Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

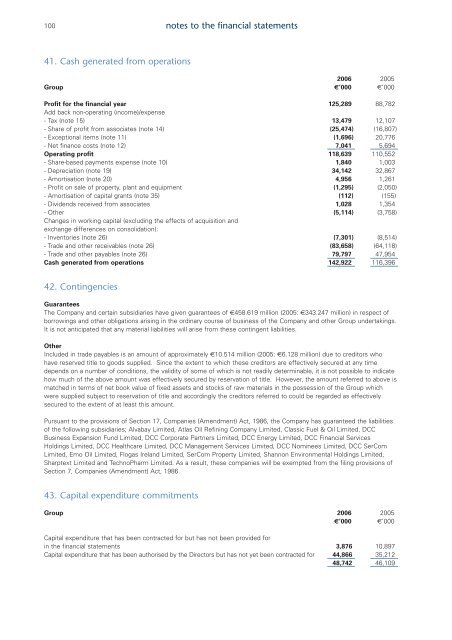

100notes to the financial statements41. Cash generated from operations<strong>2006</strong> 2005Group €’000 €’000Profit for the financial year 125,289 88,782Add back non-operating (income)/expense- Tax (note 15) 13,479 12,107- Share of profit from associates (note 14) (25,474) (16,807)- Exceptional items (note 11) (1,696) 20,776- Net finance costs (note 12) 7,041 5,694Operating profit 118,639 110,552- Share-based payments expense (note 10) 1,840 1,003- Depreciation (note 19) 34,142 32,867- Amortisation (note 20) 4,956 1,261- Profit on sale of property, plant <strong>and</strong> equipment (1,295) (2,050)- Amortisation of capital grants (note 35) (112) (155)- Dividends received from associates 1,028 1,354- Other (5,114) (3,758)Changes in working capital (excluding the effects of acquisition <strong>and</strong>exchange differences on consolidation):- Inventories (note 26) (7,301) (8,514)- Trade <strong>and</strong> other receivables (note 26) (83,658) (64,118)- Trade <strong>and</strong> other payables (note 26) 79,797 47,954Cash generated from operations 142,922 116,39642. ContingenciesGuaranteesThe Company <strong>and</strong> certain subsidiaries have given guarantees of €458.619 million (2005: €343.247 million) in respect ofborrowings <strong>and</strong> other obligations arising in the ordinary course of business of the Company <strong>and</strong> other Group undertakings.It is not anticipated that any material liabilities will arise from these contingent liabilities.OtherIncluded in trade payables is an amount of approximately €10.514 million (2005: €6.128 million) due to creditors whohave reserved title to goods supplied. Since the extent to which these creditors are effectively secured at any timedepends on a number of conditions, the validity of some of which is not readily determinable, it is not possible to indicatehow much of the above amount was effectively secured by reservation of title. However, the amount referred to above ismatched in terms of net book value of fixed assets <strong>and</strong> stocks of raw materials in the possession of the Group whichwere supplied subject to reservation of title <strong>and</strong> accordingly the creditors referred to could be regarded as effectivelysecured to the extent of at least this amount.Pursuant to the provisions of Section 17, Companies (Amendment) Act, 1986, the Company has guaranteed the liabilitiesof the following subsidiaries; Alvabay Limited, Atlas Oil Refining Company Limited, Classic Fuel & Oil Limited, <strong>DCC</strong>Business Expansion Fund Limited, <strong>DCC</strong> Corporate Partners Limited, <strong>DCC</strong> Energy Limited, <strong>DCC</strong> Financial ServicesHoldings Limited, <strong>DCC</strong> Healthcare Limited, <strong>DCC</strong> Management Services Limited, <strong>DCC</strong> Nominees Limited, <strong>DCC</strong> SerComLimited, Emo Oil Limited, Flogas Irel<strong>and</strong> Limited, SerCom Property Limited, Shannon Environmental Holdings Limited,Sharptext Limited <strong>and</strong> TechnoPharm Limited. As a result, these companies will be exempted from the filing provisions ofSection 7, Companies (Amendment) Act, 1986.43. Capital expenditure commitmentsGroup <strong>2006</strong> 2005€’000 €’000Capital expenditure that has been contracted for but has not been provided forin the financial statements 3,876 10,897Capital expenditure that has been authorised by the Directors but has not yet been contracted for 44,866 35,21248,742 46,109