La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

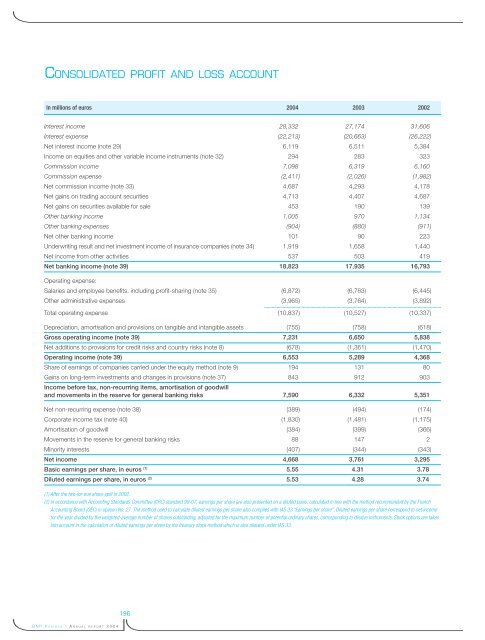

CONSOLIDATED PROFIT AND LOSS ACCOUNTIn millions of euros <strong>2004</strong> 2003 2002Interest income 28,332 27,174 31,606Interest expense (22,213) (20,663) (26,222)Net interest income (note 29) 6,119 6,511 5,384Income on e<strong>qui</strong>ties and other variable income instruments (note 32) 294 283 323Commission income 7,098 6,319 6,160Commission expense (2,411) (2,026) (1,982)Net commission income (note 33) 4,687 4,293 4,178Net gains on trading account securities 4,713 4,407 4,687Net gains on securities available for sale 453 190 139Other banking income 1,005 970 1,134Other banking expenses (904) (880) (911)Net other banking income 101 90 223Underwriting result and net investment income of insurance companies (note 34) 1,919 1,658 1,440Net income from other activities 537 503 419Net banking income (note 39) 18,823 17,935 16,793Operating expense:Salaries and employee benefits, including profit-sharing (note 35) (6,872) (6,763) (6,445)Other administrative expenses (3,965) (3,764) (3,892)Total operating expense (10,837) (10,527) (10,337)Depreciation, amortisation and provisions on tangible and intangible assets (755) (758) (618)Gross operating income (note 39) 7,231 6,650 5,838Net additions to provisions for credit risks and country risks (note 8) (678) (1,361) (1,470)Operating income (note 39) 6,553 5,289 4,368Share of earnings of companies carried under the e<strong>qui</strong>ty method (note 9) 194 131 80Gains on long-term investments and <strong>change</strong>s in provisions (note 37) 843 912 903Income before tax, non-recurring items, amortisation of goodwilland movements in the reserve for general banking risks 7,590 6,332 5,351Net non-recurring expense (note 38) (389) (494) (174)Corporate income tax (note 40) (1,830) (1,481) (1,175)Amortisation of goodwill (384) (399) (366)Movements in the reserve for general banking risks 88 147 2Minority interests (407) (344) (343)Net income 4,668 3,761 3,295Basic earnings per share, in euros (1) 5.55 4.31 3.78Diluted earnings per share, in euros (2) 5.53 4.28 3.74(1) After the two-for-one share-split in 2002.(2) In accordance with Accounting Standards Committee (CRC) standard 99-07, earnings per share are also presented on a diluted basis, calculated in line with the method recommended by the FrenchAccounting Board (OEC) in opinion No. 27. The method used to calculate diluted earnings per share also complies with IAS 33 “Earnings per share”. Diluted earnings per share correspond to net incomefor the year divided by the weighted-average number of shares outstanding, adjusted for the maximum number of potential ordinary shares, corresponding to dilutive instruments. Stock options are takeninto account in the calculation of diluted earnings per share by the treasury stock method which is also allowed under IAS 33.196<strong>BNP</strong> PARIBAS - ANNUAL REPORT <strong>2004</strong>