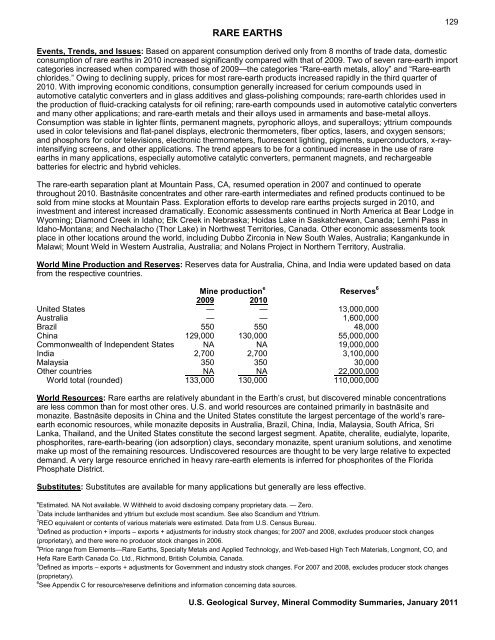

RARE EARTHS129Events, Trends, <strong>and</strong> Issues: Based on apparent consumption derived only from 8 months of trade data, domesticconsumption of rare earths in 2010 increased significantly compared with that of 2009. Two of seven rare-earth importcategories increased when compared with those of 2009—the categories “Rare-earth metals, alloy” <strong>and</strong> “Rare-earthchlorides.” Owing to declining supply, prices for most rare-earth products increased rapidly in the third quarter of2010. With improving economic conditions, consumption generally increased for cerium compounds used inautomotive catalytic converters <strong>and</strong> in glass additives <strong>and</strong> glass-polishing compounds; rare-earth chlorides used inthe production of fluid-cracking catalysts for oil refining; rare-earth compounds used in automotive catalytic converters<strong>and</strong> many other applications; <strong>and</strong> rare-earth metals <strong>and</strong> their alloys used in armaments <strong>and</strong> base-metal alloys.Consumption was stable in lighter flints, permanent magnets, pyrophoric alloys, <strong>and</strong> superalloys; yttrium compoundsused in color televisions <strong>and</strong> flat-panel displays, electronic thermometers, fiber optics, lasers, <strong>and</strong> oxygen sensors;<strong>and</strong> phosphors for color televisions, electronic thermometers, fluorescent lighting, pigments, superconductors, x-rayintensifyingscreens, <strong>and</strong> other applications. The trend appears to be for a continued increase in the use of rareearths in many applications, especially automotive catalytic converters, permanent magnets, <strong>and</strong> rechargeablebatteries for electric <strong>and</strong> hybrid vehicles.The rare-earth separation plant at Mountain Pass, CA, resumed operation in 2007 <strong>and</strong> continued to operatethroughout 2010. Bastnäsite concentrates <strong>and</strong> other rare-earth intermediates <strong>and</strong> refined products continued to besold from mine stocks at Mountain Pass. Exploration efforts to develop rare earths projects surged in 2010, <strong>and</strong>investment <strong>and</strong> interest increased dramatically. Economic assessments continued in North America at Bear Lodge inWyoming; Diamond Creek in Idaho; Elk Creek in Nebraska; Hoidas Lake in Saskatchewan, Canada; Lemhi Pass inIdaho-Montana; <strong>and</strong> Nechalacho (Thor Lake) in Northwest Territories, Canada. Other economic assessments tookplace in other locations around the world, including Dubbo Zirconia in New South Wales, Australia; Kangankunde inMalawi; Mount Weld in Western Australia, Australia; <strong>and</strong> Nolans Project in Northern Territory, Australia.World Mine Production <strong>and</strong> Reserves: Reserves data for Australia, China, <strong>and</strong> India were updated based on datafrom the respective countries.Mine production e Reserves 62009 2010United States — — 13,000,000Australia — — 1,600,000Brazil 550 550 48,000China 129,000 130,000 55,000,000Commonwealth of Independent States NA NA 19,000,000India 2,700 2,700 3,100,000Malaysia 350 350 30,000Other countries NA NA22,000,000World total (rounded) 133,000 130,000 110,000,000World Resources: Rare earths are relatively abundant in the Earth’s crust, but discovered minable concentrationsare less common than for most other ores. U.S. <strong>and</strong> world resources are contained primarily in bastnäsite <strong>and</strong>monazite. Bastnäsite deposits in China <strong>and</strong> the United States constitute the largest percentage of the world’s rareeartheconomic resources, while monazite deposits in Australia, Brazil, China, India, Malaysia, South Africa, SriLanka, Thail<strong>and</strong>, <strong>and</strong> the United States constitute the second largest segment. Apatite, cheralite, eudialyte, loparite,phosphorites, rare-earth-bearing (ion adsorption) clays, secondary monazite, spent uranium solutions, <strong>and</strong> xenotimemake up most of the remaining resources. Undiscovered resources are thought to be very large relative to expecteddem<strong>and</strong>. A very large resource enriched in heavy rare-earth elements is inferred for phosphorites of the FloridaPhosphate District.Substitutes: Substitutes are available for many applications but generally are less effective.e Estimated. NA Not available. W Withheld to avoid disclosing company proprietary data. — Zero.1 Data include lanthanides <strong>and</strong> yttrium but exclude most sc<strong>and</strong>ium. See also Sc<strong>and</strong>ium <strong>and</strong> Yttrium.2 REO equivalent or contents of various materials were estimated. Data from U.S. Census Bureau.3 Defined as production + imports – exports + adjustments for industry stock changes; for 2007 <strong>and</strong> 2008, excludes producer stock changes(proprietary), <strong>and</strong> there were no producer stock changes in 2006.4 Price range from Elements—Rare Earths, Specialty Metals <strong>and</strong> Applied Technology, <strong>and</strong> Web-based High Tech Materials, Longmont, CO, <strong>and</strong>Hefa Rare Earth Canada Co. Ltd., Richmond, British Columbia, Canada.5 Defined as imports – exports + adjustments for Government <strong>and</strong> industry stock changes. For 2007 <strong>and</strong> 2008, excludes producer stock changes(proprietary).6 See Appendix C for resource/reserve definitions <strong>and</strong> information concerning data sources.U.S. Geological Survey, <strong>Mineral</strong> <strong>Commodity</strong> <strong>Summaries</strong>, January <strong>2011</strong>

130RHENIUM(Data in kilograms of rhenium content unless otherwise noted)Domestic Production <strong>and</strong> Use: During 2010, ores containing rhenium were mined at four operations (two inArizona, <strong>and</strong> one each in Montana <strong>and</strong> Utah). Rhenium compounds are included in molybdenum concentratesderived from porphyry copper deposits, <strong>and</strong> rhenium is recovered as a byproduct from roasting such molybdenumconcentrates. Rhenium-containing products included ammonium perrhenate (APR), metal powder, <strong>and</strong> perrhenicacid. The major uses of rhenium were in petroleum-reforming catalysts <strong>and</strong> in superalloys used in high-temperatureturbine engine components, representing an estimated 20% <strong>and</strong> 70%, respectively, of the end use. Bimetallicplatinum-rhenium catalysts were used in petroleum-reforming for the production of high-octane hydrocarbons, whichare used in the production of lead-free gasoline. Rhenium improves the high-temperature (1,000° C) strengthproperties of some nickel-based superalloys. Rhenium alloys were used in crucibles, electrical contacts,electromagnets, electron tubes <strong>and</strong> targets, heating elements, ionization gauges, mass spectrographs, metalliccoatings, semiconductors, temperature controls, thermocouples, vacuum tubes, <strong>and</strong> other applications. Theestimated value of rhenium consumed in 2010 was about $63 million.Salient Statistics—United States: 2006 2007 2008 2009 2010 eProduction1 8,110 7,090 7,910 5,580 6,000Imports for consumption 32,100 31,700 32,700 24,900 36,000Exports NA NA NA NA NAConsumption, apparent 40,200 38,800 40,600 30,500 42,000Price, 2 average value, dollars per kilogram,gross weight:Metal powder, 99.99% pure 1,260 1,620 2,030 2,460 2,300Ammonium perrhenate 840 2,730 2,160 955 540Stocks, yearend, consumer, producer, dealer NA NA NA NA NAEmployment, number Small Small Small Small SmallNet import reliance 3 as a percentage ofapparent consumption 80 82 81 82 86Recycling: Small amounts of molybdenum-rhenium <strong>and</strong> tungsten-rhenium scrap have been processed by severalcompanies during the past few years. All spent platinum-rhenium catalysts were recycled.Import Sources (2006–09): Rhenium metal powder: Chile, 93%; Netherl<strong>and</strong>s, 3%; <strong>and</strong> other, 4%. Ammoniumperrhenate: Kazakhstan, 57%; Chile, 12%; United Kingdom, 8%; China, 6%; <strong>and</strong> other, 17%.Tariff: Item Number Normal Trade Relations12-31-10Salts of peroxometallic acids, other—ammonium perrhenate 2841.90.2000 3.1% ad val.Rhenium, etc., (metals) waste <strong>and</strong> scrap 8112.92.0600 Free.Rhenium, (metals) unwrought; powders 8112.92.5000 3% ad val.Rhenium, etc., (metals) wrought; etc. 8112.99.9000 4% ad val.Depletion Allowance: 14% (Domestic <strong>and</strong> foreign).Government Stockpile: None.Prepared by Désirée E. Polyak [(703) 648-4909, dpolyak@usgs.gov, fax: (703) 648-7757]

- Page 3:

U.S. Department of the InteriorKEN

- Page 6 and 7:

INTRODUCTION3Each chapter of the 20

- Page 8 and 9:

5NET EXPORTS OF MINERALRAW MATERIAL

- Page 10 and 11:

SIGNIFICANT EVENTS, TRENDS, AND ISS

- Page 12 and 13:

mineral materials valued at $1.30 b

- Page 14 and 15:

11MAJOR METAL-PRODUCING AREASAuB2P1

- Page 16 and 17:

13MAJOR INDUSTRIAL MINERAL-PRODUCIN

- Page 18 and 19:

ABRASIVES (MANUFACTURED)15Events, T

- Page 20 and 21:

ALUMINUM17The United States continu

- Page 22 and 23:

ANTIMONY19Events, Trends, and Issue

- Page 24 and 25:

ARSENIC21According to university me

- Page 26 and 27:

ASBESTOS23Events, Trends, and Issue

- Page 28 and 29:

BARITE25Nationally, the rig count o

- Page 30 and 31:

BAUXITE AND ALUMINA27Events, Trends

- Page 32 and 33:

BERYLLIUM29Events, Trends, and Issu

- Page 34 and 35:

BISMUTH31Events, Trends, and Issues

- Page 36 and 37:

BORON33Events, Trends, and Issues:

- Page 38 and 39:

BROMINE35Events, Trends, and Issues

- Page 40 and 41:

CADMIUM37NiCd battery use in consum

- Page 42 and 43:

CEMENT39The manufacture of clinker

- Page 44 and 45:

CESIUM41Events, Trends, and Issues:

- Page 46 and 47:

CHROMIUM43Stockpile Status—9-30-1

- Page 48 and 49:

CLAYS45Tariff: Item Number Normal T

- Page 50 and 51:

COBALT47Events, Trends, and Issues:

- Page 52 and 53:

COPPER49Events, Trends, and Issues:

- Page 54 and 55:

DIAMOND (INDUSTRIAL)51Events, Trend

- Page 56 and 57:

DIATOMITE53Events, Trends, and Issu

- Page 58 and 59:

FELDSPAR55Feldspar use in tile and

- Page 60 and 61:

FLUORSPAR57with planned output of 1

- Page 62 and 63:

GALLIUM59In response to the unprece

- Page 64 and 65:

GARNET (INDUSTRIAL)61Events, Trends

- Page 66 and 67:

GEMSTONES63Events, Trends, and Issu

- Page 68 and 69:

GERMANIUM65Events, Trends, and Issu

- Page 70 and 71:

GOLD67With the increase in price of

- Page 72 and 73:

GRAPHITE (NATURAL)69Events, Trends,

- Page 74 and 75:

GYPSUM71Through 2010, more than 3,6

- Page 76 and 77:

HELIUM73Events, Trends, and Issues:

- Page 78 and 79:

INDIUM75China’s 21 indium produce

- Page 80 and 81:

IODINE77Events, Trends, and Issues:

- Page 82 and 83: IRON AND STEEL79Events, Trends, and

- Page 84 and 85: IRON AND STEEL SCRAP81Tariff: Item

- Page 86 and 87: IRON AND STEEL SLAG83Events, Trends

- Page 88 and 89: IRON ORE85In 2009, China imported a

- Page 90 and 91: IRON OXIDE PIGMENTS87Events, Trends

- Page 92 and 93: KYANITE AND RELATED MATERIALS89Even

- Page 94 and 95: LEAD91caused by underground fires a

- Page 96 and 97: LIME93The lime industry is facing p

- Page 98 and 99: LITHIUM95market, and a facility at

- Page 100 and 101: MAGNESIUM COMPOUNDS97In Australia,

- Page 102 and 103: MAGNESIUM METAL99U.S. magnesium con

- Page 104 and 105: MANGANESE101Government Stockpile:St

- Page 106 and 107: MERCURY103Events, Trends, and Issue

- Page 108 and 109: MICA (NATURAL)105Depletion Allowanc

- Page 110 and 111: MOLYBDENUM107Events, Trends, and Is

- Page 112 and 113: NICKEL109Nickel prices were adverse

- Page 114 and 115: NIOBIUM (COLUMBIUM)111Events, Trend

- Page 116 and 117: NITROGEN (FIXED)—AMMONIA113Accord

- Page 118 and 119: PEAT115Events, Trends, and Issues:

- Page 120 and 121: PERLITE117Events, Trends, and Issue

- Page 122 and 123: PHOSPHATE ROCK119Events, Trends, an

- Page 124 and 125: PLATINUM-GROUP METALS121Events, Tre

- Page 126 and 127: POTASH123Events, Trends, and Issues

- Page 128 and 129: PUMICE AND PUMICITE125Events, Trend

- Page 130 and 131: QUARTZ CRYSTAL (INDUSTRIAL)127Event

- Page 134 and 135: RHENIUM131Events, Trends, and Issue

- Page 136 and 137: RUBIDIUM133Events, Trends, and Issu

- Page 138 and 139: SALT135Many chefs have advocated us

- Page 140 and 141: SAND AND GRAVEL (CONSTRUCTION)137Ev

- Page 142 and 143: SAND AND GRAVEL (INDUSTRIAL)139The

- Page 144 and 145: SCANDIUM141Scandium’s use in meta

- Page 146 and 147: SELENIUM143Events, Trends, and Issu

- Page 148 and 149: SILICON145Events, Trends, and Issue

- Page 150 and 151: SILVER147Silver was used as a repla

- Page 152 and 153: SODA ASH149A Wyoming soda ash produ

- Page 154 and 155: SODIUM SULFATE151Events, Trends, an

- Page 156 and 157: STONE (CRUSHED)153Events, Trends, a

- Page 158 and 159: STONE (DIMENSION)155Events, Trends,

- Page 160 and 161: STRONTIUM157Events, Trends, and Iss

- Page 162 and 163: SULFUR159World sulfur production in

- Page 164 and 165: TALC AND PYROPHYLLITE161Events, Tre

- Page 166 and 167: TANTALUM163Events, Trends, and Issu

- Page 168 and 169: TELLURIUM165Events, Trends, and Iss

- Page 170: THALLIUM167Beginning in 2009, there

- Page 173 and 174: 170TIN(Data in metric tons of tin c

- Page 175 and 176: 172TITANIUM AND TITANIUM DIOXIDE 1(

- Page 177 and 178: 174TITANIUM MINERAL CONCENTRATES 1(

- Page 179 and 180: 176TUNGSTEN(Data in metric tons of

- Page 181 and 182: 178VANADIUM(Data in metric tons of

- Page 183 and 184:

180VERMICULITE(Data in thousand met

- Page 185 and 186:

182WOLLASTONITE(Data in metric tons

- Page 187 and 188:

184YTTRIUM 1(Data in metric tons of

- Page 189 and 190:

186ZEOLITES (NATURAL)(Data in metri

- Page 191 and 192:

188ZINC(Data in thousand metric ton

- Page 193 and 194:

190ZIRCONIUM AND HAFNIUM(Data in me

- Page 195 and 196:

192APPENDIX AAbbreviations and Unit

- Page 197 and 198:

194Demonstrated.—A term for the s

- Page 199 and 200:

196Part B—Sources of Reserves Dat

- Page 201:

198Europe and Central Eurasia—con