Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Annual Report and Accounts 2006 - DCC plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

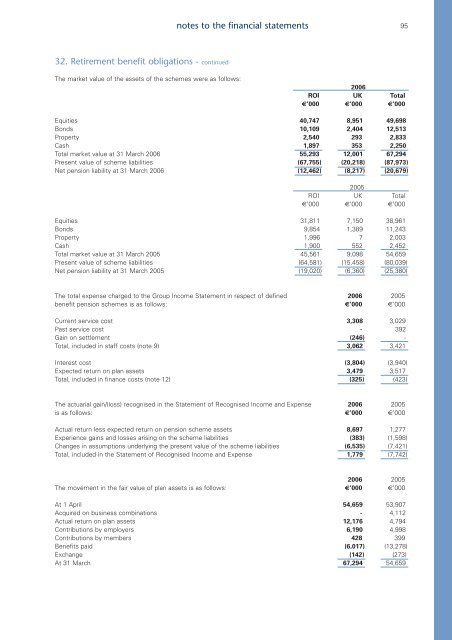

notes to the financial statements9532. Retirement benefit obligations - continuedThe market value of the assets of the schemes were as follows:<strong>2006</strong>ROI UK Total€’000 €’000 €’000Equities 40,747 8,951 49,698Bonds 10,109 2,404 12,513Property 2,540 293 2,833Cash 1,897 353 2,250Total market value at 31 March <strong>2006</strong> 55,293 12,001 67,294Present value of scheme liabilities (67,755) (20,218) (87,973)Net pension liability at 31 March <strong>2006</strong> (12,462) (8,217) (20,679)2005ROI UK Total€’000 €’000 €’000Equities 31,811 7,150 38,961Bonds 9,854 1,389 11,243Property 1,996 7 2,003Cash 1,900 552 2,452Total market value at 31 March 2005 45,561 9,098 54,659Present value of scheme liabilities (64,581) (15,458) (80,039)Net pension liability at 31 March 2005 (19,020) (6,360) (25,380)The total expense charged to the Group Income Statement in respect of defined <strong>2006</strong> 2005benefit pension schemes is as follows: €’000 €’000Current service cost 3,308 3,029Past service cost - 392Gain on settlement (246) -Total, included in staff costs (note 9) 3,062 3,421Interest cost (3,804) (3,940)Expected return on plan assets 3,479 3,517Total, included in finance costs (note 12) (325) (423)The actuarial gain/(loss) recognised in the Statement of Recognised Income <strong>and</strong> Expense <strong>2006</strong> 2005is as follows: €’000 €’000Actual return less expected return on pension scheme assets 8,697 1,277Experience gains <strong>and</strong> losses arising on the scheme liabilities (383) (1,598)Changes in assumptions underlying the present value of the scheme liabilities (6,535) (7,421)Total, included in the Statement of Recognised Income <strong>and</strong> Expense 1,779 (7,742)<strong>2006</strong> 2005The movement in the fair value of plan assets is as follows: €’000 €’000At 1 April 54,659 53,907Acquired on business combinations - 4,112Actual return on plan assets 12,176 4,794Contributions by employers 6,190 4,998Contributions by members 428 399Benefits paid (6,017) (13,278)Exchange (142) (273)At 31 March 67,294 54,659