Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

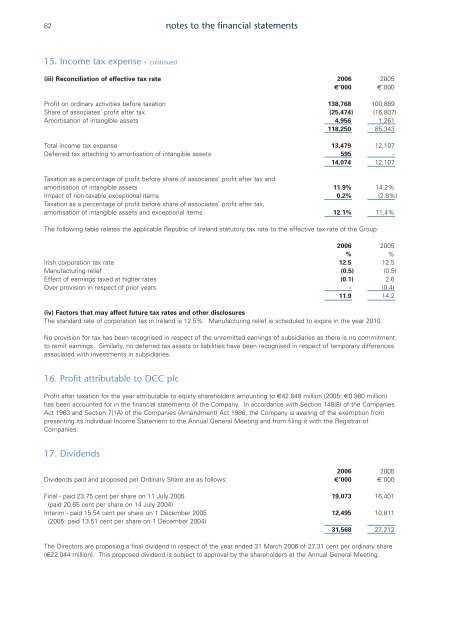

82notes to the financial statements15. Income tax expense - continued(iii) Reconciliation of effective tax rate <strong>2006</strong> 2005€’000 €’000Profit on ordinary activities before taxation 138,768 100,889Share of associates’ profit after tax (25,474) (16,807)Amortisation of intangible assets 4,956 1,261118,250 85,343Total income tax expense 13,479 12,107Deferred tax attaching to amortisation of intangible assets 595 -14,074 12,107Taxation as a percentage of profit before share of associates’ profit after tax <strong>and</strong>amortisation of intangible assets 11.9% 14.2%Impact of non-taxable exceptional items 0.2% (2.8%)Taxation as a percentage of profit before share of associates’ profit after tax,amortisation of intangible assets <strong>and</strong> exceptional items 12.1% 11.4%The following table relates the applicable Republic of Irel<strong>and</strong> statutory tax rate to the effective tax rate of the Group:<strong>2006</strong> 2005% %Irish corporation tax rate 12.5 12.5Manufacturing relief (0.5) (0.5)Effect of earnings taxed at higher rates (0.1) 2.6Over provision in respect of prior years - (0.4)11.9 14.2(iv) Factors that may affect future tax rates <strong>and</strong> other disclosuresThe st<strong>and</strong>ard rate of corporation tax in Irel<strong>and</strong> is 12.5%. Manufacturing relief is scheduled to expire in the year 2010.No provision for tax has been recognised in respect of the unremitted earnings of subsidiaries as there is no commitmentto remit earnings. Similarly, no deferred tax assets or liabilities have been recognised in respect of temporary differencesassociated with investments in subsidiaries.16. Profit attributable to <strong>DCC</strong> <strong>plc</strong>Profit after taxation for the year attributable to equity shareholders amounting to €42.848 million (2005: €0.980 million)has been accounted for in the financial statements of the Company. In accordance with Section 148(8) of the CompaniesAct 1963 <strong>and</strong> Section 7(1A) of the Companies (Amendment) Act 1986, the Company is availing of the exemption frompresenting its individual Income Statement to the <strong>Annual</strong> General Meeting <strong>and</strong> from filing it with the Registrar ofCompanies.17. Dividends<strong>2006</strong> 2005Dividends paid <strong>and</strong> proposed per Ordinary Share are as follows: €’000 €’000Final - paid 23.75 cent per share on 11 July 2005 19,073 16,401(paid 20.65 cent per share on 14 July 2004)Interim - paid 15.54 cent per share on 1 December 2005 12,495 10,811(2005: paid 13.51 cent per share on 1 December 2004)31,568 27,212The Directors are proposing a final dividend in respect of the year ended 31 March <strong>2006</strong> of 27.31 cent per ordinary share(€22.044 million). This proposed dividend is subject to approval by the shareholders at the <strong>Annual</strong> General Meeting.