Performance Report â 2010 - Ministry of Finance and Planning

Performance Report â 2010 - Ministry of Finance and Planning

Performance Report â 2010 - Ministry of Finance and Planning

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

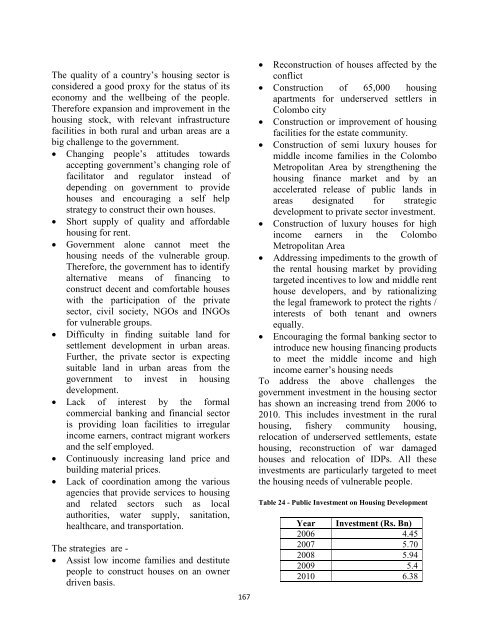

The quality <strong>of</strong> a country’s housing sector isconsidered a good proxy for the status <strong>of</strong> itseconomy <strong>and</strong> the wellbeing <strong>of</strong> the people.Therefore expansion <strong>and</strong> improvement in thehousing stock, with relevant infrastructurefacilities in both rural <strong>and</strong> urban areas are abig challenge to the government. Changing people’s attitudes towardsaccepting government’s changing role <strong>of</strong>facilitator <strong>and</strong> regulator instead <strong>of</strong>depending on government to providehouses <strong>and</strong> encouraging a self helpstrategy to construct their own houses. Short supply <strong>of</strong> quality <strong>and</strong> affordablehousing for rent. Government alone cannot meet thehousing needs <strong>of</strong> the vulnerable group.Therefore, the government has to identifyalternative means <strong>of</strong> financing toconstruct decent <strong>and</strong> comfortable houseswith the participation <strong>of</strong> the privatesector, civil society, NGOs <strong>and</strong> INGOsfor vulnerable groups.Difficulty in finding suitable l<strong>and</strong> forsettlement development in urban areas.Further, the private sector is expectingsuitable l<strong>and</strong> in urban areas from thegovernment to invest in housingdevelopment. Lack <strong>of</strong> interest by the formalcommercial banking <strong>and</strong> financial sectoris providing loan facilities to irregularincome earners, contract migrant workers<strong>and</strong> the self employed.Continuously increasing l<strong>and</strong> price <strong>and</strong>building material prices.Lack <strong>of</strong> coordination among the variousagencies that provide services to housing<strong>and</strong> related sectors such as localauthorities, water supply, sanitation,healthcare, <strong>and</strong> transportation.The strategies are - Assist low income families <strong>and</strong> destitutepeople to construct houses on an ownerdriven basis.167 Reconstruction <strong>of</strong> houses affected by theconflict Construction <strong>of</strong> 65,000 housingapartments for underserved settlers inColombo city Construction or improvement <strong>of</strong> housingfacilities for the estate community. Construction <strong>of</strong> semi luxury houses formiddle income families in the ColomboMetropolitan Area by strengthening thehousing finance market <strong>and</strong> by anaccelerated release <strong>of</strong> public l<strong>and</strong>s inareas designated for strategicdevelopment to private sector investment. Construction <strong>of</strong> luxury houses for highincome earners in the ColomboMetropolitan Area Addressing impediments to the growth <strong>of</strong>the rental housing market by providingtargeted incentives to low <strong>and</strong> middle renthouse developers, <strong>and</strong> by rationalizingthe legal framework to protect the rights /interests <strong>of</strong> both tenant <strong>and</strong> ownersequally.Encouraging the formal banking sector tointroduce new housing financing productsto meet the middle income <strong>and</strong> highincome earner’s housing needsTo address the above challenges thegovernment investment in the housing sectorhas shown an increasing trend from 2006 to<strong>2010</strong>. This includes investment in the ruralhousing, fishery community housing,relocation <strong>of</strong> underserved settlements, estatehousing, reconstruction <strong>of</strong> war damagedhouses <strong>and</strong> relocation <strong>of</strong> IDPs. All theseinvestments are particularly targeted to meetthe housing needs <strong>of</strong> vulnerable people.Table 24 - Public Investment on Housing DevelopmentYear Investment (Rs. Bn)2006 4.452007 5.702008 5.942009 5.4<strong>2010</strong> 6.38