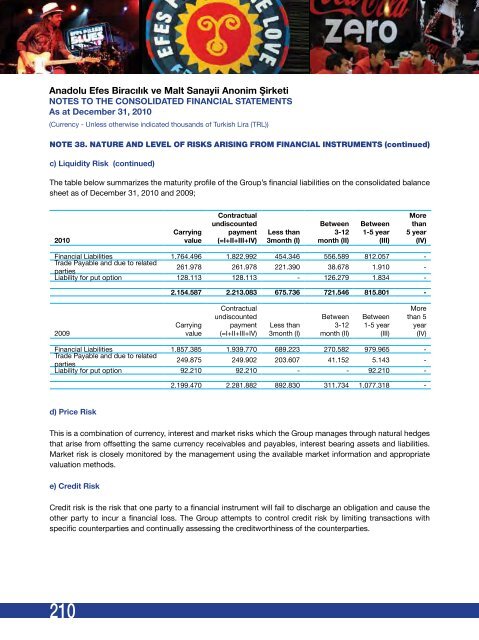

- Page 209 and 210: Anadolu Efes Biracılık ve Malt Sa

- Page 211: Anadolu Efes Biracılık ve Malt Sa

- Page 215 and 216: Anadolu Efes Biracılık ve Malt Sa

- Page 217 and 218: Anadolu Efes Biracılık ve Malt Sa