Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

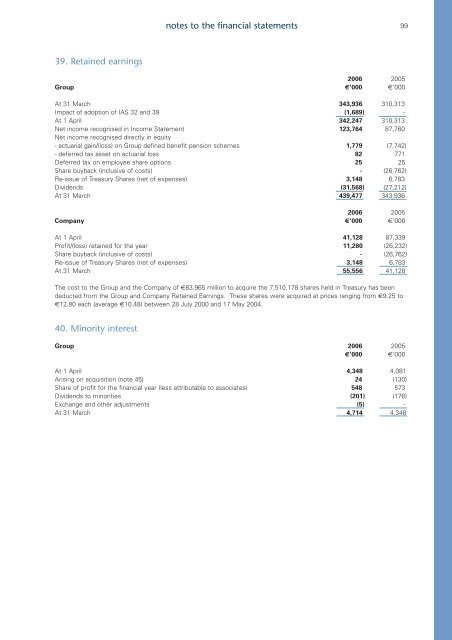

notes to the financial statements9939. Retained earnings<strong>2006</strong> 2005Group €’000 €’000At 31 March 343,936 310,313Impact of adoption of IAS 32 <strong>and</strong> 39 (1,689) -At 1 April 342,247 310,313Net income recognised in Income Statement 123,764 87,760Net income recognised directly in equity- actuarial gain/(loss) on Group defined benefit pension schemes 1,779 (7,742)- deferred tax asset on actuarial loss 82 771Deferred tax on employee share options 25 25Share buyback (inclusive of costs) - (26,762)Re-issue of Treasury Shares (net of expenses) 3,148 6,783Dividends (31,568) (27,212)At 31 March 439,477 343,936<strong>2006</strong> 2005Company €’000 €’000At 1 April 41,128 87,339Profit/(loss) retained for the year 11,280 (26,232)Share buyback (inclusive of costs) - (26,762)Re-issue of Treasury Shares (net of expenses) 3,148 6,783At 31 March 55,556 41,128The cost to the Group <strong>and</strong> the Company of €83.965 million to acquire the 7,510,178 shares held in Treasury has beendeducted from the Group <strong>and</strong> Company Retained Earnings. These shares were acquired at prices ranging from €9.25 to€12.80 each (average €10.48) between 28 July 2000 <strong>and</strong> 17 May 2004.40. Minority interestGroup <strong>2006</strong> 2005€’000 €’000At 1 April 4,348 4,081Arising on acquisition (note 45) 24 (130)Share of profit for the financial year (less attributable to associates) 548 573Dividends to minorities (201) (176)Exchange <strong>and</strong> other adjustments (5) -At 31 March 4,714 4,348