La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

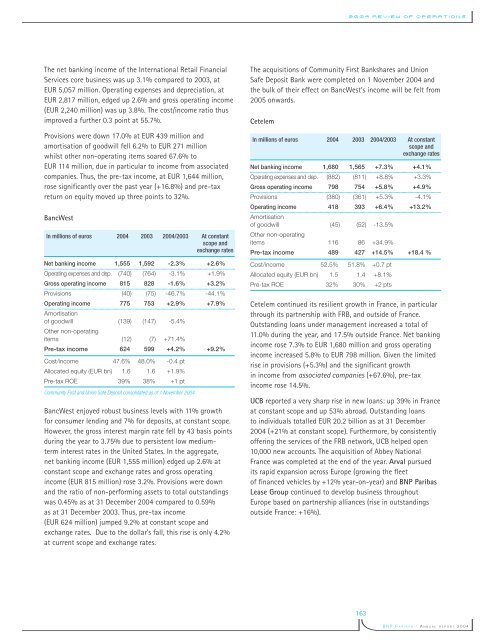

<strong>2004</strong> Review of OperationsThe net banking income of the International Retail FinancialServices core business was up 3.1% compared to 2003, atEUR 5,057 million. Operating expenses and depreciation, atEUR 2,817 million, edged up 2.6% and gross operating income(EUR 2,240 million) was up 3.8%. The cost/income ratio thusimproved a further 0.3 point at 55.7%.Provisions were down 17.0% at EUR 439 million andamortisation of goodwill fell 6.2% to EUR 271 millionwhilst other non-operating items soared 67.6% toEUR 114 million, due in particular to income from associatedcompanies. Thus, the pre-tax income, at EUR 1,644 million,rose significantly over the past year (+16.8%) and pre-taxreturn on e<strong>qui</strong>ty moved up three points to 32%.BancWestIn millions of euros <strong>2004</strong> 2003 <strong>2004</strong>/2003 At constantscope andex<strong>change</strong> ratesNet banking income 1,555 1,592 -2.3% +2.6%Operating expenses and dep. (740) (764) -3.1% +1.9%Gross operating income 815 828 -1.6% +3.2%Provisions (40) (75) -46.7% -44.1%Operating income 775 753 +2.9% +7.9%Amortisationof goodwill (139) (147) -5.4%Other non-operatingitems (12) (7) +71.4%Pre-tax income 624 599 +4.2% +9.2%Cost/income 47.6% 48.0% -0.4 ptAllocated e<strong>qui</strong>ty (EUR bn) 1.6 1.6 +1.9%Pre-tax ROE 39% 38% +1 ptCommunity First and Union Safe Deposit consolidated as of 1 November <strong>2004</strong>.BancWest enjoyed robust business levels with 11% growthfor consumer lending and 7% for deposits, at constant scope.However, the gross interest margin rate fell by 43 basis pointsduring the year to 3.75% due to persistent low mediumterminterest rates in the United States. In the aggregate,net banking income (EUR 1,555 million) edged up 2.6% atconstant scope and ex<strong>change</strong> rates and gross operatingincome (EUR 815 million) rose 3.2%. Provisions were downand the ratio of non-performing assets to total outstandingswas 0.45% as at 31 December <strong>2004</strong> compared to 0.59%as at 31 December 2003. Thus, pre-tax income(EUR 624 million) jumped 9.2% at constant scope andex<strong>change</strong> rates. Due to the dollar’s fall, this rise is only 4.2%at current scope and ex<strong>change</strong> rates.The ac<strong>qui</strong>sitions of Community First Bankshares and UnionSafe Deposit Bank were completed on 1 November <strong>2004</strong> andthe bulk of their effect on BancWest’s income will be felt from2005 onwards.CetelemIn millions of euros <strong>2004</strong> 2003 <strong>2004</strong>/2003 At constantscope andex<strong>change</strong> ratesNet banking income 1,680 1,565 +7.3% +4.1%Operating expenses and dep. (882) (811) +8.8% +3.3%Gross operating income 798 754 +5.8% +4.9%Provisions (380) (361) +5.3% -4.1%Operating income 418 393 +6.4% +13.2%Amortisationof goodwill (45) (52) -13.5%Other non-operatingitems 116 86 +34.9%Pre-tax income 489 427 +14.5% +18.4 %Cost/income 52.5% 51.8% +0.7 ptAllocated e<strong>qui</strong>ty (EUR bn) 1.5 1.4 +8.1%Pre-tax ROE 32% 30% +2 ptsCetelem continued its resilient growth in France, in particularthrough its partnership with FRB, and outside of France.Outstanding loans under management increased a total of11.0% during the year, and 17.5% outside France. Net bankingincome rose 7.3% to EUR 1,680 million and gross operatingincome increased 5.8% to EUR 798 million. Given the limitedrise in provisions (+5.3%) and the significant growthin income from associated companies (+67.6%), pre-taxincome rose 14.5%.UCB reported a very sharp rise in new loans: up 39% in Franceat constant scope and up 53% abroad. Outstanding loansto individuals totalled EUR 20.2 billion as at 31 December<strong>2004</strong> (+21% at constant scope). Furthermore, by consistentlyoffering the services of the FRB network, UCB helped open10,000 new accounts. The ac<strong>qui</strong>sition of Abbey NationalFrance was completed at the end of the year. Arval pursuedits rapid expansion across Europe (growing the fleetof financed vehicles by +12% year-on-year) and <strong>BNP</strong> <strong>Paribas</strong>Lease Group continued to develop business throughoutEurope based on partnership alliances (rise in outstandingsoutside France: +16%).163<strong>BNP</strong> PARIBAS - ANNUAL REPORT <strong>2004</strong>