Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

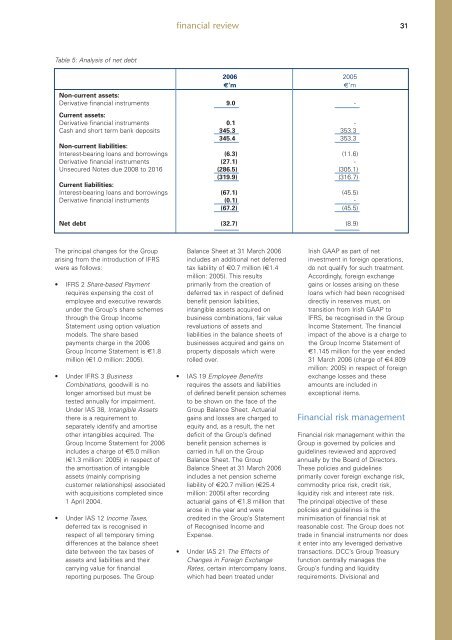

financial review31Table 5: Analysis of net debt<strong>2006</strong> 2005€’m€’mNon-current assets:Derivative financial instruments 9.0 -Current assets:Derivative financial instruments 0.1 -Cash <strong>and</strong> short term bank deposits 345.3 353.3345.4 353.3Non-current liabilities:Interest-bearing loans <strong>and</strong> borrowings (6.3) (11.6)Derivative financial instruments (27.1) -Unsecured Notes due 2008 to 2016 (286.5) (305.1)(319.9) (316.7)Current liabilities:Interest-bearing loans <strong>and</strong> borrowings (67.1) (45.5)Derivative financial instruments (0.1) -(67.2) (45.5)Net debt (32.7) (8.9)The principal changes for the Grouparising from the introduction of IFRSwere as follows:• IFRS 2 Share-based Paymentrequires expensing the cost ofemployee <strong>and</strong> executive rewardsunder the Group’s share schemesthrough the Group IncomeStatement using option valuationmodels. The share basedpayments charge in the <strong>2006</strong>Group Income Statement is €1.8million (€1.0 million: 2005).• Under IFRS 3 BusinessCombinations, goodwill is nolonger amortised but must betested annually for impairment.Under IAS 38, Intangible Assetsthere is a requirement toseparately identify <strong>and</strong> amortiseother intangibles acquired. TheGroup Income Statement for <strong>2006</strong>includes a charge of €5.0 million(€1.3 million: 2005) in respect ofthe amortisation of intangibleassets (mainly comprisingcustomer relationships) associatedwith acquisitions completed since1 April 2004.• Under IAS 12 Income Taxes,deferred tax is recognised inrespect of all temporary timingdifferences at the balance sheetdate between the tax bases ofassets <strong>and</strong> liabilities <strong>and</strong> theircarrying value for financialreporting purposes. The GroupBalance Sheet at 31 March <strong>2006</strong>includes an additional net deferredtax liability of €0.7 million (€1.4million: 2005). This resultsprimarily from the creation ofdeferred tax in respect of definedbenefit pension liabilities,intangible assets acquired onbusiness combinations, fair valuerevaluations of assets <strong>and</strong>liabilities in the balance sheets ofbusinesses acquired <strong>and</strong> gains onproperty disposals which wererolled over.• IAS 19 Employee Benefitsrequires the assets <strong>and</strong> liabilitiesof defined benefit pension schemesto be shown on the face of theGroup Balance Sheet. Actuarialgains <strong>and</strong> losses are charged toequity <strong>and</strong>, as a result, the netdeficit of the Group’s definedbenefit pension schemes iscarried in full on the GroupBalance Sheet. The GroupBalance Sheet at 31 March <strong>2006</strong>includes a net pension schemeliability of €20.7 million (€25.4million: 2005) after recordingactuarial gains of €1.8 million thatarose in the year <strong>and</strong> werecredited in the Group’s Statementof Recognised Income <strong>and</strong>Expense.• Under IAS 21 The Effects ofChanges in Foreign ExchangeRates, certain intercompany loans,which had been treated underIrish GAAP as part of netinvestment in foreign operations,do not qualify for such treatment.Accordingly, foreign exchangegains or losses arising on theseloans which had been recogniseddirectly in reserves must, ontransition from Irish GAAP toIFRS, be recognised in the GroupIncome Statement. The financialimpact of the above is a charge tothe Group Income Statement of€1.145 million for the year ended31 March <strong>2006</strong> (charge of €4.809million: 2005) in respect of foreignexchange losses <strong>and</strong> theseamounts are included inexceptional items.Financial risk managementFinancial risk management within theGroup is governed by policies <strong>and</strong>guidelines reviewed <strong>and</strong> approvedannually by the Board of Directors.These policies <strong>and</strong> guidelinesprimarily cover foreign exchange risk,commodity price risk, credit risk,liquidity risk <strong>and</strong> interest rate risk.The principal objective of thesepolicies <strong>and</strong> guidelines is theminimisation of financial risk atreasonable cost. The Group does nottrade in financial instruments nor doesit enter into any leveraged derivativetransactions. <strong>DCC</strong>’s Group Treasuryfunction centrally manages theGroup’s funding <strong>and</strong> liquidityrequirements. Divisional <strong>and</strong>