Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

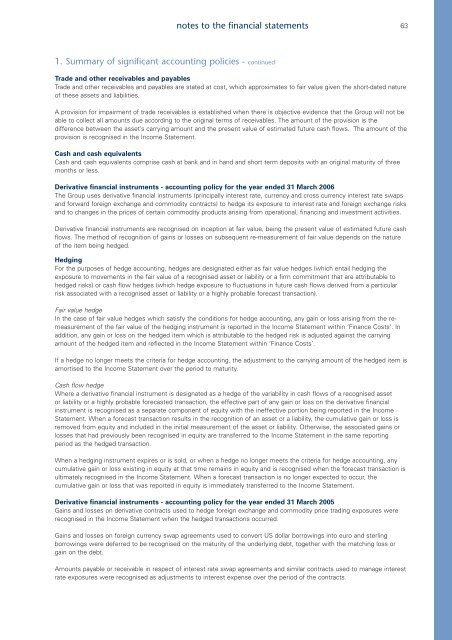

notes to the financial statements631. Summary of significant accounting policies - continuedTrade <strong>and</strong> other receivables <strong>and</strong> payablesTrade <strong>and</strong> other receivables <strong>and</strong> payables are stated at cost, which approximates to fair value given the short-dated natureof these assets <strong>and</strong> liabilities.A provision for impairment of trade receivables is established when there is objective evidence that the Group will not beable to collect all amounts due according to the original terms of receivables. The amount of the provision is thedifference between the asset’s carrying amount <strong>and</strong> the present value of estimated future cash flows. The amount of theprovision is recognised in the Income Statement.Cash <strong>and</strong> cash equivalentsCash <strong>and</strong> cash equivalents comprise cash at bank <strong>and</strong> in h<strong>and</strong> <strong>and</strong> short term deposits with an original maturity of threemonths or less.Derivative financial instruments - accounting policy for the year ended 31 March <strong>2006</strong>The Group uses derivative financial instruments (principally interest rate, currency <strong>and</strong> cross currency interest rate swaps<strong>and</strong> forward foreign exchange <strong>and</strong> commodity contracts) to hedge its exposure to interest rate <strong>and</strong> foreign exchange risks<strong>and</strong> to changes in the prices of certain commodity products arising from operational, financing <strong>and</strong> investment activities.Derivative financial instruments are recognised on inception at fair value, being the present value of estimated future cashflows. The method of recognition of gains or losses on subsequent re-measurement of fair value depends on the natureof the item being hedged.HedgingFor the purposes of hedge accounting, hedges are designated either as fair value hedges (which entail hedging theexposure to movements in the fair value of a recognised asset or liability or a firm commitment that are attributable tohedged risks) or cash flow hedges (which hedge exposure to fluctuations in future cash flows derived from a particularrisk associated with a recognised asset or liability or a highly probable forecast transaction).Fair value hedgeIn the case of fair value hedges which satisfy the conditions for hedge accounting, any gain or loss arising from the remeasurementof the fair value of the hedging instrument is reported in the Income Statement within ‘Finance Costs’. Inaddition, any gain or loss on the hedged item which is attributable to the hedged risk is adjusted against the carryingamount of the hedged item <strong>and</strong> reflected in the Income Statement within ‘Finance Costs’.If a hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of the hedged item isamortised to the Income Statement over the period to maturity.Cash flow hedgeWhere a derivative financial instrument is designated as a hedge of the variability in cash flows of a recognised assetor liability or a highly probable forecasted transaction, the effective part of any gain or loss on the derivative financialinstrument is recognised as a separate component of equity with the ineffective portion being reported in the IncomeStatement. When a forecast transaction results in the recognition of an asset or a liability, the cumulative gain or loss isremoved from equity <strong>and</strong> included in the initial measurement of the asset or liability. Otherwise, the associated gains orlosses that had previously been recognised in equity are transferred to the Income Statement in the same reportingperiod as the hedged transaction.When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, anycumulative gain or loss existing in equity at that time remains in equity <strong>and</strong> is recognised when the forecast transaction isultimately recognised in the Income Statement. When a forecast transaction is no longer expected to occur, thecumulative gain or loss that was reported in equity is immediately transferred to the Income Statement.Derivative financial instruments - accounting policy for the year ended 31 March 2005Gains <strong>and</strong> losses on derivative contracts used to hedge foreign exchange <strong>and</strong> commodity price trading exposures wererecognised in the Income Statement when the hedged transactions occurred.Gains <strong>and</strong> losses on foreign currency swap agreements used to convert US dollar borrowings into euro <strong>and</strong> sterlingborrowings were deferred to be recognised on the maturity of the underlying debt, together with the matching loss orgain on the debt.Amounts payable or receivable in respect of interest rate swap agreements <strong>and</strong> similar contracts used to manage interestrate exposures were recognised as adjustments to interest expense over the period of the contracts.