Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

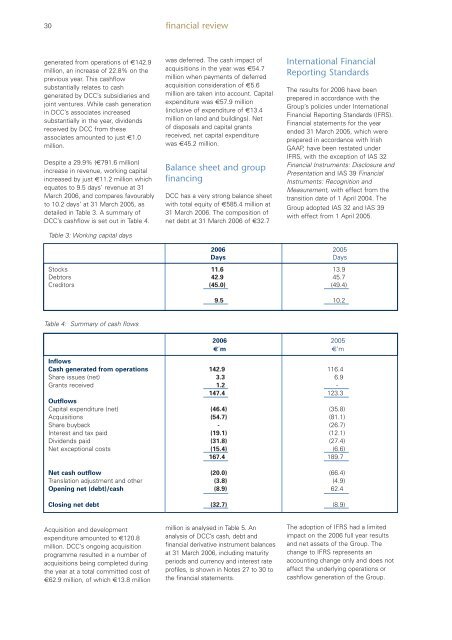

30financial reviewgenerated from operations of €142.9million, an increase of 22.8% on theprevious year. This cashflowsubstantially relates to cashgenerated by <strong>DCC</strong>’s subsidiaries <strong>and</strong>joint ventures. While cash generationin <strong>DCC</strong>’s associates increasedsubstantially in the year, dividendsreceived by <strong>DCC</strong> from theseassociates amounted to just €1.0million.Despite a 29.9% (€791.6 million)increase in revenue, working capitalincreased by just €11.2 million whichequates to 9.5 days’ revenue at 31March <strong>2006</strong>, <strong>and</strong> compares favourablyto 10.2 days’ at 31 March 2005, asdetailed in Table 3. A summary of<strong>DCC</strong>’s cashflow is set out in Table 4.Table 3: Working capital dayswas deferred. The cash impact ofacquisitions in the year was €54.7million when payments of deferredacquisition consideration of €5.6million are taken into account. Capitalexpenditure was €57.9 million(inclusive of expenditure of €13.4million on l<strong>and</strong> <strong>and</strong> buildings). Netof disposals <strong>and</strong> capital grantsreceived, net capital expenditurewas €45.2 million.Balance sheet <strong>and</strong> groupfinancing<strong>DCC</strong> has a very strong balance sheetwith total equity of €585.4 million at31 March <strong>2006</strong>. The composition ofnet debt at 31 March <strong>2006</strong> of €32.7International Financial<strong>Report</strong>ing St<strong>and</strong>ardsThe results for <strong>2006</strong> have beenprepared in accordance with theGroup’s policies under InternationalFinancial <strong>Report</strong>ing St<strong>and</strong>ards (IFRS).Financial statements for the yearended 31 March 2005, which wereprepared in accordance with IrishGAAP, have been restated underIFRS, with the exception of IAS 32Financial Instruments: Disclosure <strong>and</strong>Presentation <strong>and</strong> IAS 39 FinancialInstruments: Recognition <strong>and</strong>Measurement, with effect from thetransition date of 1 April 2004. TheGroup adopted IAS 32 <strong>and</strong> IAS 39with effect from 1 April 2005.<strong>2006</strong> 2005DaysDaysStocks 11.6 13.9Debtors 42.9 45.7Creditors (45.0) (49.4)9.5 10.2Table 4: Summary of cash flows<strong>2006</strong> 2005€’m€’mInflowsCash generated from operations 142.9 116.4Share issues (net) 3.3 6.9Grants received 1.2 -147.4 123.3OutflowsCapital expenditure (net) (46.4) (35.8)Acquisitions (54.7) (81.1)Share buyback - (26.7)Interest <strong>and</strong> tax paid (19.1) (12.1)Dividends paid (31.8) (27.4)Net exceptional costs (15.4) (6.6)167.4 189.7Net cash outflow (20.0) (66.4)Translation adjustment <strong>and</strong> other (3.8) (4.9)Opening net (debt)/cash (8.9) 62.4Closing net debt (32.7) (8.9)Acquisition <strong>and</strong> developmentexpenditure amounted to €120.8million. <strong>DCC</strong>’s ongoing acquisitionprogramme resulted in a number ofacquisitions being completed duringthe year at a total committed cost of€62.9 million, of which €13.8 millionmillion is analysed in Table 5. Ananalysis of <strong>DCC</strong>’s cash, debt <strong>and</strong>financial derivative instrument balancesat 31 March <strong>2006</strong>, including maturityperiods <strong>and</strong> currency <strong>and</strong> interest rateprofiles, is shown in Notes 27 to 30 tothe financial statements.The adoption of IFRS had a limitedimpact on the <strong>2006</strong> full year results<strong>and</strong> net assets of the Group. Thechange to IFRS represents anaccounting change only <strong>and</strong> does notaffect the underlying operations orcashflow generation of the Group.