Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

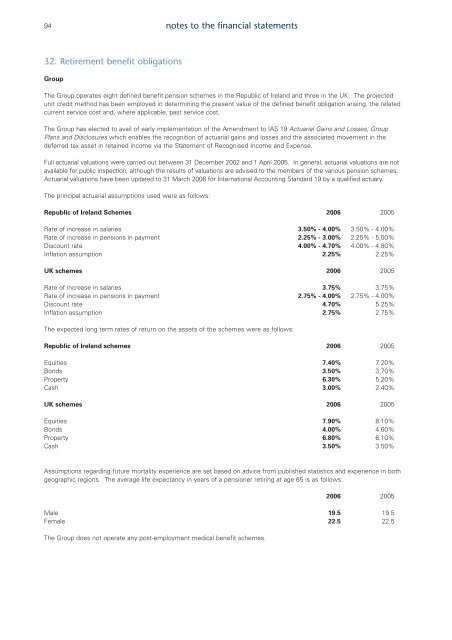

94notes to the financial statements32. Retirement benefit obligationsGroupThe Group operates eight defined benefit pension schemes in the Republic of Irel<strong>and</strong> <strong>and</strong> three in the UK. The projectedunit credit method has been employed in determining the present value of the defined benefit obligation arising, the relatedcurrent service cost <strong>and</strong>, where applicable, past service cost.The Group has elected to avail of early implementation of the Amendment to IAS 19 Actuarial Gains <strong>and</strong> Losses, GroupPlans <strong>and</strong> Disclosures which enables the recognition of actuarial gains <strong>and</strong> losses <strong>and</strong> the associated movement in thedeferred tax asset in retained income via the Statement of Recognised Income <strong>and</strong> Expense.Full actuarial valuations were carried out between 31 December 2002 <strong>and</strong> 1 April 2005. In general, actuarial valuations are notavailable for public inspection, although the results of valuations are advised to the members of the various pension schemes.Actuarial valuations have been updated to 31 March <strong>2006</strong> for International Accounting St<strong>and</strong>ard 19 by a qualified actuary.The principal actuarial assumptions used were as follows:Republic of Irel<strong>and</strong> Schemes <strong>2006</strong> 2005Rate of increase in salaries 3.50% - 4.00% 3.50% - 4.00%Rate of increase in pensions in payment 2.25% - 3.00% 2.25% - 5.00%Discount rate 4.00% - 4.70% 4.00% - 4.80%Inflation assumption 2.25% 2.25%UK schemes <strong>2006</strong> 2005Rate of increase in salaries 3.75% 3.75%Rate of increase in pensions in payment 2.75% - 4.00% 2.75% - 4.00%Discount rate 4.70% 5.25%Inflation assumption 2.75% 2.75%The expected long term rates of return on the assets of the schemes were as follows:Republic of Irel<strong>and</strong> schemes <strong>2006</strong> 2005Equities 7.40% 7.20%Bonds 3.50% 3.70%Property 6.30% 5.20%Cash 3.00% 2.40%UK schemes <strong>2006</strong> 2005Equities 7.90% 8.10%Bonds 4.00% 4.60%Property 6.80% 6.10%Cash 3.50% 3.50%Assumptions regarding future mortality experience are set based on advice from published statistics <strong>and</strong> experience in bothgeographic regions. The average life expectancy in years of a pensioner retiring at age 65 is as follows:<strong>2006</strong> 2005Male 19.5 19.5Female 22.5 22.5The Group does not operate any post-employment medical benefit schemes.