Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

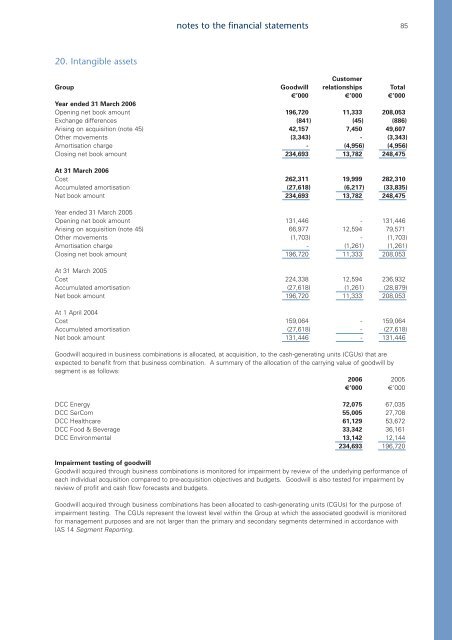

notes to the financial statements8520. Intangible assetsCustomerGroup Goodwill relationships Total€’000 €’000 €’000Year ended 31 March <strong>2006</strong>Opening net book amount 196,720 11,333 208,053Exchange differences (841) (45) (886)Arising on acquisition (note 45) 42,157 7,450 49,607Other movements (3,343) - (3,343)Amortisation charge - (4,956) (4,956)Closing net book amount 234,693 13,782 248,475At 31 March <strong>2006</strong>Cost 262,311 19,999 282,310Accumulated amortisation (27,618) (6,217) (33,835)Net book amount 234,693 13,782 248,475Year ended 31 March 2005Opening net book amount 131,446 - 131,446Arising on acquisition (note 45) 66,977 12,594 79,571Other movements (1,703) - (1,703)Amortisation charge - (1,261) (1,261)Closing net book amount 196,720 11,333 208,053At 31 March 2005Cost 224,338 12,594 236,932Accumulated amortisation (27,618) (1,261) (28,879)Net book amount 196,720 11,333 208,053At 1 April 2004Cost 159,064 - 159,064Accumulated amortisation (27,618) - (27,618)Net book amount 131,446 - 131,446Goodwill acquired in business combinations is allocated, at acquisition, to the cash-generating units (CGUs) that areexpected to benefit from that business combination. A summary of the allocation of the carrying value of goodwill bysegment is as follows:<strong>2006</strong> 2005€’000 €’000<strong>DCC</strong> Energy 72,075 67,035<strong>DCC</strong> SerCom 55,005 27,708<strong>DCC</strong> Healthcare 61,129 53,672<strong>DCC</strong> Food & Beverage 33,342 36,161<strong>DCC</strong> Environmental 13,142 12,144234,693 196,720Impairment testing of goodwillGoodwill acquired through business combinations is monitored for impairment by review of the underlying performance ofeach individual acquisition compared to pre-acquisition objectives <strong>and</strong> budgets. Goodwill is also tested for impairment byreview of profit <strong>and</strong> cash flow forecasts <strong>and</strong> budgets.Goodwill acquired through business combinations has been allocated to cash-generating units (CGUs) for the purpose ofimpairment testing. The CGUs represent the lowest level within the Group at which the associated goodwill is monitoredfor management purposes <strong>and</strong> are not larger than the primary <strong>and</strong> secondary segments determined in accordance withIAS 14 Segment <strong>Report</strong>ing.