Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

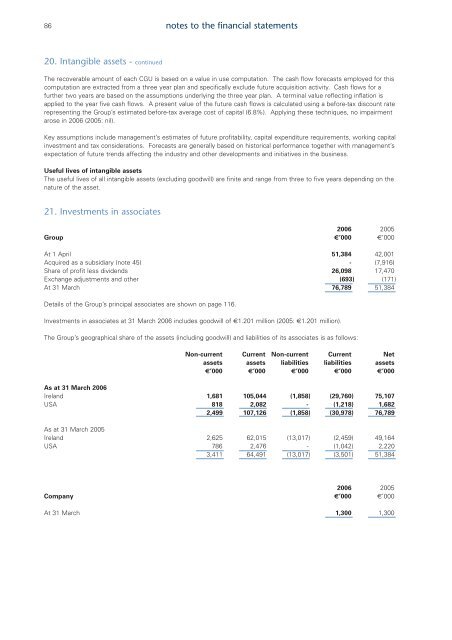

86notes to the financial statements20. Intangible assets - continuedThe recoverable amount of each CGU is based on a value in use computation. The cash flow forecasts employed for thiscomputation are extracted from a three year plan <strong>and</strong> specifically exclude future acquisition activity. Cash flows for afurther two years are based on the assumptions underlying the three year plan. A terminal value reflecting inflation isapplied to the year five cash flows. A present value of the future cash flows is calculated using a before-tax discount raterepresenting the Group’s estimated before-tax average cost of capital (6.8%). Applying these techniques, no impairmentarose in <strong>2006</strong> (2005: nil).Key assumptions include management’s estimates of future profitability, capital expenditure requirements, working capitalinvestment <strong>and</strong> tax considerations. Forecasts are generally based on historical performance together with management’sexpectation of future trends affecting the industry <strong>and</strong> other developments <strong>and</strong> initiatives in the business.Useful lives of intangible assetsThe useful lives of all intangible assets (excluding goodwill) are finite <strong>and</strong> range from three to five years depending on thenature of the asset.21. Investments in associates<strong>2006</strong> 2005Group €’000 €’000At 1 April 51,384 42,001Acquired as a subsidiary (note 45) - (7,916)Share of profit less dividends 26,098 17,470Exchange adjustments <strong>and</strong> other (693) (171)At 31 March 76,789 51,384Details of the Group’s principal associates are shown on page 116.Investments in associates at 31 March <strong>2006</strong> includes goodwill of €1.201 million (2005: €1.201 million).The Group’s geographical share of the assets (including goodwill) <strong>and</strong> liabilities of its associates is as follows:Non-current Current Non-current Current Netassets assets liabilities liabilities assets€’000 €’000 €’000 €’000 €’000As at 31 March <strong>2006</strong>Irel<strong>and</strong> 1,681 105,044 (1,858) (29,760) 75,107USA 818 2,082 - (1,218) 1,6822,499 107,126 (1,858) (30,978) 76,789As at 31 March 2005Irel<strong>and</strong> 2,625 62,015 (13,017) (2,459) 49,164USA 786 2,476 - (1,042) 2,2203,411 64,491 (13,017) (3,501) 51,384<strong>2006</strong> 2005Company €’000 €’000At 31 March 1,300 1,300