Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

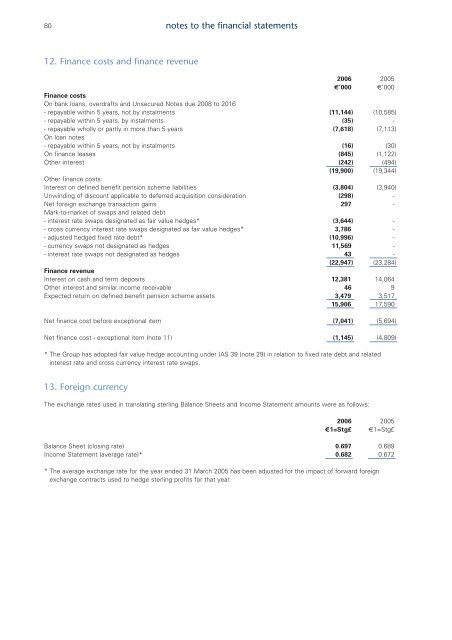

80 notes to the financial statements12. Finance costs <strong>and</strong> finance revenue<strong>2006</strong> 2005€’000 €’000Finance costsOn bank loans, overdrafts <strong>and</strong> Unsecured Notes due 2008 to 2016- repayable within 5 years, not by instalments (11,144) (10,585)- repayable within 5 years, by instalments (35) -- repayable wholly or partly in more than 5 years (7,618) (7,113)On loan notes- repayable within 5 years, not by instalments (16) (30)On finance leases (845) (1,122)Other interest (242) (494)(19,900) (19,344)Other finance costs:Interest on defined benefit pension scheme liabilities (3,804) (3,940)Unwinding of discount applicable to deferred acquisition consideration (298) -Net foreign exchange transaction gains 297 -Mark-to-market of swaps <strong>and</strong> related debt- interest rate swaps designated as fair value hedges* (3,644) -- cross currency interest rate swaps designated as fair value hedges* 3,786 -- adjusted hedged fixed rate debt* (10,996) -- currency swaps not designated as hedges 11,569 -- interest rate swaps not designated as hedges 43 -(22,947) (23,284)Finance revenueInterest on cash <strong>and</strong> term deposits 12,381 14,064Other interest <strong>and</strong> similar income receivable 46 9Expected return on defined benefit pension scheme assets 3,479 3,51715,906 17,590Net finance cost before exceptional item (7,041) (5,694)Net finance cost - exceptional item (note 11) (1,145) (4,809)* The Group has adopted fair value hedge accounting under IAS 39 (note 29) in relation to fixed rate debt <strong>and</strong> relatedinterest rate <strong>and</strong> cross currency interest rate swaps.13. Foreign currencyThe exchange rates used in translating sterling Balance Sheets <strong>and</strong> Income Statement amounts were as follows:<strong>2006</strong> 2005€1=Stg£ €1=Stg£Balance Sheet (closing rate) 0.697 0.689Income Statement (average rate)* 0.682 0.672* The average exchange rate for the year ended 31 March 2005 has been adjusted for the impact of forward foreignexchange contracts used to hedge sterling profits for that year.