Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

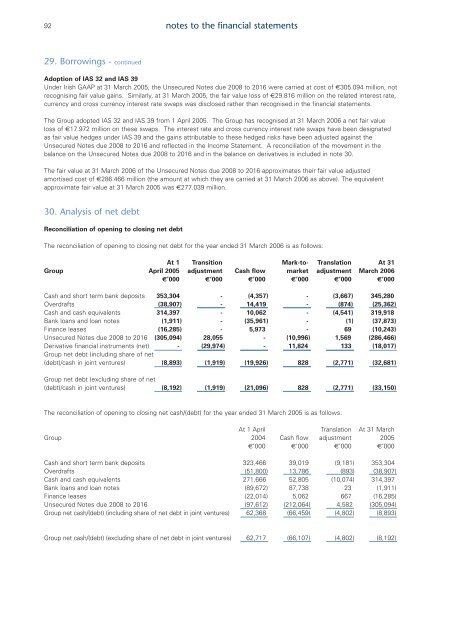

92notes to the financial statements29. Borrowings - continuedAdoption of IAS 32 <strong>and</strong> IAS 39Under Irish GAAP at 31 March 2005, the Unsecured Notes due 2008 to 2016 were carried at cost of €305.094 million, notrecognising fair value gains. Similarly, at 31 March 2005, the fair value loss of €29.816 million on the related interest rate,currency <strong>and</strong> cross currency interest rate swaps was disclosed rather than recognised in the financial statements.The Group adopted IAS 32 <strong>and</strong> IAS 39 from 1 April 2005. The Group has recognised at 31 March <strong>2006</strong> a net fair valueloss of €17.972 million on these swaps. The interest rate <strong>and</strong> cross currency interest rate swaps have been designatedas fair value hedges under IAS 39 <strong>and</strong> the gains attributable to these hedged risks have been adjusted against theUnsecured Notes due 2008 to 2016 <strong>and</strong> reflected in the Income Statement. A reconciliation of the movement in thebalance on the Unsecured Notes due 2008 to 2016 <strong>and</strong> in the balance on derivatives is included in note 30.The fair value at 31 March <strong>2006</strong> of the Unsecured Notes due 2008 to 2016 approximates their fair value adjustedamortised cost of €286.466 million (the amount at which they are carried at 31 March <strong>2006</strong> as above). The equivalentapproximate fair value at 31 March 2005 was €277.039 million.30. Analysis of net debtReconciliation of opening to closing net debtThe reconciliation of opening to closing net debt for the year ended 31 March <strong>2006</strong> is as follows:At 1 Transition Mark-to- Translation At 31Group April 2005 adjustment Cash flow market adjustment March <strong>2006</strong>€’000 €’000 €’000 €’000 €’000 €’000Cash <strong>and</strong> short term bank deposits 353,304 - (4,357) - (3,667) 345,280Overdrafts (38,907) - 14,419 - (874) (25,362)Cash <strong>and</strong> cash equivalents 314,397 - 10,062 - (4,541) 319,918Bank loans <strong>and</strong> loan notes (1,911) - (35,961) - (1) (37,873)Finance leases (16,285) - 5,973 - 69 (10,243)Unsecured Notes due 2008 to 2016 (305,094) 28,055 - (10,996) 1,569 (286,466)Derivative financial instruments (net) - (29,974) - 11,824 133 (18,017)Group net debt (including share of net(debt)/cash in joint ventures) (8,893) (1,919) (19,926) 828 (2,771) (32,681)Group net debt (excluding share of net(debt)/cash in joint ventures) (8,192) (1,919) (21,096) 828 (2,771) (33,150)The reconciliation of opening to closing net cash/(debt) for the year ended 31 March 2005 is as follows:At 1 April Translation At 31 MarchGroup 2004 Cash flow adjustment 2005€’000 €’000 €’000 €’000Cash <strong>and</strong> short term bank deposits 323,466 39,019 (9,181) 353,304Overdrafts (51,800) 13,786 (893) (38,907)Cash <strong>and</strong> cash equivalents 271,666 52,805 (10,074) 314,397Bank loans <strong>and</strong> loan notes (89,672) 87,738 23 (1,911)Finance leases (22,014) 5,062 667 (16,285)Unsecured Notes due 2008 to 2016 (97,612) (212,064) 4,582 (305,094)Group net cash/(debt) (including share of net debt in joint ventures) 62,368 (66,459) (4,802) (8,893)Group net cash/(debt) (excluding share of net debt in joint ventures) 62,717 (66,107) (4,802) (8,192)