La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

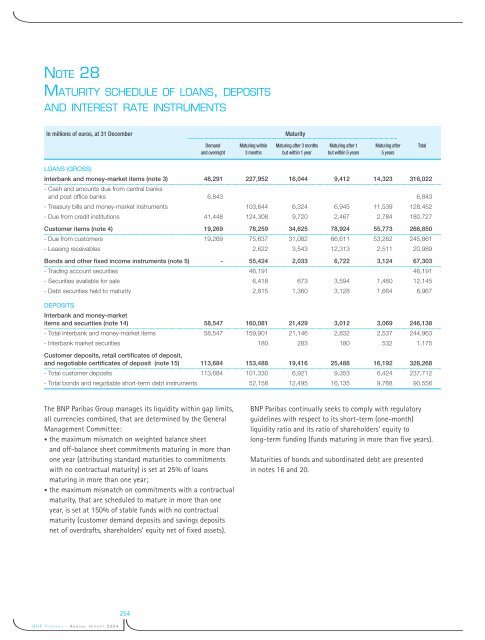

NOTE 28MATURITY SCHEDULE OF LOANS, DEPOSITSAND INTEREST RATE INSTRUMENTSIn millions of euros, at 31 DecemberMaturityDemand Maturing within Maturing after 3 months Maturing after 1 Maturing after Totaland overnight 3 months but within 1 year but within 5 years 5 yearsLOANS (GROSS)Interbank and money-market items (note 3) 48,291 227,952 16,044 9,412 14,323 316,022- Cash and amounts due from central banksand post office banks 6,843 6,843- Treasury bills and money-market instruments 103,644 6,324 6,945 11,539 128,452- Due from credit institutions 41,448 124,308 9,720 2,467 2,784 180,727Customer items (note 4) 19,269 78,259 34,625 78,924 55,773 266,850- Due from customers 19,269 75,637 31,082 66,611 53,262 245,861- Leasing receivables 2,622 3,543 12,313 2,511 20,989Bonds and other fixed income instruments (note 5) - 55,424 2,033 6,722 3,124 67,303- Trading account securities 46,191 46,191- Securities available for sale 6,418 673 3,594 1,460 12,145- Debt securities held to maturity 2,815 1,360 3,128 1,664 8,967DEPOSITSInterbank and money-marketitems and securities (note 14) 58,547 160,081 21,429 3,012 3,069 246,138- Total interbank and money-market items 58,547 159,901 21,146 2,832 2,537 244,963- Interbank market securities 180 283 180 532 1,175Customer deposits, retail certificates of deposit,and negotiable certificates of deposit (note 15) 113,684 153,488 19,416 25,488 16,192 328,268- Total customer deposits 113,684 101,330 6,921 9,353 6,424 237,712- Total bonds and negotiable short-term debt instruments 52,158 12,495 16,135 9,768 90,556The <strong>BNP</strong> <strong>Paribas</strong> Group manages its li<strong>qui</strong>dity within gap limits,all currencies combined, that are determined by the GeneralManagement Committee:• the maximum mismatch on weighted balance sheetand off-balance sheet commitments maturing in more thanone year (attributing standard maturities to commitmentswith no contractual maturity) is set at 25% of loansmaturing in more than one year;• the maximum mismatch on commitments with a contractualmaturity, that are scheduled to mature in more than oneyear, is set at 150% of stable funds with no contractualmaturity (customer demand deposits and savings depositsnet of overdrafts, shareholders’ e<strong>qui</strong>ty net of fixed assets).<strong>BNP</strong> <strong>Paribas</strong> continually seeks to comply with regulatoryguidelines with respect to its short-term (one-month)li<strong>qui</strong>dity ratio and its ratio of shareholders’ e<strong>qui</strong>ty tolong-term funding (funds maturing in more than five years).Maturities of bonds and subordinated debt are presentedin notes 16 and 20.254<strong>BNP</strong> PARIBAS - ANNUAL REPORT <strong>2004</strong>