La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

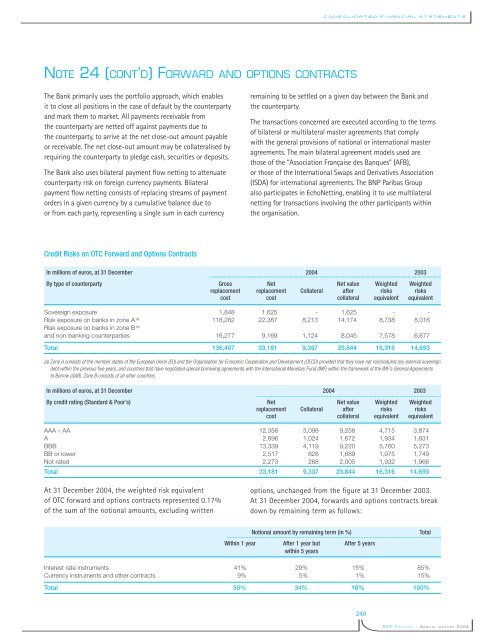

Consolidated FInancial statementsNOTE 24 (CONT’D) FORWARD AND OPTIONS CONTRACTSThe Bank primarily uses the portfolio approach, which enablesit to close all positions in the case of default by the counterpartyand mark them to market. All payments receivable fromthe counterparty are netted off against payments due tothe counterparty, to arrive at the net close-out amount payableor receivable. The net close-out amount may be collateralised byre<strong>qui</strong>ring the counterparty to pledge cash, securities or deposits.The Bank also uses bilateral payment flow netting to attenuatecounterparty risk on foreign currency payments. Bilateralpayment flow netting consists of replacing streams of paymentorders in a given currency by a cumulative balance due toor from each party, representing a single sum in each currencyremaining to be settled on a given day between the Bank andthe counterparty.The transactions concerned are executed according to the termsof bilateral or multilateral master agreements that complywith the general provisions of national or international masteragreements. The main bilateral agreement models used arethose of the “Association Française des Banques” (AFB),or those of the International Swaps and Derivatives Association(ISDA) for international agreements. The <strong>BNP</strong> <strong>Paribas</strong> Groupalso participates in EchoNetting, enabling it to use multilateralnetting for transactions involving the other participants withinthe organisation.Credit Risks on OTC Forward and Options ContractsIn millions of euros, at 31 December <strong>2004</strong> 2003By type of counterparty Gross Net Net value Weighted Weightedreplacement replacement Collateral after risks riskscost cost collateral e<strong>qui</strong>valent e<strong>qui</strong>valentSovereign exposure 1,848 1,625 - 1,625 - -Risk exposure on banks in zone A (a) 118,282 22,387 8,213 14,174 8,738 8,016Risk exposure on banks in zone B (a)and non-banking counterparties 16,277 9,169 1,124 8,045 7,578 6,677Total 136,407 33,181 9,337 23,844 16,316 14,693(a) Zone A consists of the member states of the European Union (EU) and the Organisation for Economic Cooperation and Development (OECD) provided that they have not rescheduled any external sovereigndebt within the previous five years, and countries that have negotiated special borrowing agreements with the International Monetary Fund (IMF) within the framework of the IMF’s General Agreementsto Borrow (GAB). Zone B consists of all other countries.In millions of euros, at 31 December <strong>2004</strong> 2003By credit rating (Standard & Poor’s) Net Net value Weighted Weightedreplacement Collateral after risks riskscost collateral e<strong>qui</strong>valent e<strong>qui</strong>valentAAA – AA 12,356 3,098 9,258 4,715 3,874A 2,696 1,024 1,672 1,934 1,831BBB 13,339 4,119 9,220 5,760 5,273BB or lower 2,517 828 1,689 1,975 1,749Not rated 2,273 268 2,005 1,932 1,966Total 33,181 9,337 23,844 16,316 14,693At 31 December <strong>2004</strong>, the weighted risk e<strong>qui</strong>valentof OTC forward and options contracts represented 0.17%of the sum of the notional amounts, excluding writtenoptions, un<strong>change</strong>d from the figure at 31 December 2003.At 31 December <strong>2004</strong>, forwards and options contracts breakdown by remaining term as follows:Notional amount by remaining term (in %)Within 1 year After 1 year but After 5 yearswithin 5 yearsTotalInterest rate instruments 41% 29% 15% 85%Currency instruments and other contracts 9% 5% 1% 15%Total 50% 34% 16% 100%249<strong>BNP</strong> PARIBAS - ANNUAL REPORT <strong>2004</strong>