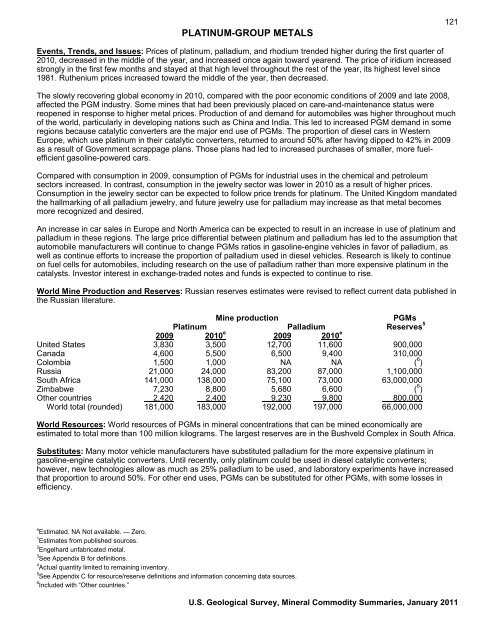

PLATINUM-GROUP METALS121Events, Trends, <strong>and</strong> Issues: Prices of platinum, palladium, <strong>and</strong> rhodium trended higher during the first quarter of2010, decreased in the middle of the year, <strong>and</strong> increased once again toward yearend. The price of iridium increasedstrongly in the first few months <strong>and</strong> stayed at that high level throughout the rest of the year, its highest level since1981. Ruthenium prices increased toward the middle of the year, then decreased.The slowly recovering global economy in 2010, compared with the poor economic conditions of 2009 <strong>and</strong> late 2008,affected the PGM industry. Some mines that had been previously placed on care-<strong>and</strong>-maintenance status werereopened in response to higher metal prices. Production of <strong>and</strong> dem<strong>and</strong> for automobiles was higher throughout muchof the world, particularly in developing nations such as China <strong>and</strong> India. This led to increased PGM dem<strong>and</strong> in someregions because catalytic converters are the major end use of PGMs. The proportion of diesel cars in WesternEurope, which use platinum in their catalytic converters, returned to around 50% after having dipped to 42% in 2009as a result of Government scrappage plans. Those plans had led to increased purchases of smaller, more fuelefficientgasoline-powered cars.Compared with consumption in 2009, consumption of PGMs for industrial uses in the chemical <strong>and</strong> petroleumsectors increased. In contrast, consumption in the jewelry sector was lower in 2010 as a result of higher prices.Consumption in the jewelry sector can be expected to follow price trends for platinum. The United Kingdom m<strong>and</strong>atedthe hallmarking of all palladium jewelry, <strong>and</strong> future jewelry use for palladium may increase as that metal becomesmore recognized <strong>and</strong> desired.An increase in car sales in Europe <strong>and</strong> North America can be expected to result in an increase in use of platinum <strong>and</strong>palladium in these regions. The large price differential between platinum <strong>and</strong> palladium has led to the assumption thatautomobile manufacturers will continue to change PGMs ratios in gasoline-engine vehicles in favor of palladium, aswell as continue efforts to increase the proportion of palladium used in diesel vehicles. Research is likely to continueon fuel cells for automobiles, including research on the use of palladium rather than more expensive platinum in thecatalysts. Investor interest in exchange-traded notes <strong>and</strong> funds is expected to continue to rise.World Mine Production <strong>and</strong> Reserves: Russian reserves estimates were revised to reflect current data published inthe Russian literature.Mine productionPGMsPlatinum Palladium Reserves 52009 2010 e 2009 2010 eUnited States 3,830 3,500 12,700 11,600 900,000Canada 4,600 5,500 6,500 9,400 310,000Colombia 1,500 1,000 NA NA ( 6 )Russia 21,000 24,000 83,200 87,000 1,100,000South Africa 141,000 138,000 75,100 73,000 63,000,000Zimbabwe 7,230 8,800 5,680 6,600 ( 6 )Other countries 2,420 2,400 9,230 9,800800,000World total (rounded) 181,000 183,000 192,000 197,000 66,000,000World Resources: World resources of PGMs in mineral concentrations that can be mined economically areestimated to total more than 100 million kilograms. The largest reserves are in the Bushveld Complex in South Africa.Substitutes: Many motor vehicle manufacturers have substituted palladium for the more expensive platinum ingasoline-engine catalytic converters. Until recently, only platinum could be used in diesel catalytic converters;however, new technologies allow as much as 25% palladium to be used, <strong>and</strong> laboratory experiments have increasedthat proportion to around 50%. For other end uses, PGMs can be substituted for other PGMs, with some losses inefficiency.e Estimated. NA Not available. — Zero.1 Estimates from published sources.2 Engelhard unfabricated metal.3 See Appendix B for definitions.4 Actual quantity limited to remaining inventory.5 See Appendix C for resource/reserve definitions <strong>and</strong> information concerning data sources.6 Included with “Other countries.”U.S. Geological Survey, <strong>Mineral</strong> <strong>Commodity</strong> <strong>Summaries</strong>, January <strong>2011</strong>

122POTASH(Data in thous<strong>and</strong> metric tons of K 2 O equivalent unless otherwise noted)Domestic Production <strong>and</strong> Use: In 2010, the production value of marketable potash, f.o.b. mine, was about $540million. Potash was produced in Michigan, New Mexico, <strong>and</strong> Utah. Most of the production was from southeastern NewMexico, where two companies operated three mines. New Mexico sylvinite <strong>and</strong> langbeinite ores were beneficiated byflotation, dissolution-recrystallization, heavy-media separations, or combinations of these processes, <strong>and</strong> providedmore than 75% of total U.S. producer sales. In Utah, which has three operations, one company extractedunderground sylvinite ore by deep-well solution mining. Solar evaporation crystallized the sylvinite ore from the brinesolution, <strong>and</strong> a flotation process separated the potassium chloride (muriate of potash or MOP) from byproduct sodiumchloride. Two companies processed surface <strong>and</strong> subsurface brines by solar evaporation <strong>and</strong> flotation to produceMOP, potassium sulfate (sulfate of potash or SOP), <strong>and</strong> byproducts. In Michigan, one company used deep-wellsolution mining <strong>and</strong> mechanical evaporation for crystallization of MOP <strong>and</strong> byproduct sodium chloride.The fertilizer industry used about 85% of U.S. potash sales, <strong>and</strong> the chemical industry used the remainder. More than60% of the produced potash was MOP. Potassium magnesium sulfate (sulfate of potash-magnesia or SOPM) <strong>and</strong>SOP, which are required by certain crops <strong>and</strong> soils, also were produced.Salient Statistics—United States: 2006 2007 2008 2009 2010 eProduction, marketable 1 1,100 1,100 1,100 700 900Imports for consumption 4,470 4,970 5,800 2,220 4,700Exports 332 199 222 303 380Consumption, apparent 1 5,200 5,900 6,700 2,600 5,200Price, dollars per metric ton of K 2 O,average, muriate, f.o.b. mine 2 375 400 675 835 600Employment, number:Mine 480 480 525 510 540Mill 620 580 615 640 650Net import reliance 3 as a percentage ofapparent consumption 79 81 84 73 83Recycling: None.Import Sources (2006–09): Canada, 87%; Belarus, 5%; Russia,5 %; <strong>and</strong> other, 3%.Tariff: Item Number Normal Trade Relations12-31-10Potassium nitrate 2834.21.0000 Free.Potassium chloride 3104.20.0000 Free.Potassium sulfate 3104.30.0000 Free.Potassic fertilizers, other 3104.90.0100 Free.Potassium-sodium nitrate mixtures 3105.90.0010 Free.Depletion Allowance: 14% (Domestic <strong>and</strong> foreign).Government Stockpile: None.Prepared by Stephen M. Jasinski [(703) 648-7711, sjasinsk@usgs.gov, fax: (703) 648-7757]

- Page 3:

U.S. Department of the InteriorKEN

- Page 6 and 7:

INTRODUCTION3Each chapter of the 20

- Page 8 and 9:

5NET EXPORTS OF MINERALRAW MATERIAL

- Page 10 and 11:

SIGNIFICANT EVENTS, TRENDS, AND ISS

- Page 12 and 13:

mineral materials valued at $1.30 b

- Page 14 and 15:

11MAJOR METAL-PRODUCING AREASAuB2P1

- Page 16 and 17:

13MAJOR INDUSTRIAL MINERAL-PRODUCIN

- Page 18 and 19:

ABRASIVES (MANUFACTURED)15Events, T

- Page 20 and 21:

ALUMINUM17The United States continu

- Page 22 and 23:

ANTIMONY19Events, Trends, and Issue

- Page 24 and 25:

ARSENIC21According to university me

- Page 26 and 27:

ASBESTOS23Events, Trends, and Issue

- Page 28 and 29:

BARITE25Nationally, the rig count o

- Page 30 and 31:

BAUXITE AND ALUMINA27Events, Trends

- Page 32 and 33:

BERYLLIUM29Events, Trends, and Issu

- Page 34 and 35:

BISMUTH31Events, Trends, and Issues

- Page 36 and 37:

BORON33Events, Trends, and Issues:

- Page 38 and 39:

BROMINE35Events, Trends, and Issues

- Page 40 and 41:

CADMIUM37NiCd battery use in consum

- Page 42 and 43:

CEMENT39The manufacture of clinker

- Page 44 and 45:

CESIUM41Events, Trends, and Issues:

- Page 46 and 47:

CHROMIUM43Stockpile Status—9-30-1

- Page 48 and 49:

CLAYS45Tariff: Item Number Normal T

- Page 50 and 51:

COBALT47Events, Trends, and Issues:

- Page 52 and 53:

COPPER49Events, Trends, and Issues:

- Page 54 and 55:

DIAMOND (INDUSTRIAL)51Events, Trend

- Page 56 and 57:

DIATOMITE53Events, Trends, and Issu

- Page 58 and 59:

FELDSPAR55Feldspar use in tile and

- Page 60 and 61:

FLUORSPAR57with planned output of 1

- Page 62 and 63:

GALLIUM59In response to the unprece

- Page 64 and 65:

GARNET (INDUSTRIAL)61Events, Trends

- Page 66 and 67:

GEMSTONES63Events, Trends, and Issu

- Page 68 and 69:

GERMANIUM65Events, Trends, and Issu

- Page 70 and 71:

GOLD67With the increase in price of

- Page 72 and 73:

GRAPHITE (NATURAL)69Events, Trends,

- Page 74 and 75: GYPSUM71Through 2010, more than 3,6

- Page 76 and 77: HELIUM73Events, Trends, and Issues:

- Page 78 and 79: INDIUM75China’s 21 indium produce

- Page 80 and 81: IODINE77Events, Trends, and Issues:

- Page 82 and 83: IRON AND STEEL79Events, Trends, and

- Page 84 and 85: IRON AND STEEL SCRAP81Tariff: Item

- Page 86 and 87: IRON AND STEEL SLAG83Events, Trends

- Page 88 and 89: IRON ORE85In 2009, China imported a

- Page 90 and 91: IRON OXIDE PIGMENTS87Events, Trends

- Page 92 and 93: KYANITE AND RELATED MATERIALS89Even

- Page 94 and 95: LEAD91caused by underground fires a

- Page 96 and 97: LIME93The lime industry is facing p

- Page 98 and 99: LITHIUM95market, and a facility at

- Page 100 and 101: MAGNESIUM COMPOUNDS97In Australia,

- Page 102 and 103: MAGNESIUM METAL99U.S. magnesium con

- Page 104 and 105: MANGANESE101Government Stockpile:St

- Page 106 and 107: MERCURY103Events, Trends, and Issue

- Page 108 and 109: MICA (NATURAL)105Depletion Allowanc

- Page 110 and 111: MOLYBDENUM107Events, Trends, and Is

- Page 112 and 113: NICKEL109Nickel prices were adverse

- Page 114 and 115: NIOBIUM (COLUMBIUM)111Events, Trend

- Page 116 and 117: NITROGEN (FIXED)—AMMONIA113Accord

- Page 118 and 119: PEAT115Events, Trends, and Issues:

- Page 120 and 121: PERLITE117Events, Trends, and Issue

- Page 122 and 123: PHOSPHATE ROCK119Events, Trends, an

- Page 126 and 127: POTASH123Events, Trends, and Issues

- Page 128 and 129: PUMICE AND PUMICITE125Events, Trend

- Page 130 and 131: QUARTZ CRYSTAL (INDUSTRIAL)127Event

- Page 132 and 133: RARE EARTHS129Events, Trends, and I

- Page 134 and 135: RHENIUM131Events, Trends, and Issue

- Page 136 and 137: RUBIDIUM133Events, Trends, and Issu

- Page 138 and 139: SALT135Many chefs have advocated us

- Page 140 and 141: SAND AND GRAVEL (CONSTRUCTION)137Ev

- Page 142 and 143: SAND AND GRAVEL (INDUSTRIAL)139The

- Page 144 and 145: SCANDIUM141Scandium’s use in meta

- Page 146 and 147: SELENIUM143Events, Trends, and Issu

- Page 148 and 149: SILICON145Events, Trends, and Issue

- Page 150 and 151: SILVER147Silver was used as a repla

- Page 152 and 153: SODA ASH149A Wyoming soda ash produ

- Page 154 and 155: SODIUM SULFATE151Events, Trends, an

- Page 156 and 157: STONE (CRUSHED)153Events, Trends, a

- Page 158 and 159: STONE (DIMENSION)155Events, Trends,

- Page 160 and 161: STRONTIUM157Events, Trends, and Iss

- Page 162 and 163: SULFUR159World sulfur production in

- Page 164 and 165: TALC AND PYROPHYLLITE161Events, Tre

- Page 166 and 167: TANTALUM163Events, Trends, and Issu

- Page 168 and 169: TELLURIUM165Events, Trends, and Iss

- Page 170: THALLIUM167Beginning in 2009, there

- Page 173 and 174: 170TIN(Data in metric tons of tin c

- Page 175 and 176:

172TITANIUM AND TITANIUM DIOXIDE 1(

- Page 177 and 178:

174TITANIUM MINERAL CONCENTRATES 1(

- Page 179 and 180:

176TUNGSTEN(Data in metric tons of

- Page 181 and 182:

178VANADIUM(Data in metric tons of

- Page 183 and 184:

180VERMICULITE(Data in thousand met

- Page 185 and 186:

182WOLLASTONITE(Data in metric tons

- Page 187 and 188:

184YTTRIUM 1(Data in metric tons of

- Page 189 and 190:

186ZEOLITES (NATURAL)(Data in metri

- Page 191 and 192:

188ZINC(Data in thousand metric ton

- Page 193 and 194:

190ZIRCONIUM AND HAFNIUM(Data in me

- Page 195 and 196:

192APPENDIX AAbbreviations and Unit

- Page 197 and 198:

194Demonstrated.—A term for the s

- Page 199 and 200:

196Part B—Sources of Reserves Dat

- Page 201:

198Europe and Central Eurasia—con