Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

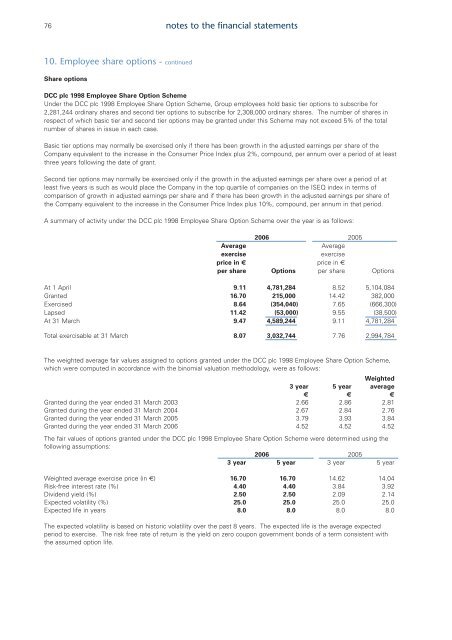

76notes to the financial statements10. Employee share options - continuedShare options<strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option SchemeUnder the <strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme, Group employees hold basic tier options to subscribe for2,281,244 ordinary shares <strong>and</strong> second tier options to subscribe for 2,308,000 ordinary shares. The number of shares inrespect of which basic tier <strong>and</strong> second tier options may be granted under this Scheme may not exceed 5% of the totalnumber of shares in issue in each case.Basic tier options may normally be exercised only if there has been growth in the adjusted earnings per share of theCompany equivalent to the increase in the Consumer Price Index plus 2%, compound, per annum over a period of at leastthree years following the date of grant.Second tier options may normally be exercised only if the growth in the adjusted earnings per share over a period of atleast five years is such as would place the Company in the top quartile of companies on the ISEQ index in terms ofcomparison of growth in adjusted earnings per share <strong>and</strong> if there has been growth in the adjusted earnings per share ofthe Company equivalent to the increase in the Consumer Price Index plus 10%, compound, per annum in that period.A summary of activity under the <strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme over the year is as follows:<strong>2006</strong> 2005AverageAverageexerciseexerciseprice in € price in €per share Options per share OptionsAt 1 April 9.11 4,781,284 8.52 5,104,084Granted 16.70 215,000 14.42 382,000Exercised 8.64 (354,040) 7.65 (666,300)Lapsed 11.42 (53,000) 9.55 (38,500)At 31 March 9.47 4,589,244 9.11 4,781,284Total exercisable at 31 March 8.07 3,032,744 7.76 2,994,784The weighted average fair values assigned to options granted under the <strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme,which were computed in accordance with the binomial valuation methodology, were as follows:Weighted3 year 5 year average€ € €Granted during the year ended 31 March 2003 2.66 2.86 2.81Granted during the year ended 31 March 2004 2.67 2.84 2.76Granted during the year ended 31 March 2005 3.79 3.93 3.84Granted during the year ended 31 March <strong>2006</strong> 4.52 4.52 4.52The fair values of options granted under the <strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme were determined using thefollowing assumptions:<strong>2006</strong> 20053 year 5 year 3 year 5 yearWeighted average exercise price (in €) 16.70 16.70 14.62 14.04Risk-free interest rate (%) 4.40 4.40 3.84 3.92Dividend yield (%) 2.50 2.50 2.09 2.14Expected volatility (%) 25.0 25.0 25.0 25.0Expected life in years 8.0 8.0 8.0 8.0The expected volatility is based on historic volatility over the past 8 years. The expected life is the average expectedperiod to exercise. The risk free rate of return is the yield on zero coupon government bonds of a term consistent withthe assumed option life.