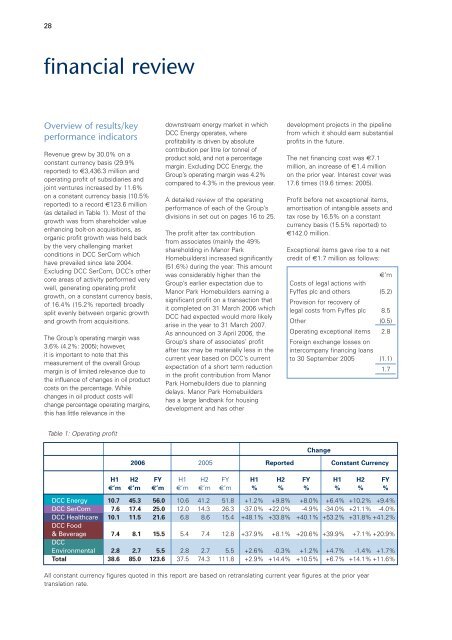

28financial reviewOverview of results/keyperformance indicatorsRevenue grew by 30.0% on aconstant currency basis (29.9%reported) to €3,436.3 million <strong>and</strong>operating profit of subsidiaries <strong>and</strong>joint ventures increased by 11.6%on a constant currency basis (10.5%reported) to a record €123.6 million(as detailed in Table 1). Most of thegrowth was from shareholder valueenhancing bolt-on acquisitions, asorganic profit growth was held backby the very challenging marketconditions in <strong>DCC</strong> SerCom whichhave prevailed since late 2004.Excluding <strong>DCC</strong> SerCom, <strong>DCC</strong>’s othercore areas of activity performed verywell, generating operating profitgrowth, on a constant currency basis,of 16.4% (15.2% reported) broadlysplit evenly between organic growth<strong>and</strong> growth from acquisitions.The Group’s operating margin was3.6% (4.2%: 2005); however,it is important to note that thismeasurement of the overall Groupmargin is of limited relevance due tothe influence of changes in oil productcosts on the percentage. Whilechanges in oil product costs willchange percentage operating margins,this has little relevance in thedownstream energy market in which<strong>DCC</strong> Energy operates, whereprofitability is driven by absolutecontribution per litre (or tonne) ofproduct sold, <strong>and</strong> not a percentagemargin. Excluding <strong>DCC</strong> Energy, theGroup’s operating margin was 4.2%compared to 4.3% in the previous year.A detailed review of the operatingperformance of each of the Group’sdivisions in set out on pages 16 to 25.The profit after tax contributionfrom associates (mainly the 49%shareholding in Manor ParkHomebuilders) increased significantly(51.6%) during the year. This amountwas considerably higher than theGroup’s earlier expectation due toManor Park Homebuilders earning asignificant profit on a transaction thatit completed on 31 March <strong>2006</strong> which<strong>DCC</strong> had expected would more likelyarise in the year to 31 March 2007.As announced on 3 April <strong>2006</strong>, theGroup’s share of associates’ profitafter tax may be materially less in thecurrent year based on <strong>DCC</strong>’s currentexpectation of a short term reductionin the profit contribution from ManorPark Homebuilders due to planningdelays. Manor Park Homebuildershas a large l<strong>and</strong>bank for housingdevelopment <strong>and</strong> has otherdevelopment projects in the pipelinefrom which it should earn substantialprofits in the future.The net financing cost was €7.1million, an increase of €1.4 millionon the prior year. Interest cover was17.6 times (19.6 times: 2005).Profit before net exceptional items,amortisation of intangible assets <strong>and</strong>tax rose by 16.5% on a constantcurrency basis (15.5% reported) to€142.0 million.Exceptional items gave rise to a netcredit of €1.7 million as follows:€’mCosts of legal actions withFyffes <strong>plc</strong> <strong>and</strong> others (5.2)Provision for recovery oflegal costs from Fyffes <strong>plc</strong> 8.5Other (0.5)Operating exceptional items 2.8Foreign exchange losses onintercompany financing loansto 30 September 2005 (1.1)1.7Table 1: Operating profitChange<strong>2006</strong> 2005 <strong>Report</strong>ed Constant CurrencyH1 H2 FY H1 H2 FY H1 H2 FY H1 H2 FY€’m €’m €’m €’m €’m €’m % % % % % %<strong>DCC</strong> Energy 10.7 45.3 56.0 10.6 41.2 51.8 +1.2% +9.8% +8.0% +6.4% +10.2% +9.4%<strong>DCC</strong> SerCom 7.6 17.4 25.0 12.0 14.3 26.3 -37.0% +22.0% -4.9% -34.0% +21.1% -4.0%<strong>DCC</strong> Healthcare 10.1 11.5 21.6 6.8 8.6 15.4 +48.1% +33.8% +40.1% +53.2% +31.8% +41.2%<strong>DCC</strong> Food& Beverage 7.4 8.1 15.5 5.4 7.4 12.8 +37.9% +8.1% +20.6% +39.9% +7.1% +20.9%<strong>DCC</strong>Environmental 2.8 2.7 5.5 2.8 2.7 5.5 +2.6% -0.3% +1.2% +4.7% -1.4% +1.7%Total 38.6 85.0 123.6 37.5 74.3 111.8 +2.9% +14.4% +10.5% +6.7% +14.1% +11.6%All constant currency figures quoted in this report are based on retranslating current year figures at the prior yeartranslation rate.

financial review 29On 21 December 2005, the Irish HighCourt found in favour of <strong>DCC</strong> <strong>and</strong>Others in the case taken against themby Fyffes <strong>plc</strong>, under Part V of the IrishCompanies Act 1990, in relation tothe sale of shares by Lotus Green inFebruary 2000. In dismissing Fyffes’claim against all of the defendants,the Court held that the share saleswere entirely lawful <strong>and</strong> that none ofthe defendants had any liability arisingfrom the sales of the shares in Fyffesin February 2000.On 10 February <strong>2006</strong>, the Irish HighCourt decided that Fyffes should paymost of <strong>DCC</strong>’s costs in relation toFyffes’ failed legal action against theGroup. <strong>DCC</strong> expects to recoupapproximately €8.5 million fromFyffes following this High Court order<strong>and</strong>, accordingly, has accrued thisamount as a credit under exceptionaloperating costs.On 29 November 2005, the HsinchuDistrict Court in Taiwan issued ajudgment ordering that the LondonHigh Court order obtained by <strong>DCC</strong>’ssubsidiary, Days Healthcare, againstPihsiang Machinery ManufacturingCompany Limited (a Taiwanese publiccompany), Donald Wu (its chairman<strong>and</strong> major shareholder) <strong>and</strong> Jenny Wu(his wife <strong>and</strong> director) be enforced inTaiwan. Accordingly, as at 31 MarchTable 2: Return on capital employedUnder Irish GAAP (accountingpractices generally accepted in theRepublic of Irel<strong>and</strong>) certainintercompany loans had beentreated as part of net investment inforeign operations <strong>and</strong> foreignexchange gains or losses arising onthese loans had been recogniseddirectly in reserves. On transitionfrom Irish GAAP, certain of theseloans between fellow subsidiaries donot qualify under IFRS as part of netinvestment in foreign operations <strong>and</strong>therefore gains or losses on theseloans must be recognised in theIncome Statement.The financial impact of the above isa charge to the Income Statement of€1.145 million for the year ended 31March <strong>2006</strong> (charge of €4.809million: 2005) in respect of foreignexchange losses <strong>and</strong> these amountsare included in exceptional items.The majority of the intercompanybalances which gave rise to theseaccounting charges (previously takento reserves) were restructuredduring the year ended 31 March2005 <strong>and</strong> the half year ended 30September 2005 so as to eliminateaccounting volatility from 30September 2005 onwards.basis (14.6% reported) to 157.23 cent.<strong>DCC</strong> has achieved compound annualgrowth in reported adjusted earningsper share of 13.2% over the last fiveyears <strong>and</strong> 17.3% over the last tenyears.DividendThe total dividend for the year of42.85 cent per share represents anincrease of 15% over the previousyear. The dividend is covered 3.7times (3.7 times: 2005) by adjustedearnings per share.Return on capital employedA core strength of <strong>DCC</strong> is the creationof shareholder value through thedelivery of consistent, long-termreturns in excess of <strong>DCC</strong>’s cost ofcapital. In the year under review,<strong>DCC</strong> again achieved excellent returnson capital employed (as detailed inTable 2), generating a return of43.0% excluding intangible assets <strong>and</strong>19.1% including intangible assets(44.9% <strong>and</strong> 20.4% respectively: 2005).<strong>DCC</strong>’s return on capital employed hasremained consistently high through acombination of good organic growth,attractive acquisition valuations <strong>and</strong>excellent integration synergies.<strong>2006</strong> 2005ROCE ROCE ROCE ROCE(excl intangible assets) (incl intangible assets) (excl intangible assets) (incl intangible assets)<strong>DCC</strong> Energy 53.8% 24.5% 53.4% 25.3%<strong>DCC</strong> SerCom 24.4% 14.3% 30.3% 18.4%<strong>DCC</strong> Healthcare 60.5% 16.7% 50.3% 13.6%<strong>DCC</strong> Food& Beverage 55.2% 18.7% 57.1% 21.3%<strong>DCC</strong>Environmental 31.8% 17.4% 45.7% 20.7%Group 43.0% 19.1% 44.9% 20.4%<strong>2006</strong>, these parties are jointly <strong>and</strong>severally liable to pay the <strong>DCC</strong> GroupStg£14.3 million (€20.5 million),including Stg£2.1 million in accruedinterest. <strong>DCC</strong> has not accrued any ofthis amount due pending the outcomeof an appeal by the defendants to theTaiwanese High Court, but hasexpensed all the litigation costs.TaxationThe effective tax rate for the Group,including associates, increasedmarginally to 12.7% from 12.0%.Adjusted earnings per shareAdjusted earnings per share increasedby 15.5% on a constant currencyCash flow<strong>DCC</strong> focuses on operating cash flowto maximise shareholder value overthe long term. Operating cash flow isprincipally used to fund investment inexisting operations, complementarybolt-on acquisitions, dividend payments<strong>and</strong> selective share buybacks. <strong>DCC</strong>’srecord of excellent cash generationcontinued with operating cash flow