Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

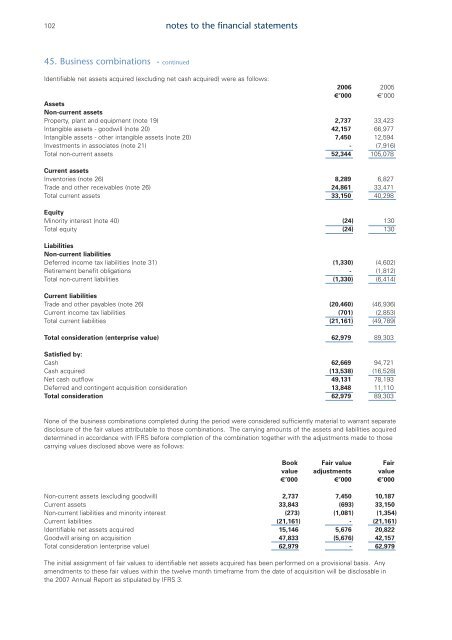

102notes to the financial statements45. Business combinations - continuedIdentifiable net assets acquired (excluding net cash acquired) were as follows:<strong>2006</strong> 2005€’000 €’000AssetsNon-current assetsProperty, plant <strong>and</strong> equipment (note 19) 2,737 33,423Intangible assets - goodwill (note 20) 42,157 66,977Intangible assets - other intangible assets (note 20) 7,450 12,594Investments in associates (note 21) - (7,916)Total non-current assets 52,344 105,078Current assetsInventories (note 26) 8,289 6,827Trade <strong>and</strong> other receivables (note 26) 24,861 33,471Total current assets 33,150 40,298EquityMinority interest (note 40) (24) 130Total equity (24) 130LiabilitiesNon-current liabilitiesDeferred income tax liabilities (note 31) (1,330) (4,602)Retirement benefit obligations - (1,812)Total non-current liabilities (1,330) (6,414)Current liabilitiesTrade <strong>and</strong> other payables (note 26) (20,460) (46,936)Current income tax liabilities (701) (2,853)Total current liabilities (21,161) (49,789)Total consideration (enterprise value) 62,979 89,303Satisfied by:Cash 62,669 94,721Cash acquired (13,538) (16,528)Net cash outflow 49,131 78,193Deferred <strong>and</strong> contingent acquisition consideration 13,848 11,110Total consideration 62,979 89,303None of the business combinations completed during the period were considered sufficiently material to warrant separatedisclosure of the fair values attributable to those combinations. The carrying amounts of the assets <strong>and</strong> liabilities acquireddetermined in accordance with IFRS before completion of the combination together with the adjustments made to thosecarrying values disclosed above were as follows:Book Fair value Fairvalue adjustments value€’000 €’000 €’000Non-current assets (excluding goodwill) 2,737 7,450 10,187Current assets 33,843 (693) 33,150Non-current liabilities <strong>and</strong> minority interest (273) (1,081) (1,354)Current liabilities (21,161) - (21,161)Identifiable net assets acquired 15,146 5,676 20,822Goodwill arising on acquisition 47,833 (5,676) 42,157Total consideration (enterprise value) 62,979 - 62,979The initial assignment of fair values to identifiable net assets acquired has been performed on a provisional basis. Anyamendments to these fair values within the twelve month timeframe from the date of acquisition will be disclosable inthe 2007 <strong>Annual</strong> <strong>Report</strong> as stipulated by IFRS 3.