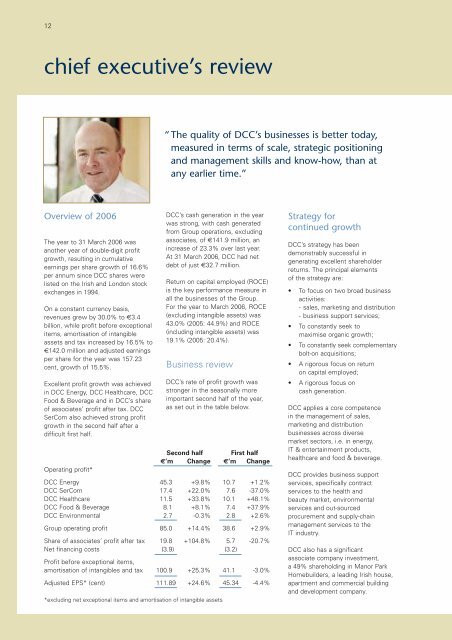

12chief executive’s review“ The quality of <strong>DCC</strong>’s businesses is better today,measured in terms of scale, strategic positioning<strong>and</strong> management skills <strong>and</strong> know-how, than atany earlier time.”Overview of <strong>2006</strong>The year to 31 March <strong>2006</strong> wasanother year of double-digit profitgrowth, resulting in cumulativeearnings per share growth of 16.6%per annum since <strong>DCC</strong> shares werelisted on the Irish <strong>and</strong> London stockexchanges in 1994.On a constant currency basis,revenues grew by 30.0% to €3.4billion, while profit before exceptionalitems, amortisation of intangibleassets <strong>and</strong> tax increased by 16.5% to€142.0 million <strong>and</strong> adjusted earningsper share for the year was 157.23cent, growth of 15.5%.Excellent profit growth was achievedin <strong>DCC</strong> Energy, <strong>DCC</strong> Healthcare, <strong>DCC</strong>Food & Beverage <strong>and</strong> in <strong>DCC</strong>’s shareof associates’ profit after tax. <strong>DCC</strong>SerCom also achieved strong profitgrowth in the second half after adifficult first half.Operating profit*<strong>DCC</strong>’s cash generation in the yearwas strong, with cash generatedfrom Group operations, excludingassociates, of €141.9 million, anincrease of 23.3% over last year.At 31 March <strong>2006</strong>, <strong>DCC</strong> had netdebt of just €32.7 million.Return on capital employed (ROCE)is the key performance measure inall the businesses of the Group.For the year to March <strong>2006</strong>, ROCE(excluding intangible assets) was43.0% (2005: 44.9%) <strong>and</strong> ROCE(including intangible assets) was19.1% (2005: 20.4%).Business review<strong>DCC</strong>’s rate of profit growth wasstronger in the seasonally moreimportant second half of the year,as set out in the table below.Second half First half€’m Change €’m Change<strong>DCC</strong> Energy 45.3 +9.8% 10.7 +1.2%<strong>DCC</strong> SerCom 17.4 +22.0% 7.6 -37.0%<strong>DCC</strong> Healthcare 11.5 +33.8% 10.1 +48.1%<strong>DCC</strong> Food & Beverage 8.1 +8.1% 7.4 +37.9%<strong>DCC</strong> Environmental 2.7 -0.3% 2.8 +2.6%Group operating profit 85.0 +14.4% 38.6 +2.9%Share of associates’ profit after tax 19.8 +104.8% 5.7 -20.7%Net financing costs (3.9) (3.2)Profit before exceptional items,amortisation of intangibles <strong>and</strong> tax 100.9 +25.3% 41.1 -3.0%Adjusted EPS* (cent) 111.89 +24.6% 45.34 -4.4%*excluding net exceptional items <strong>and</strong> amortisation of intangible assetsStrategy forcontinued growth<strong>DCC</strong>’s strategy has beendemonstrably successful ingenerating excellent shareholderreturns. The principal elementsof the strategy are:• To focus on two broad businessactivities:- sales, marketing <strong>and</strong> distribution- business support services;• To constantly seek tomaximise organic growth;• To constantly seek complementarybolt-on acquisitions;• A rigorous focus on returnon capital employed;• A rigorous focus oncash generation.<strong>DCC</strong> applies a core competencein the management of sales,marketing <strong>and</strong> distributionbusinesses across diversemarket sectors, i.e. in energy,IT & entertainment products,healthcare <strong>and</strong> food & beverage.<strong>DCC</strong> provides business supportservices, specifically contractservices to the health <strong>and</strong>beauty market, environmentalservices <strong>and</strong> out-sourcedprocurement <strong>and</strong> supply-chainmanagement services to theIT industry.<strong>DCC</strong> also has a significantassociate company investment,a 49% shareholding in Manor ParkHomebuilders, a leading Irish house,apartment <strong>and</strong> commercial building<strong>and</strong> development company.

13<strong>DCC</strong>’s broad business base reducesindustry specific risk <strong>and</strong> provides arange of platforms for growth.We are alive to the need to regularlyreview <strong>DCC</strong>’s strategy for growth ina rapidly changing global businessenvironment. We seek to position<strong>DCC</strong> for consistent <strong>and</strong> resilientgrowth that optimises returns forshareholders over the long term.The achievement of long-termgrowth requires both correctstrategic positioning <strong>and</strong> superioroperational effectiveness.The quality of <strong>DCC</strong>’s businesses isbetter today, measured in terms ofscale, strategic positioning <strong>and</strong>management skills <strong>and</strong> know-how,than at any earlier time.<strong>DCC</strong> Energy is a resilient, highlycash-generative business, withstrong market positions in Irel<strong>and</strong><strong>and</strong> Britain. There is a considerableopportunity to substantially increasethe scale of the oil distributionbusiness in Britain.<strong>DCC</strong> SerCom, a high-growthbusiness for <strong>DCC</strong> up to 2001, hasbeen challenged by product pricedeflation in the IT industry in recentyears. However, the business inBritain <strong>and</strong> Irel<strong>and</strong> has consistentlyachieved strong organic sales volumegrowth, has best-in-class operationalmetrics <strong>and</strong> achieves a good returnon capital employed. Amelioration inproduct price deflation should reveala growing business <strong>and</strong> renewedprofit growth.<strong>DCC</strong> Healthcare is a business withconsiderable growth potential basedon a clear strategy to build aEuropean business on the foundationof product knowledge <strong>and</strong> expertise.<strong>DCC</strong> Food & Beverage operates inhigher growth, niche areas within thefood industry <strong>and</strong> has demonstratedresilient growth in Irel<strong>and</strong>.<strong>DCC</strong> Environmental is a rapidlydeveloping, newer business area for<strong>DCC</strong>, with significant growthopportunities, particularly in Britain.These businesses position <strong>DCC</strong> forcontinued growth but, as ever, therewill be a relentless focus onexcellence in operations in eachbusiness area to maintaincompetitive advantage.Management changesKevin Murray, executive Director <strong>and</strong>Managing Director of <strong>DCC</strong> Healthcare,is resigning with effect from 30 June<strong>2006</strong> to pursue involvement in theprivate company arena in preferenceto the continuation of a seniormanagement role in a public company.During his 18 years with <strong>DCC</strong>, Kevin’scommitment to the Group has beenunstinting <strong>and</strong> his contribution hasbeen outst<strong>and</strong>ing. Kevin will continueto have some part-time involvementwith the Group on selected projects.A number of senior managementchanges, to take effect from 1 July<strong>2006</strong>, were recently announced:• Tommy Breen, currently ManagingDirector of <strong>DCC</strong> Energy <strong>and</strong> <strong>DCC</strong>Environmental, will become<strong>DCC</strong>’s Chief Operating Officer.This will allow me, as GroupChief Executive, to devoteadditional time to strategic <strong>and</strong>developmental matters.• Donal Murphy, currentlyManaging Director of <strong>DCC</strong>SerCom, will become ManagingDirector of <strong>DCC</strong> Energy <strong>and</strong> <strong>DCC</strong>Environmental.• Niall Ennis, currently Finance <strong>and</strong>Development Director of <strong>DCC</strong>SerCom, will become ManagingDirector of <strong>DCC</strong> SerCom.• Conor Costigan, currently Finance<strong>and</strong> Development Director of <strong>DCC</strong>Healthcare, will become ManagingDirector of <strong>DCC</strong> Healthcare.The senior management team in <strong>DCC</strong>,together with the highly experienced<strong>and</strong> committed operating managementteams in subsidiaries, give <strong>DCC</strong> themanagement strength <strong>and</strong> businessarea focus to drive the Group forward.Employees<strong>DCC</strong> currently employs approximately5,400 people. We seek to foster amanagement culture that givesenlightened leadership to employees.We recognise that employees arekey to <strong>DCC</strong>’s success <strong>and</strong> that theycan all be ambassadors for the Group.Corporate <strong>and</strong> socialresponsibilityStakeholders correctly have higherexpectations in relation to corporate<strong>and</strong> social responsibility. Set out onpages 33 to 35 is <strong>DCC</strong>’s corporate<strong>and</strong> social responsibility statement,which reports on how we relate toour marketplace, our environment,our workplace, our community <strong>and</strong>on health & safety.Outlook<strong>DCC</strong> has budgeted for continuedgood operating profit growth fromsubsidiaries in the current year to 31March 2007. As announced on 3 April<strong>2006</strong>, the share of associates’ profitafter tax may be materially less in thecurrent year, based on <strong>DCC</strong>’s currentexpectation of a short term reductionin the profit contribution from its49% shareholding in Manor ParkHomebuilders due to planning delays.Manor Park has a large l<strong>and</strong> bankfor housing development <strong>and</strong> otherdevelopment projects in the pipelinefrom which it should earn substantialprofits in the future.Jim FlavinChief Executive/Deputy Chairman12 May <strong>2006</strong>