CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

NOTE 3. BUSINESS COMBINATIONS (continued)<br />

Transactions Related with 2009 (continued)<br />

Acquisitions (continued)<br />

In accordance with the change in the scope of consolidation and in conformity with IFRS 3, Group’s share<br />

of fair value difference amounting to TRL4.916 occurred from the financial statements of Turkmenistan CC<br />

prepared according to fair value basis was recorded by the Group as “fair value difference” in consolidated<br />

comprehensive income statement.<br />

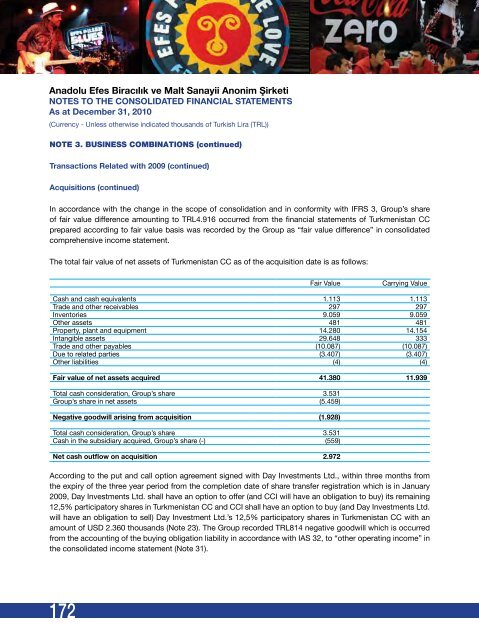

The total fair value of net assets of Turkmenistan CC as of the acquisition date is as follows:<br />

172<br />

Fair Value Carrying Value<br />

Cash and cash equivalents 1.113 1.113<br />

Trade and other receivables 297 297<br />

Inventories 9.059 9.059<br />

Other assets 481 481<br />

Property, plant and equipment 14.280 14.154<br />

Intangible assets 29.648 333<br />

Trade and other payables (10.087) (10.087)<br />

Due to related parties (3.407) (3.407)<br />

Other liabilities (4) (4)<br />

Fair value of net assets acquired 41.380 11.939<br />

Total cash consideration, Group’s share 3.531<br />

Group’s share in net assets (5.459)<br />

Negative goodwill arising from acquisition (1.928)<br />

Total cash consideration, Group’s share 3.531<br />

Cash in the subsidiary acquired, Group’s share (-) (559)<br />

Net cash outflow on acquisition 2.972<br />

According to the put and call option agreement signed with Day Investments Ltd., within three months from<br />

the expiry of the three year period from the completion date of share transfer registration which is in January<br />

2009, Day Investments Ltd. shall have an option to offer (and CCI will have an obligation to buy) its remaining<br />

12,5% participatory shares in Turkmenistan CC and CCI shall have an option to buy (and Day Investments Ltd.<br />

will have an obligation to sell) Day Investment Ltd.’s 12,5% participatory shares in Turkmenistan CC with an<br />

amount of USD 2.360 thousands (Note 23). The Group recorded TRL814 negative goodwill which is occurred<br />

from the accounting of the buying obligation liability in accordance with IAS 32, to “other operating income” in<br />

the consolidated income statement (Note 31).