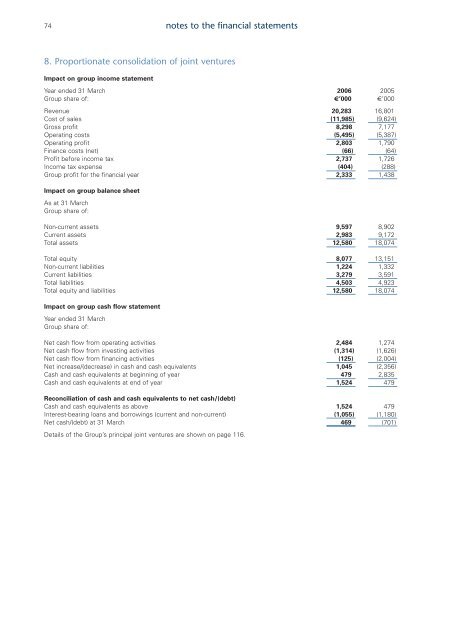

74 notes to the financial statements8. Proportionate consolidation of joint venturesImpact on group income statementYear ended 31 March <strong>2006</strong> 2005Group share of: €’000 €’000Revenue 20,283 16,801Cost of sales (11,985) (9,624)Gross profit 8,298 7,177Operating costs (5,495) (5,387)Operating profit 2,803 1,790Finance costs (net) (66) (64)Profit before income tax 2,737 1,726Income tax expense (404) (288)Group profit for the financial year 2,333 1,438Impact on group balance sheetAs at 31 MarchGroup share of:Non-current assets 9,597 8,902Current assets 2,983 9,172Total assets 12,580 18,074Total equity 8,077 13,151Non-current liabilities 1,224 1,332Current liabilities 3,279 3,591Total liabilities 4,503 4,923Total equity <strong>and</strong> liabilities 12,580 18,074Impact on group cash flow statementYear ended 31 MarchGroup share of:Net cash flow from operating activities 2,484 1,274Net cash flow from investing activities (1,314) (1,626)Net cash flow from financing activities (125) (2,004)Net increase/(decrease) in cash <strong>and</strong> cash equivalents 1,045 (2,356)Cash <strong>and</strong> cash equivalents at beginning of year 479 2,835Cash <strong>and</strong> cash equivalents at end of year 1,524 479Reconciliation of cash <strong>and</strong> cash equivalents to net cash/(debt)Cash <strong>and</strong> cash equivalents as above 1,524 479Interest-bearing loans <strong>and</strong> borrowings (current <strong>and</strong> non-current) (1,055) (1,180)Net cash/(debt) at 31 March 469 (701)Details of the Group’s principal joint ventures are shown on page 116.

notes to the financial statements759. EmploymentThe average weekly number of persons (including executive Directors <strong>and</strong> the Group’s share of employees of jointventures, applying proportionate consolidation) employed by the Group during the year analysed by class of business was:<strong>2006</strong> 2005number number<strong>DCC</strong> Energy 1,779 1,733<strong>DCC</strong> SerCom 1,321 1,284<strong>DCC</strong> Healthcare 929 742<strong>DCC</strong> Food & Beverage 907 833<strong>DCC</strong> Environmental 173 1545,109 4,746The staff costs for the above were: <strong>2006</strong> 2005€’000 €’000Wages <strong>and</strong> salaries 174,860 157,924Social welfare costs 18,033 16,679Share based payment expense (note 10) 1,840 1,003Pension costs - defined contribution plans 4,816 3,639Pension costs - defined benefit plans (note 32) 3,062 3,421202,611 182,66610. Employee share optionsThe Group’s employee share options are equity-settled share-based payments as defined in IFRS 2 Share-based Payment.The IFRS requires that a recognised valuation methodology be employed to determine the fair value of share optionsgranted. The expense reported in the Income Statement of €1.840 million (2005: €1.003 million) has been arrived atthrough applying the binomial model, which is a lattice option-pricing model, for options issued under the <strong>DCC</strong> <strong>plc</strong> 1998Employee Share Option Scheme <strong>and</strong> the Black Scholes option valuation model for options issued under the <strong>DCC</strong>Sharesave Scheme 2001.Impact on income statementIn compliance with the transitional provisions set out in IFRS 2 Share-based Payment the Group has elected to implementthe measurement requirements of the IFRS in respect of share options that were granted after 7 November 2002 thathad not vested as at 1 January 2005, the effective date of the st<strong>and</strong>ard.The total expense is analysed as follows:WeightedExpense inGrant Duration Number of average income statementprice of vesting options fair value <strong>2006</strong> 2005Date of grant € period granted € €’000 €’000<strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme12 November 2002 10.38 3 <strong>and</strong> 5 years 609,500 2.81 349 39422 December 2003 10.70 3 <strong>and</strong> 5 years 132,000 2.76 94 9418 May 2004 12.75 3 <strong>and</strong> 5 years 162,500 3.42 150 1259 November 2004 15.65 3 <strong>and</strong> 5 years 219,500 4.15 269 9015 December 2005 16.70 3 <strong>and</strong> 5 years 215,000 4.52 79 -941 703<strong>DCC</strong> Sharesave Scheme 200110 December 2004 12.63 3 <strong>and</strong> 5 years 716,010 4.67 899 300Total expense 1,840 1,003