CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

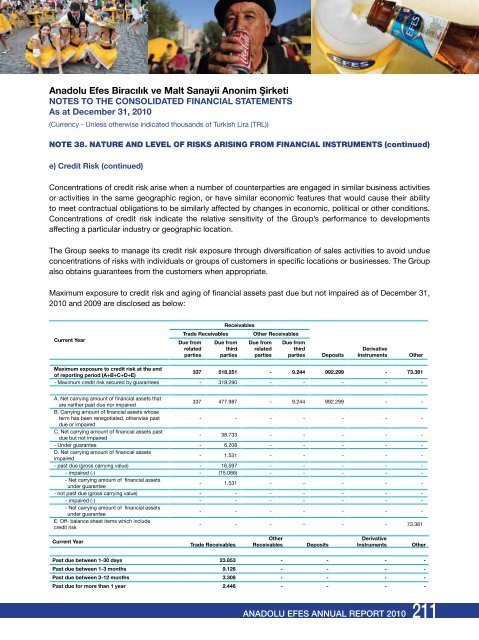

NOTE 38. NATURE AND LEVEL <strong>OF</strong> RISKS ARISING FROM FINANCIAL INSTRUMENTS (continued)<br />

e) Credit Risk (continued)<br />

Concentrations of credit risk arise when a number of counterparties are engaged in similar business activities<br />

or activities in the same geographic region, or have similar economic features that would cause their ability<br />

to meet contractual obligations to be similarly affected by changes in economic, political or other conditions.<br />

Concentrations of credit risk indicate the relative sensitivity of the Group’s performance to developments<br />

affecting a particular industry or geographic location.<br />

The Group seeks to manage its credit risk exposure through diversification of sales activities to avoid undue<br />

concentrations of risks with individuals or groups of customers in specific locations or businesses. The Group<br />

also obtains guarantees from the customers when appropriate.<br />

Maximum exposure to credit risk and aging of financial assets past due but not impaired as of December 31,<br />

2010 and 2009 are disclosed as below:<br />

Current Year<br />

Receivables<br />

Trade Receivables Other Receivables<br />

Due from Due from Due from Due from<br />

related third related third<br />

parties parties parties parties<br />

Deposits<br />

Derivative<br />

Instruments Other<br />

Maximum exposure to credit risk at the end<br />

of reporting period (A+B+C+D+E)<br />

337 518.251 - 9.244 992.299 - 73.361<br />

- Maximum credit risk secured by guarantees - 318.290 - - - - -<br />

A. Net carrying amount of financial assets that<br />

are neither past due nor impaired<br />

B. Carrying amount of financial assets whose<br />

337 477.987 - 9.244 992.299 - -<br />

term has been renegotiated, otherwise past<br />

due or impaired<br />

- - - - - - -<br />

C. Net carrying amount of financial assets past<br />

due but not impaired<br />

- 38.733 - - - - -<br />

- Under guarantee - 6.208 - - - - -<br />

D. Net carrying amount of financial assets<br />

impaired<br />

- 1.531 - - - - -<br />

- past due (gross carrying value) - 16.597 - - - - -<br />

- impaired (-) - (15.066) - - - - -<br />

- Net carrying amount of financial assets<br />

under guarantee<br />

- 1.531 - - - - -<br />

- not past due (gross carrying value) - - - - - - -<br />

- impaired (-) - - - - - - -<br />

- Net carrying amount of financial assets<br />

under guarantee<br />

- - - - - - -<br />

E. Off- balance sheet items which include<br />

credit risk<br />

- - - - - - 73.361<br />

Current Year<br />

Trade Receivables<br />

Other<br />

Receivables Deposits<br />

Derivative<br />

Instruments Other<br />

Past due between 1-30 days 23.853 - - - -<br />

Past due between 1-3 months 9.126 - - - -<br />

Past due between 3-12 months 3.308 - - - -<br />

Past due for more than 1 year 2.446 - - - -<br />

<strong>ANADOLU</strong> <strong>EFES</strong> ANNUAL REPORT 2010<br />

211