CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

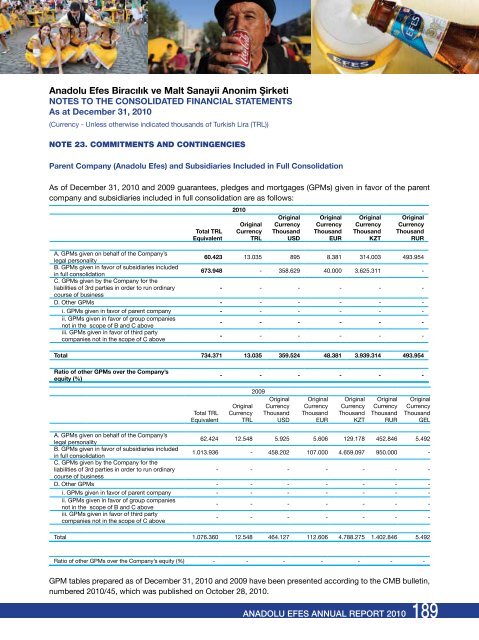

NOTE 23. COMMITMENTS AND CONTINGENCIES<br />

Parent Company (Anadolu Efes) and Subsidiaries Included in Full Consolidation<br />

As of December 31, 2010 and 2009 guarantees, pledges and mortgages (GPMs) given in favor of the parent<br />

company and subsidiaries included in full consolidation are as follows:<br />

Total TRL<br />

Equivalent<br />

2010<br />

Original<br />

Currency<br />

TRL<br />

Original<br />

Currency<br />

Thousand<br />

USD<br />

Original<br />

Currency<br />

Thousand<br />

EUR<br />

Original<br />

Currency<br />

Thousand<br />

KZT<br />

<strong>ANADOLU</strong> <strong>EFES</strong> ANNUAL REPORT 2010<br />

Original<br />

Currency<br />

Thousand<br />

RUR<br />

A. GPMs given on behalf of the Company’s<br />

legal personality<br />

60.423 13.035 895 8.381 314.003 493.954<br />

B. GPMs given in favor of subsidiaries included<br />

in full consolidation<br />

C. GPMs given by the Company for the<br />

673.948 - 358.629 40.000 3.625.311 -<br />

liabilities of 3rd parties in order to run ordinary<br />

course of business<br />

- - - - - -<br />

D. Other GPMs - - - - - -<br />

i. GPMs given in favor of parent company - - - - - -<br />

ii. GPMs given in favor of group companies<br />

not in the scope of B and C above<br />

- - - - - -<br />

iii. GPMs given in favor of third party<br />

companies not in the scope of C above<br />

- - - - - -<br />

Total 734.371 13.035 359.524 48.381 3.939.314 493.954<br />

Ratio of other GPMs over the Company’s<br />

equity (%)<br />

Total TRL<br />

Equivalent<br />

- - - - - -<br />

Original<br />

Currency<br />

TRL<br />

2009<br />

Original<br />

Currency<br />

Thousand<br />

USD<br />

Original<br />

Currency<br />

Thousand<br />

EUR<br />

Original<br />

Currency<br />

Thousand<br />

KZT<br />

Original<br />

Currency<br />

Thousand<br />

RUR<br />

Original<br />

Currency<br />

Thousand<br />

GEL<br />

A. GPMs given on behalf of the Company’s<br />

legal personality<br />

62.424 12.548 5.925 5.606 129.178 452.846 5.492<br />

B. GPMs given in favor of subsidiaries included<br />

in full consolidation<br />

C. GPMs given by the Company for the<br />

1.013.936 - 458.202 107.000 4.659.097 950.000 -<br />

liabilities of 3rd parties in order to run ordinary<br />

course of business<br />

- - - - - - -<br />

D. Other GPMs - - - - - - -<br />

i. GPMs given in favor of parent company - - - - - - -<br />

ii. GPMs given in favor of group companies<br />

not in the scope of B and C above<br />

- - - - - - -<br />

iii. GPMs given in favor of third party<br />

companies not in the scope of C above<br />

- - - - - - -<br />

Total 1.076.360 12.548 464.127 112.606 4.788.275 1.402.846 5.492<br />

Ratio of other GPMs over the Company’s equity (%) - - - - - - -<br />

GPM tables prepared as of December 31, 2010 and 2009 have been presented according to the CMB bulletin,<br />

numbered 2010/45, which was published on October 28, 2010.<br />

189