- Page 2 and 3:

contentsKey Figures 2-3Chairman’s

- Page 5 and 6:

2key Figures3Net banking incomeby c

- Page 7 and 8:

4chairman‘s and chief executive o

- Page 9 and 10:

6executive committee7COMMITTEEBNP P

- Page 11 and 12:

8trademark portfolio9BNP Paribas op

- Page 13 and 14:

The bankfor a connected10the bank f

- Page 15 and 16:

12the bank for a connected world13C

- Page 17 and 18:

14the group‘s core businesses15Fi

- Page 19 and 20:

the Netherlands. UCB has also devel

- Page 21 and 22:

ices• The division’s savings bu

- Page 23 and 24:

14chiffres clés15GASSixty Partners

- Page 25 and 26:

18CORPORATE AND INVESTMENT BANKING1

- Page 27 and 28:

20CORPORATE AND INVESTMENT BANKING2

- Page 29 and 30:

Equities andDerivatives22CORPORATE

- Page 31 and 32:

24CORPORATE AND INVESTMENT BANKING2

- Page 33 and 34:

Bnp paribas london26CORPORATE AND I

- Page 35:

28CORPORATE AND INVESTMENT BANKING2

- Page 38 and 39:

etailbankingFrench RetailBankingInt

- Page 40 and 41:

RATPChangeover Points, Hubs of Mixe

- Page 42 and 43:

IndividualclientsA fully operationa

- Page 44 and 45:

Personal loan businessoutpaces mark

- Page 46 and 47:

entrepreneursand freelanceprofessio

- Page 48 and 49:

The acquisition of Teisseire by Fru

- Page 50 and 51:

BIOVALEurope’s Largest Biotechnol

- Page 52 and 53:

internationalretail banking andf in

- Page 54 and 55:

• Outside France, new lending fur

- Page 56 and 57:

np paribaslease groupFollowing two

- Page 58 and 59:

ancwestThe sharp upturn in the Amer

- Page 60 and 61:

teb istanbulEmerging andOverseas Ma

- Page 63 and 64:

56retail banking57MANOBIExchanges o

- Page 65 and 66:

58asset management and services59

- Page 67 and 68:

6061asset management and servicesAM

- Page 69 and 70:

6263asset management and servicesco

- Page 71 and 72:

asset management et servicesPaving

- Page 73 and 74:

66asset management and services67Bn

- Page 75 and 76:

68asset management and services69bn

- Page 77 and 78:

70asset management and services71Ta

- Page 79:

72asset management and services73BN

- Page 82 and 83:

klépierre

- Page 84 and 85:

np paribascapital

- Page 87 and 88:

Patrick GeeraertHead of the Finance

- Page 89 and 90:

82sustainable development83THE GROU

- Page 91 and 92:

84sustainable development85• SAMS

- Page 93 and 94:

86sustainable development87As a res

- Page 95 and 96:

88sustainable development89BNP Pari

- Page 97 and 98:

90sustainable development91Yield an

- Page 99 and 100:

92sustainable development93Communic

- Page 101 and 102:

94sustainable development95Liaison

- Page 103 and 104:

96sustainable development97Dividend

- Page 105 and 106:

98sustainable development99Disclosu

- Page 107 and 108:

HUMAN RESOURCESDEVELOPMENT100sustai

- Page 109 and 110:

102sustainable development103(in %)

- Page 111 and 112:

104sustainable development105- the

- Page 113 and 114:

106sustainable development107Employ

- Page 115 and 116:

108sustainable development109Lastly

- Page 117 and 118:

110sustainable development111relati

- Page 119 and 120:

112sustainable development113Qualit

- Page 121 and 122:

114sustainable development115BNP Pa

- Page 123 and 124:

116sustainable development117Vendor

- Page 125 and 126:

118118119119sustainable development

- Page 127 and 128:

120sustainable development121Partne

- Page 129 and 130:

122développement durable123Chetan

- Page 131 and 132:

124sustainable development125This p

- Page 133 and 134:

126sustainable development12750 art

- Page 135 and 136:

128sustainable development129BNP Pa

- Page 137 and 138:

10101001010010100100101010101000011

- Page 139 and 140:

132board of directors133Jacques Fri

- Page 141 and 142:

134EXTRACTS FROM THE BOARD OF DIREC

- Page 143 and 144:

136report of the chairman137• The

- Page 145 and 146:

138report of the chairman139de l’

- Page 147 and 148:

140report of the chairman141• the

- Page 149 and 150:

142report of the chairman143As part

- Page 151 and 152:

144report of the chairman145for con

- Page 153 and 154:

146report of the chairman147to comb

- Page 155 and 156:

148report of the chairman149Human r

- Page 157 and 158:

150remuneration151remunerationRemun

- Page 159 and 160:

152remuneration153Remuneration of o

- Page 161:

154remuneration155Information on st

- Page 164 and 165:

Financialand legalinformation

- Page 166 and 167:

ACTIVITY2004 REVIEW OF OPERATIONSCO

- Page 168 and 169:

RESULTS OF EACH CORE BUSINESS1 - RE

- Page 170 and 171:

The Retail Banking business in Emer

- Page 172 and 173:

The core business’ operating expe

- Page 174 and 175:

Interbank and money-market items. I

- Page 176 and 177:

RECENT DEVELOPMENTS11 February 2005

- Page 178 and 179:

CHANGES IN SHARE CAPITALNumber of s

- Page 180 and 181:

REGULATORY RATIOSInternational capi

- Page 182 and 183:

on retirement bonuses should be acc

- Page 184 and 185:

Realised gains and losses on availa

- Page 186 and 187:

Credit and Counterparty Risks, comp

- Page 188 and 189:

ates (market rates and signature sp

- Page 190 and 191:

Group Tax Affairs resources include

- Page 192 and 193:

fundamentally sound companies that

- Page 194 and 195:

• GEaRThe Bank measures Value at

- Page 196 and 197:

asis for hedging decisions taking i

- Page 198 and 199:

BNP PARIBAS - ANNUAL REPORT 2004192

- Page 200 and 201:

CONSOLIDATED BALANCE SHEETASSETSIn

- Page 202 and 203:

CONSOLIDATED PROFIT AND LOSS ACCOUN

- Page 204 and 205:

APPENDICESNOTE 1ACCOUNTING POLICIES

- Page 206 and 207: association, provided that the Grou

- Page 208 and 209: However, when the market value of l

- Page 210 and 211: fixed income instruments (whether f

- Page 212 and 213: In order to reflect what appeared t

- Page 214 and 215: countries in which they operate. In

- Page 216 and 217: NOTE 2 - SCOPE OF CONSOLIDATIONChan

- Page 218 and 219: Fully-consolidated companiesFinanci

- Page 220 and 221: Financial institutions Group voting

- Page 222 and 223: Financial institutions Group voting

- Page 224 and 225: Other companies Group voting Group

- Page 226 and 227: Other companies Group voting Group

- Page 228 and 229: NOTE 3INTERBANK AND MONEY-MARKET IT

- Page 230 and 231: NOTE 5TRANSACTIONS ON TRADING ACCOU

- Page 232 and 233: NOTE 6INSURANCE COMPANY INVESTMENTS

- Page 234 and 235: NOTE 7 (CONT’D)INVESTMENTS IN NON

- Page 236 and 237: NOTE 8 (CONT’D)PROVISIONS FOR CRE

- Page 238 and 239: NOTE 10LONG-TERM INVESTMENTSIn mill

- Page 240 and 241: NOTE 12GOODWILLIn millions of euros

- Page 242 and 243: NOTE 15CUSTOMER DEPOSITS, RETAIL CE

- Page 244 and 245: NOTE 17TECHNICAL RESERVES OF INSURA

- Page 246 and 247: NOTE 20SUBORDINATED DEBTIn millions

- Page 248 and 249: NOTE 22CONSOLIDATED SHAREHOLDERS’

- Page 250 and 251: NOTE 22 (CONT’D)CONSOLIDATED SHAR

- Page 252 and 253: NOTE 22 (CONT’D)CONSOLIDATED SHAR

- Page 254 and 255: NOTE 24FORWARD AND OPTIONS CONTRACT

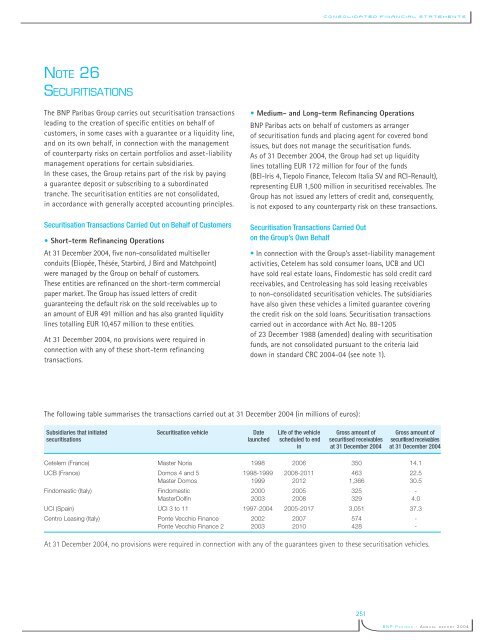

- Page 258 and 259: NOTE 26 (CONT’D)SECURITISATIONS

- Page 260 and 261: NOTE 28MATURITY SCHEDULE OF LOANS,

- Page 262 and 263: NOTE 31NET INTEREST INCOME (EXPENSE

- Page 264 and 265: NOTE 34UNDERWRITING RESULT AND NET

- Page 266 and 267: NOTE 36STOCK OPTION PLANS1 - BNP PA

- Page 268 and 269: NOTE 37GAINS (LOSSES) ON DISPOSALS

- Page 270 and 271: NOTE 39SEGMENT INFORMATION• Incom

- Page 272 and 273: NOTE 41BNP-PARIBAS MERGER-RELATED R

- Page 274 and 275: • BNP Paribas records provisions

- Page 276 and 277: PARENT COMPANY FINANCIAL STATEMENTS

- Page 278 and 279: PROFIT AND LOSS ACCOUNT OF BNP PARI

- Page 280 and 281: debt securities. They also include

- Page 282 and 283: • Debt Securities Held to Maturit

- Page 284 and 285: Forward financial instruments are p

- Page 286 and 287: Recognition of Revenue and Expenses

- Page 288 and 289: SUBSIDIARIES AND AFFILIATESSubsidia

- Page 290 and 291: Subsidiaries and affiliates Currenc

- Page 292 and 293: ACQUISITIONSOF EQUITY INTERESTS BY

- Page 294 and 295: SOCIAL AND ENVIRONMENTALINDICATORS

- Page 296 and 297: NRE indicator 2004 Comments Scope c

- Page 298 and 299: NRE indicator 2004 Comments Scope c

- Page 300 and 301: NRE indicator 2004 Comments Scope c

- Page 302 and 303: NRE indicator 2004 Comments Scope c

- Page 304 and 305: NRE indicator 2004 Comments Scope c

- Page 306 and 307:

GENERAL INFORMATIONLEGAL INFORMATIO

- Page 308 and 309:

The Axa group has also given a comm

- Page 310 and 311:

STATUTORY AUDITORSNames and address

- Page 312 and 313:

COMBINED ANNUAL AND EXTRAORDINARYGE

- Page 314 and 315:

• Eighth resolution (Renewal of t

- Page 316 and 317:

• Seventeenth resolution (Amendme

- Page 318 and 319:

Capital increaseCash flowCECEICIBA

- Page 320 and 321:

Investment clubIRBIRFSISIN codeLBOL

- Page 322 and 323:

Prime brokeragePublic tender offerQ

- Page 324 and 325:

NOTES. . . . . . . . . . . . . . .

- Page 326:

www.bnpparibas.comHEAD OFFICE16, bo