90notes to the financial statements28. Derivative financial instrumentsAs at 31 March <strong>2006</strong>Group Assets Liabilities Net€’000 €’000 €’000Interest rate swaps - fair value hedges 926 (9,167) (8,241)Interest rate swaps - not designated as hedges 6,805 (6,921) (116)Currency swaps - not designated as hedges 1,258 (3,786) (2,528)Cross currency interest rate swaps - fair value hedges - (7,203) (7,203)Forward foreign exchange contracts - cash flow hedges 2 (24) (22)Forward foreign exchange contracts - not designated as hedges 69 (21) 48Commodity price forward contracts - cash flow hedges 45 - 45Commodity price forward contracts - not designated as hedges 28 (28) -Total 9,133 (27,150) (18,017)Less non–current portionInterest rate swaps - fair value hedges 926 (9,167) (8,241)Interest rate swaps - not designated as hedges 6,805 (6,921) (116)Currency swaps - not designated as hedges 1,258 (3,786) (2,528)Cross currency interest rate swaps - fair value hedges - (7,203) (7,203)8,989 (27,077) (18,088)Current portion 144 (73) 71The full fair value of a hedging derivative is classified as a non-current asset or liability if the remaining maturity of the hedgeditem is more than twelve months <strong>and</strong> as a current asset or liability if the maturity of the hedged item is less than twelve months.Interest rate swapsThe notional principal amounts of the outst<strong>and</strong>ing interest rate swap contracts designated as fair value hedges underIAS 39 at 31 March <strong>2006</strong> total €210.149 million. At 31 March <strong>2006</strong>, the fixed interest rates vary from 5.12% to 5.76%<strong>and</strong> the floating rates are based on US$ LIBOR <strong>and</strong> sterling LIBOR.The Group also utilises interest rate swaps, not designated as fair value hedges under IAS 39, to swap floating rate sterlingassets <strong>and</strong> liabilities into fixed rate sterling assets (8.05%) <strong>and</strong> fixed rate sterling liabilities (8.1%). The notional principalamounts of these swaps (Stg£61.000 million) offset.Currency swapsThe Group utilises currency swaps in conjunction with interest rate swaps designated as fair value hedges (as notedabove) to swap fixed rate US$ denominated debt into floating rate euro debt. The currency swaps (which swap floatingUS$ denominated debt based on US$ LIBOR into floating euro denominated debt based on EURIBOR) have notionalprincipal amounts of €167.113 million <strong>and</strong> are not designated as hedges under IAS 39.Cross currency interest rate swapsThe Group utilises cross currency interest rate swaps to swap fixed rate (7.82%) US$ denominated debt of US$100.000million into floating rate sterling debt of Stg£65.000 million. These swaps are designated as fair value hedges under IAS 39.Forward foreign exchange contractsThe notional principal amounts of outst<strong>and</strong>ing forward foreign exchange contracts at 31 March <strong>2006</strong> total €17.638 million.Gains <strong>and</strong> losses recognised in the cash flow hedge reserve in equity (note 38) at 31 March <strong>2006</strong> on forward foreignexchange contracts designated as cash flow hedges under IAS 39 will be released to the Income Statement at variousdates up to four months after the balance sheet date.Commodity price forward contractsThe notional principal amounts of outst<strong>and</strong>ing forward commodity contracts at 31 March <strong>2006</strong> total €2.654 million. The gainrecognised in the cash flow hedge reserve in equity (note 38) on forward commodity contracts designated as cash flow hedgesunder IAS 39 will be released to the Income Statement at various dates up to two months after the balance sheet date.Adoption of IAS 32 <strong>and</strong> IAS 39The Group adopted IAS 32 <strong>and</strong> IAS 39 from 1 April 2005. Derivative balances at 31 March 2005 were, in accordance withIrish GAAP, disclosed rather than recognised in the financial statements for the year then ended. The fair value loss onderivatives at 31 March 2005 amounted to €29.974 million with €29.816 million of this balance relating to derivativesassociated with the Group’s Unsecured Notes due 2008 to 2016. Under Irish GAAP at 31 March <strong>2006</strong>, the Group’sUnsecured Notes due 2008 to 2016 were carried at cost of €305.094 million, not recognising fair value gains (note 29). Themovement in the Group’s net debt balance during the financial year, including the adoption of IAS 32 <strong>and</strong> IAS 39, is includedin note 30.

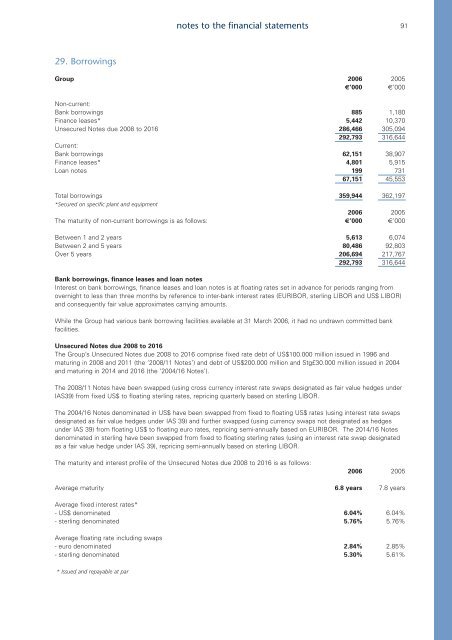

notes to the financial statements9129. BorrowingsGroup <strong>2006</strong> 2005€’000 €’000Non-current:Bank borrowings 885 1,180Finance leases* 5,442 10,370Unsecured Notes due 2008 to 2016 286,466 305,094292,793 316,644Current:Bank borrowings 62,151 38,907Finance leases* 4,801 5,915Loan notes 199 73167,151 45,553Total borrowings 359,944 362,197*Secured on specific plant <strong>and</strong> equipment<strong>2006</strong> 2005The maturity of non-current borrowings is as follows: €’000 €’000Between 1 <strong>and</strong> 2 years 5,613 6,074Between 2 <strong>and</strong> 5 years 80,486 92,803Over 5 years 206,694 217,767292,793 316,644Bank borrowings, finance leases <strong>and</strong> loan notesInterest on bank borrowings, finance leases <strong>and</strong> loan notes is at floating rates set in advance for periods ranging fromovernight to less than three months by reference to inter-bank interest rates (EURIBOR, sterling LIBOR <strong>and</strong> US$ LIBOR)<strong>and</strong> consequently fair value approximates carrying amounts.While the Group had various bank borrowing facilities available at 31 March <strong>2006</strong>, it had no undrawn committed bankfacilities.Unsecured Notes due 2008 to 2016The Group’s Unsecured Notes due 2008 to 2016 comprise fixed rate debt of US$100.000 million issued in 1996 <strong>and</strong>maturing in 2008 <strong>and</strong> 2011 (the ‘2008/11 Notes’) <strong>and</strong> debt of US$200.000 million <strong>and</strong> Stg£30.000 million issued in 2004<strong>and</strong> maturing in 2014 <strong>and</strong> 2016 (the ‘2004/16 Notes’).The 2008/11 Notes have been swapped (using cross currency interest rate swaps designated as fair value hedges underIAS39) from fixed US$ to floating sterling rates, repricing quarterly based on sterling LIBOR.The 2004/16 Notes denominated in US$ have been swapped from fixed to floating US$ rates (using interest rate swapsdesignated as fair value hedges under IAS 39) <strong>and</strong> further swapped (using currency swaps not designated as hedgesunder IAS 39) from floating US$ to floating euro rates, repricing semi-annually based on EURIBOR. The 2014/16 Notesdenominated in sterling have been swapped from fixed to floating sterling rates (using an interest rate swap designatedas a fair value hedge under IAS 39), repricing semi-annually based on sterling LIBOR.The maturity <strong>and</strong> interest profile of the Unsecured Notes due 2008 to 2016 is as follows:<strong>2006</strong> 2005Average maturity 6.8 years 7.8 yearsAverage fixed interest rates*- US$ denominated 6.04% 6.04%- sterling denominated 5.76% 5.76%Average floating rate including swaps- euro denominated 2.84% 2.85%- sterling denominated 5.30% 5.61%* Issued <strong>and</strong> repayable at par