- Page 1:

WF2WaFiv20atev01er fUve11forUe-Y1/r

- Page 4 and 5:

Chapter| Table of ContentsPage 2 Um

- Page 6:

Chapter| Foreword by the ChiefExecu

- Page 9 and 10:

| Introduction and Strategy Chapter

- Page 11 and 12:

| Introduction and Strategy Chapter

- Page 13 and 14:

| Introduction andd StrategyChapter

- Page 15 and 16:

| Introduction andd StrategyChapter

- Page 17 and 18:

| Introduction and Strategy Chapter

- Page 19 and 20:

| Introduction andd StrategyChapter

- Page 21 and 22:

| Policy StatementChapterChapter 3.

- Page 23 and 24:

| Directivesby thee MiniisterChapte

- Page 25 and 26:

For thee strategicobjective ‘excc

- Page 27 and 28:

| Self-Appraisal Chaptero The proje

- Page 29 and 30:

| Participation inCompaniesChapterC

- Page 31 and 32:

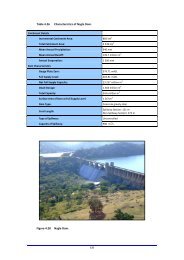

| Water ResourcesChapterChapter 7.W

- Page 33 and 34:

| Water Resources Chapter7.2 Water

- Page 35 and 36:

7.4 Water Demands, Planned Developm

- Page 37 and 38:

| Water Resources ChapterFigure 7.1

- Page 39 and 40:

| Water Resources Chapterconstructi

- Page 41 and 42:

| Water ResourcesChapterandSouthCoa

- Page 43 and 44:

| BulkPotable WaterSupply PlanChapt

- Page 45 and 46:

| BulkPotable Waterr Supply PlanCha

- Page 47 and 48:

| Bulk Potable Water Supply Plan Ch

- Page 49 and 50:

| Bulk Potable Water Supply Plan Ch

- Page 51 and 52:

8.4.2 Bulk Water Supply Infrastruct

- Page 53 and 54:

| Bulk Potable Water Supply Plan Ch

- Page 55 and 56:

| BulkPotable Waterr Supply PlanCha

- Page 57 and 58:

| BulkPotable Waterr Supply PlanCha

- Page 59 and 60:

| Bulk Wastewater Treatment andd Di

- Page 61 and 62:

| RetailSupplyChapterChapter 10.Ret

- Page 63 and 64:

| OtheOer Activitiess (Sectionn 30)

- Page 65 and 66:

| Other Activities (Section 30) Cha

- Page 67 and 68:

| HumanResources PlanChapterChapter

- Page 69 and 70:

| HumanResources PlanChapterFigure1

- Page 71 and 72:

| Human Resources Plan ChapterThe s

- Page 73 and 74: | HumanResources PlanChapter12.7Gov

- Page 75 and 76: | Environmental ManaMagementt Progr

- Page 77 and 78: | Environmental Management Programm

- Page 79 and 80: | Waterr Conservationandd Demand Ma

- Page 81 and 82: C1InpvGmeTwaacTcD2Ft2UwmUpC15npevoG

- Page 83 and 84: | Financial Plan Chapter15.2.2 Staf

- Page 85 and 86: | Financial Plan Chapter15.2.4 Raw

- Page 87 and 88: SalTabCusteTheMsunuMguSizaUguiLemSi

- Page 89 and 90: | Financial Plan Chapter15.4 Tariff

- Page 91 and 92: | Financial Plan Chapter15.5 Subsid

- Page 93 and 94: | Financial Plan Chapter15.7 Challe

- Page 95 and 96: Table 15.12: Umgeni Water Income St

- Page 97 and 98: | Financial Plan ChapterTable 15.14

- Page 99 and 100: | Financial Plan ChapterTable 15.16

- Page 101 and 102: Table 15.18: Umgeni Water Cash Flow

- Page 103 and 104: Table 15.20: Msinsi Holdings Balanc

- Page 105 and 106: Table 15.22: Umgeni Water Services

- Page 107 and 108: | Financial Plan ChapterTable 15.24

- Page 109 and 110: Table 15.26: Group Cash Flow Statem

- Page 111 and 112: | Financial Plan Chapter15.9 Capita

- Page 113 and 114: | Financial PlanChapterFigure 15. .

- Page 115 and 116: | Financial Plan ChapterProject Cat

- Page 117 and 118: | Financial PlanChapterTable 15.31:

- Page 119 and 120: Table 15.34: Rural Project Evaluati

- Page 121 and 122: | Financial Plan ChapterProject Cat

- Page 123: | Financial PlanChapterFigure15.8:

- Page 127 and 128: | Debt Management and Funding Requi

- Page 129 and 130: | DebtManagement andd Fundingg Requ

- Page 131 and 132: 16.1.6 Debt Curve| Debt Management

- Page 133 and 134: | DebtManagement andd Fundingg Requ

- Page 135 and 136: | Materiality and significance fram

- Page 137 and 138: | Financial Ratios ChapterChapter 1

- Page 139 and 140: Table 18.2: Group Financial Ratios|

- Page 141 and 142: | Self-Evaluation Staatement onFina

- Page 143 and 144: | Self-Evaluation Staatement onFina

- Page 145 and 146: | Self-Evaluation Staatement onFina

- Page 147 and 148: | Self-Evaluation Statement on Fina

- Page 149 and 150: | Bank Accounts Chapter19.7 Analysi

- Page 151 and 152: | Analysis of o RiskRksChapterChapt

- Page 153 and 154: | Analysis of Risks Chapter# Risk a

- Page 155 and 156: | Organisational Scorecard: Key Per

- Page 157 and 158: | Organisational Scorecard: Key Per

- Page 159 and 160: | Organisational Scorecard: Key Per

- Page 161 and 162: | Organisational Scorecard: Key Per

- Page 163 and 164: | Organisational Scorecard: Key Per

- Page 165 and 166: | DeclarationChapterChapter 23.Decl