CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Anadolu Efes Biracılık ve Malt Sanayii Anonim Şirketi<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

As at December 31, 2010<br />

(Currency - Unless otherwise indicated thousands of Turkish Lira (TRL))<br />

NOTE 37. RELATED PARTY BALANCES AND TRANSACTIONS (continued)<br />

b) Transactions with Related Parties (continued)<br />

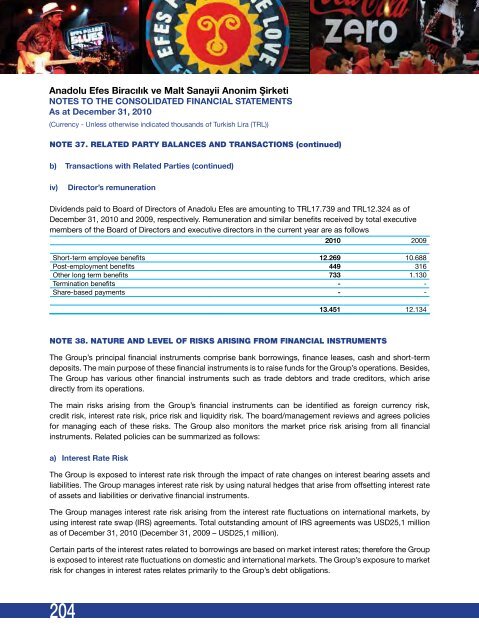

iv) Director’s remuneration<br />

Dividends paid to Board of Directors of Anadolu Efes are amounting to TRL17.739 and TRL12.324 as of<br />

December 31, 2010 and 2009, respectively. Remuneration and similar benefits received by total executive<br />

members of the Board of Directors and executive directors in the current year are as follows<br />

2010 2009<br />

Short-term employee benefits 12.269 10.688<br />

Post-employment benefits 449 316<br />

Other long term benefits 733 1.130<br />

Termination benefits - -<br />

Share-based payments - -<br />

204<br />

13.451 12.134<br />

NOTE 38. NATURE AND LEVEL <strong>OF</strong> RISKS ARISING FROM FINANCIAL INSTRUMENTS<br />

The Group’s principal financial instruments comprise bank borrowings, finance leases, cash and short-term<br />

deposits. The main purpose of these financial instruments is to raise funds for the Group’s operations. Besides,<br />

The Group has various other financial instruments such as trade debtors and trade creditors, which arise<br />

directly from its operations.<br />

The main risks arising from the Group’s financial instruments can be identified as foreign currency risk,<br />

credit risk, interest rate risk, price risk and liquidity risk. The board/management reviews and agrees policies<br />

for managing each of these risks. The Group also monitors the market price risk arising from all financial<br />

instruments. Related policies can be summarized as follows:<br />

a) Interest Rate Risk<br />

The Group is exposed to interest rate risk through the impact of rate changes on interest bearing assets and<br />

liabilities. The Group manages interest rate risk by using natural hedges that arise from offsetting interest rate<br />

of assets and liabilities or derivative financial instruments.<br />

The Group manages interest rate risk arising from the interest rate fluctuations on international markets, by<br />

using interest rate swap (IRS) agreements. Total outstanding amount of IRS agreements was USD25,1 million<br />

as of December 31, 2010 (December 31, 2009 – USD25,1 million).<br />

Certain parts of the interest rates related to borrowings are based on market interest rates; therefore the Group<br />

is exposed to interest rate fluctuations on domestic and international markets. The Group’s exposure to market<br />

risk for changes in interest rates relates primarily to the Group’s debt obligations.