Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

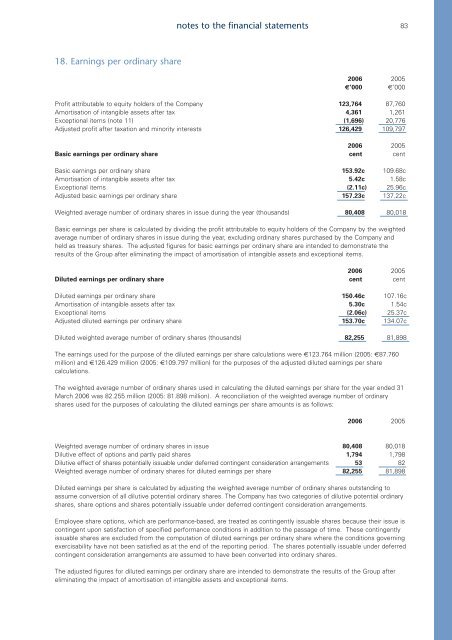

notes to the financial statements8318. Earnings per ordinary share<strong>2006</strong> 2005€’000 €’000Profit attributable to equity holders of the Company 123,764 87,760Amortisation of intangible assets after tax 4,361 1,261Exceptional items (note 11) (1,696) 20,776Adjusted profit after taxation <strong>and</strong> minority interests 126,429 109,797<strong>2006</strong> 2005Basic earnings per ordinary share cent centBasic earnings per ordinary share 153.92c 109.68cAmortisation of intangible assets after tax 5.42c 1.58cExceptional items (2.11c) 25.96cAdjusted basic earnings per ordinary share 157.23c 137.22cWeighted average number of ordinary shares in issue during the year (thous<strong>and</strong>s) 80,408 80,018Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Company by the weightedaverage number of ordinary shares in issue during the year, excluding ordinary shares purchased by the Company <strong>and</strong>held as treasury shares. The adjusted figures for basic earnings per ordinary share are intended to demonstrate theresults of the Group after eliminating the impact of amortisation of intangible assets <strong>and</strong> exceptional items.<strong>2006</strong> 2005Diluted earnings per ordinary share cent centDiluted earnings per ordinary share 150.46c 107.16cAmortisation of intangible assets after tax 5.30c 1.54cExceptional items (2.06c) 25.37cAdjusted diluted earnings per ordinary share 153.70c 134.07cDiluted weighted average number of ordinary shares (thous<strong>and</strong>s) 82,255 81,898The earnings used for the purpose of the diluted earnings per share calculations were €123.764 million (2005: €87.760million) <strong>and</strong> €126.429 million (2005: €109.797 million) for the purposes of the adjusted diluted earnings per sharecalculations.The weighted average number of ordinary shares used in calculating the diluted earnings per share for the year ended 31March <strong>2006</strong> was 82.255 million (2005: 81.898 million). A reconciliation of the weighted average number of ordinaryshares used for the purposes of calculating the diluted earnings per share amounts is as follows:<strong>2006</strong> 2005Weighted average number of ordinary shares in issue 80,408 80,018Dilutive effect of options <strong>and</strong> partly paid shares 1,794 1,798Dilutive effect of shares potentially issuable under deferred contingent consideration arrangements 53 82Weighted average number of ordinary shares for diluted earnings per share 82,255 81,898Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outst<strong>and</strong>ing toassume conversion of all dilutive potential ordinary shares. The Company has two categories of dilutive potential ordinaryshares, share options <strong>and</strong> shares potentially issuable under deferred contingent consideration arrangements.Employee share options, which are performance-based, are treated as contingently issuable shares because their issue iscontingent upon satisfaction of specified performance conditions in addition to the passage of time. These contingentlyissuable shares are excluded from the computation of diluted earnings per ordinary share where the conditions governingexercisability have not been satisfied as at the end of the reporting period. The shares potentially issuable under deferredcontingent consideration arrangements are assumed to have been converted into ordinary shares.The adjusted figures for diluted earnings per ordinary share are intended to demonstrate the results of the Group aftereliminating the impact of amortisation of intangible assets <strong>and</strong> exceptional items.