CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

CREDIt RAtING OF ANADOLU EFES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

in Russia in 2010. Consequently, EBI’s net sales revenues grew by 13.9<br />

percent and reached USD 976.8 million in FY2010 compared to FY2009.<br />

In line with higher sales revenues, gross profit increased by 7.0 percent<br />

in absolute terms to USD 90.2 million in 4Q2010 vs 4Q2009. Resulting<br />

from the slightly lower net selling price per liter in USD terms due to the<br />

factors stated above, gross margin realized as 44.9 percent in 4Q2010<br />

vs. 45.6 percent in 4Q2009. Nevertheless, both favorable input prices<br />

and higher volumes in 2010 contributed to a consolidated gross profit<br />

margin improvement of 104 bps to 47.9 percent compared to previous<br />

year. Hence, EBI’s gross profit rose by 16.5 percent to USD 468.3 million<br />

in FY2010 compared to FY2009.<br />

Resulting from lower operating expenses on per liter basis due to<br />

economies of scale, operating profit rose significantly from USD 1.8 million<br />

in 4Q2009 to USD 12.1 million in 4Q2010, despite a slight decline in gross<br />

margin in the period. On a consolidated basis, operating profit reached<br />

USD 112.7 million in FY2010, up by 36.6 percent. Consequently, EBI’s<br />

consolidated operating margin rose by 191 bps to 11.5 percent in FY2010.<br />

In the last quarter of 2010, EBI generated an EBITDA of USD 39.1 million,<br />

up by 64.4 percent compared to the same quarter of 2009, indicating<br />

a 661 bps improvement in EBITDA margin to 19.5 percent. Hence, in<br />

FY2010, consolidated EBITDA increased by 25.6 percent to USD 213.7<br />

million compared to the previous year, with a margin improvement of 203<br />

bps to 21.9 percent.<br />

In 2010, in addition to lower interest expenses due to reduced debt level<br />

and favorable F/X rates, net income attributable to shareholders increased<br />

significantly from USD 0.4 million to USD 54.2 million.<br />

In November 2010, EBI exercised the early payment option in its<br />

Syndication Loan Facility, amounting USD 150.2 million USD plus<br />

Euro 107.0 million with a maturity of July 2012 and respective costs of<br />

LIBOR+300 bps per annum and EURIBOR+300 bps per annum. The<br />

prepayment was done without any penalty nor any additional costs was<br />

involved. The amount has been partially provided from EBI’s existing cash<br />

resources, while remaining part is refinanced through bilateral loans from<br />

92<br />

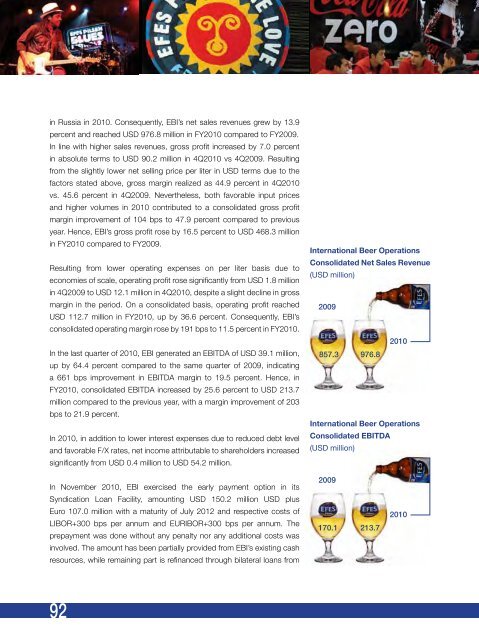

International Beer Operations<br />

Consolidated Net Sales Revenue<br />

(USD million)<br />

2009<br />

857.3 976.8<br />

2009<br />

170.1 213.7<br />

2010<br />

International Beer Operations<br />

Consolidated EBItDA<br />

(USD million)<br />

2010