La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

La banque d'un monde qui change 2004 - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

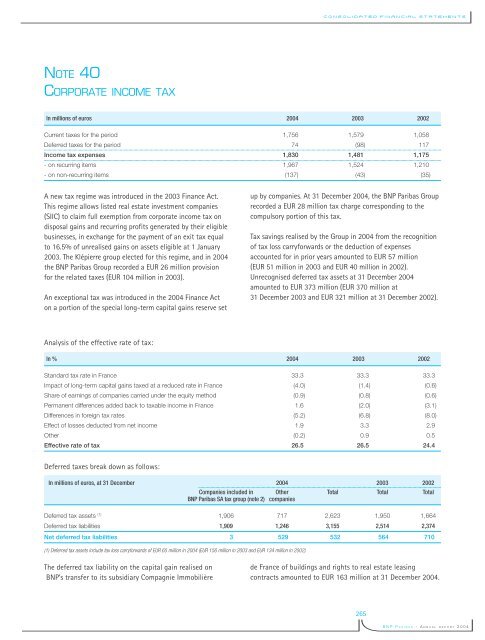

Consolidated FInancial statementsNOTE 40CORPORATE INCOME TAXIn millions of euros <strong>2004</strong> 2003 2002Current taxes for the period 1,756 1,579 1,058Deferred taxes for the period 74 (98) 117Income tax expenses 1,830 1,481 1,175- on recurring items 1,967 1,524 1,210- on non-recurring items (137) (43) (35)A new tax regime was introduced in the 2003 Finance Act.This regime allows listed real estate investment companies(SIIC) to claim full exemption from corporate income tax ondisposal gains and recurring profits generated by their eligiblebusinesses, in ex<strong>change</strong> for the payment of an exit tax equalto 16.5% of unrealised gains on assets eligible at 1 January2003. The Klépierre group elected for this regime, and in <strong>2004</strong>the <strong>BNP</strong> <strong>Paribas</strong> Group recorded a EUR 26 million provisionfor the related taxes (EUR 104 million in 2003).An exceptional tax was introduced in the <strong>2004</strong> Finance Acton a portion of the special long-term capital gains reserve setup by companies. At 31 December <strong>2004</strong>, the <strong>BNP</strong> <strong>Paribas</strong> Grouprecorded a EUR 28 million tax charge corresponding to thecompulsory portion of this tax.Tax savings realised by the Group in <strong>2004</strong> from the recognitionof tax loss carryforwards or the deduction of expensesaccounted for in prior years amounted to EUR 57 million(EUR 51 million in 2003 and EUR 40 million in 2002).Unrecognised deferred tax assets at 31 December <strong>2004</strong>amounted to EUR 373 million (EUR 370 million at31 December 2003 and EUR 321 million at 31 December 2002).Analysis of the effective rate of tax:In % <strong>2004</strong> 2003 2002Standard tax rate in France 33.3 33.3 33.3Impact of long-term capital gains taxed at a reduced rate in France (4.0) (1.4) (0.6)Share of earnings of companies carried under the e<strong>qui</strong>ty method (0.9) (0.8) (0.6)Permanent differences added back to taxable income in France 1.6 (2.0) (3.1)Differences in foreign tax rates (5.2) (6.8) (8.0)Effect of losses deducted from net income 1.9 3.3 2.9Other (0.2) 0.9 0.5Effective rate of tax 26.5 26.5 24.4Deferred taxes break down as follows:In millions of euros, at 31 December <strong>2004</strong> 2003 2002Companies included in Other Total Total Total<strong>BNP</strong> <strong>Paribas</strong> SA tax group (note 2) companiesDeferred tax assets (1) 1,906 717 2,623 1,950 1,664Deferred tax liabilities 1,909 1,246 3,155 2,514 2,374Net deferred tax liabilities 3 529 532 564 710(1) Deferred tax assets include tax loss carryforwards of EUR 65 million in <strong>2004</strong> (EUR 156 million in 2003 and EUR 134 million in 2002).The deferred tax liability on the capital gain realised on<strong>BNP</strong>’s transfer to its subsidiary Compagnie Immobilièrede France of buildings and rights to real estate leasingcontracts amounted to EUR 163 million at 31 December <strong>2004</strong>.265<strong>BNP</strong> PARIBAS - ANNUAL REPORT <strong>2004</strong>