Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

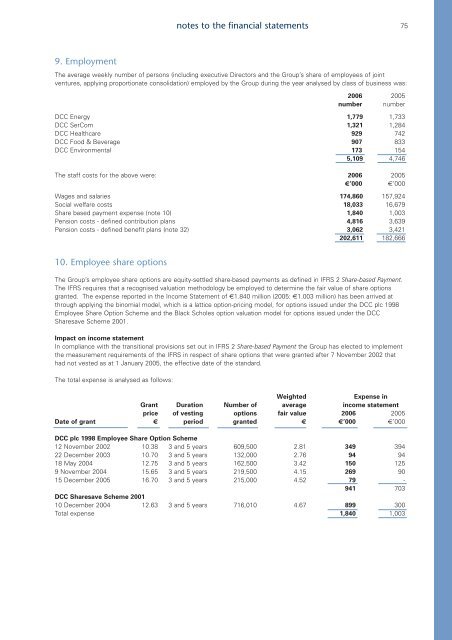

notes to the financial statements759. EmploymentThe average weekly number of persons (including executive Directors <strong>and</strong> the Group’s share of employees of jointventures, applying proportionate consolidation) employed by the Group during the year analysed by class of business was:<strong>2006</strong> 2005number number<strong>DCC</strong> Energy 1,779 1,733<strong>DCC</strong> SerCom 1,321 1,284<strong>DCC</strong> Healthcare 929 742<strong>DCC</strong> Food & Beverage 907 833<strong>DCC</strong> Environmental 173 1545,109 4,746The staff costs for the above were: <strong>2006</strong> 2005€’000 €’000Wages <strong>and</strong> salaries 174,860 157,924Social welfare costs 18,033 16,679Share based payment expense (note 10) 1,840 1,003Pension costs - defined contribution plans 4,816 3,639Pension costs - defined benefit plans (note 32) 3,062 3,421202,611 182,66610. Employee share optionsThe Group’s employee share options are equity-settled share-based payments as defined in IFRS 2 Share-based Payment.The IFRS requires that a recognised valuation methodology be employed to determine the fair value of share optionsgranted. The expense reported in the Income Statement of €1.840 million (2005: €1.003 million) has been arrived atthrough applying the binomial model, which is a lattice option-pricing model, for options issued under the <strong>DCC</strong> <strong>plc</strong> 1998Employee Share Option Scheme <strong>and</strong> the Black Scholes option valuation model for options issued under the <strong>DCC</strong>Sharesave Scheme 2001.Impact on income statementIn compliance with the transitional provisions set out in IFRS 2 Share-based Payment the Group has elected to implementthe measurement requirements of the IFRS in respect of share options that were granted after 7 November 2002 thathad not vested as at 1 January 2005, the effective date of the st<strong>and</strong>ard.The total expense is analysed as follows:WeightedExpense inGrant Duration Number of average income statementprice of vesting options fair value <strong>2006</strong> 2005Date of grant € period granted € €’000 €’000<strong>DCC</strong> <strong>plc</strong> 1998 Employee Share Option Scheme12 November 2002 10.38 3 <strong>and</strong> 5 years 609,500 2.81 349 39422 December 2003 10.70 3 <strong>and</strong> 5 years 132,000 2.76 94 9418 May 2004 12.75 3 <strong>and</strong> 5 years 162,500 3.42 150 1259 November 2004 15.65 3 <strong>and</strong> 5 years 219,500 4.15 269 9015 December 2005 16.70 3 <strong>and</strong> 5 years 215,000 4.52 79 -941 703<strong>DCC</strong> Sharesave Scheme 200110 December 2004 12.63 3 <strong>and</strong> 5 years 716,010 4.67 899 300Total expense 1,840 1,003