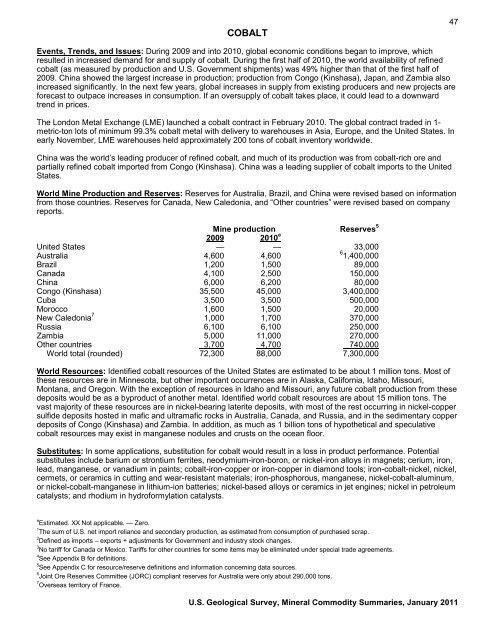

COBALT47Events, Trends, <strong>and</strong> Issues: During 2009 <strong>and</strong> into 2010, global economic conditions began to improve, whichresulted in increased dem<strong>and</strong> for <strong>and</strong> supply of cobalt. During the first half of 2010, the world availability of refinedcobalt (as measured by production <strong>and</strong> U.S. Government shipments) was 49% higher than that of the first half of2009. China showed the largest increase in production; production from Congo (Kinshasa), Japan, <strong>and</strong> Zambia alsoincreased significantly. In the next few years, global increases in supply from existing producers <strong>and</strong> new projects areforecast to outpace increases in consumption. If an oversupply of cobalt takes place, it could lead to a downwardtrend in prices.The London Metal Exchange (LME) launched a cobalt contract in February 2010. The global contract traded in 1-metric-ton lots of minimum 99.3% cobalt metal with delivery to warehouses in Asia, Europe, <strong>and</strong> the United States. Inearly November, LME warehouses held approximately 200 tons of cobalt inventory worldwide.China was the world’s leading producer of refined cobalt, <strong>and</strong> much of its production was from cobalt-rich ore <strong>and</strong>partially refined cobalt imported from Congo (Kinshasa). China was a leading supplier of cobalt imports to the UnitedStates.World Mine Production <strong>and</strong> Reserves: Reserves for Australia, Brazil, <strong>and</strong> China were revised based on informationfrom those countries. Reserves for Canada, New Caledonia, <strong>and</strong> “Other countries” were revised based on companyreports.Mine production Reserves 52009 2010 eUnited States — — 33,000Australia 4,600 4,6001,400,000Brazil 1,200 1,500 89,000Canada 4,100 2,500 150,000China 6,000 6,200 80,000Congo (Kinshasa) 35,500 45,000 3,400,000Cuba 3,500 3,500 500,000Morocco 1,600 1,500 20,000New Caledonia 7 1,000 1,700 370,000Russia 6,100 6,100 250,000Zambia 5,000 11,000 270,000Other countries 3,700 4,700740,000World total (rounded) 72,300 88,000 7,300,000World Resources: Identified cobalt resources of the United States are estimated to be about 1 million tons. Most ofthese resources are in Minnesota, but other important occurrences are in Alaska, California, Idaho, Missouri,Montana, <strong>and</strong> Oregon. With the exception of resources in Idaho <strong>and</strong> Missouri, any future cobalt production from thesedeposits would be as a byproduct of another metal. Identified world cobalt resources are about 15 million tons. Thevast majority of these resources are in nickel-bearing laterite deposits, with most of the rest occurring in nickel-coppersulfide deposits hosted in mafic <strong>and</strong> ultramafic rocks in Australia, Canada, <strong>and</strong> Russia, <strong>and</strong> in the sedimentary copperdeposits of Congo (Kinshasa) <strong>and</strong> Zambia. In addition, as much as 1 billion tons of hypothetical <strong>and</strong> speculativecobalt resources may exist in manganese nodules <strong>and</strong> crusts on the ocean floor.Substitutes: In some applications, substitution for cobalt would result in a loss in product performance. Potentialsubstitutes include barium or strontium ferrites, neodymium-iron-boron, or nickel-iron alloys in magnets; cerium, iron,lead, manganese, or vanadium in paints; cobalt-iron-copper or iron-copper in diamond tools; iron-cobalt-nickel, nickel,cermets, or ceramics in cutting <strong>and</strong> wear-resistant materials; iron-phosphorous, manganese, nickel-cobalt-aluminum,or nickel-cobalt-manganese in lithium-ion batteries; nickel-based alloys or ceramics in jet engines; nickel in petroleumcatalysts; <strong>and</strong> rhodium in hydroformylation catalysts.e Estimated. XX Not applicable. — Zero.1 The sum of U.S. net import reliance <strong>and</strong> secondary production, as estimated from consumption of purchased scrap.2 Defined as imports – exports + adjustments for Government <strong>and</strong> industry stock changes.3 No tariff for Canada or Mexico. Tariffs for other countries for some items may be eliminated under special trade agreements.4 See Appendix B for definitions.5 See Appendix C for resource/reserve definitions <strong>and</strong> information concerning data sources.6 Joint Ore Reserves Committee (JORC) compliant reserves for Australia were only about 290,000 tons.7 Overseas territory of France.U.S. Geological Survey, <strong>Mineral</strong> <strong>Commodity</strong> <strong>Summaries</strong>, January <strong>2011</strong>

48COPPER(Data in thous<strong>and</strong> metric tons of copper content unless otherwise noted)Domestic Production <strong>and</strong> Use: Domestic mine production of copper in 2010 declined by about 5% to 1.12 milliontons but its value rose to about $8.4 billion. The principal mining States, in descending order of production—Arizona,Utah, Nevada, New Mexico, <strong>and</strong> Montana—accounted for more than 99% of domestic production; copper also wasrecovered at mines in Idaho <strong>and</strong> Missouri. Although copper was recovered at 28 mines operating in the United States,19 mines accounted for about 99% of production. Three primary smelters, 4 electrolytic <strong>and</strong> 3 fire refineries, <strong>and</strong> 15solvent extraction-electrowinning facilities operated during the year. Refined copper <strong>and</strong> direct-melt scrap wereconsumed at about 30 brass mills; 15 rod mills; <strong>and</strong> 500 foundries, chemical plants, <strong>and</strong> miscellaneous consumers.Copper <strong>and</strong> copper alloy products were used in building construction, 49%; electric <strong>and</strong> electronic products, 20%;transportation equipment, 12%; consumer <strong>and</strong> general products, 10%; <strong>and</strong> industrial machinery <strong>and</strong> equipment, 9%. 1Salient Statistics—United States: 2006 2007 2008 2009 2010 eProduction:Mine 1,200 1,170 1,310 1,180 1,120Refinery:Primary 1,210 1,270 1,220 1,110 1,050Secondary 45 46 54 46 45Copper from all old scrap 151 158 155 172 160Imports for consumption:Ores <strong>and</strong> concentrates ( 2 ) 1 1 ( 2 ) 1Refined 1,070 829 724 664 640Unmanufactured 1,320 1,100 934 788 760General imports, refined 1,070 832 721 645 620Exports:Ores <strong>and</strong> concentrates 108 134 301 151 140Refined 106 51 37 81 90Unmanufactured 990 884 1,090 932 1,020Consumption:Reported, refined 2,110 2,140 2,020 1,650 1,730Apparent, unmanufactured 3 2,200 2,270 2,000 1,600 1,730Price, average, cents per pound:Domestic producer, cathode 314.8 328.0 319.2 241.2 342London Metal Exchange, high-grade 304.9 322.8 315.0 233.6 335Stocks, yearend, refined, held by U.S.producers, consumers, <strong>and</strong> metal exchanges 194 130 187 433 440Employment, mine <strong>and</strong> mill, thous<strong>and</strong>s 8.4 9.7 11.9 8.3 8.7Net import reliance 4 as a percentage ofapparent consumption 38 37 31 20 30Recycling: Old scrap, converted to refined metal <strong>and</strong> alloys, provided 160,000 tons of copper, equivalent to 9% ofapparent consumption. Purchased new scrap, derived from fabricating operations, yielded 670,000 tons of containedcopper; about 82% of the copper contained in new scrap was consumed at brass or wire-rod mills. Of the total copperrecovered from scrap (including aluminum- <strong>and</strong> nickel-based scrap), brass mills recovered 70%; miscellaneousmanufacturers, foundries, <strong>and</strong> chemical plants, 14%; ingot makers, 11%; <strong>and</strong> copper smelters <strong>and</strong> refiners, 5%.Copper in all old <strong>and</strong> new, refined or remelted scrap contributed about 35% of the U.S. copper supply.Import Sources (2006–09): Unmanufactured: Chile, 41%; Canada, 33%; Peru, 13%; Mexico, 6%; <strong>and</strong> other, 7%.Refined copper accounted for 82% of unwrought copper imports.Tariff: Item Number Normal Trade Relations 512-31-10Copper ores <strong>and</strong> concentrates 2603.00.0000 1.7¢/kg on lead content.Unrefined copper; anodes 7402.00.0000 Free.Refined <strong>and</strong> alloys; unwrought 7403.00.0000 1.0% ad val.Copper wire (rod) 7408.11.6000 3.0% ad val.Depletion Allowance: 15% (Domestic), 14% (Foreign).Government Stockpile: The stockpiles of refined copper <strong>and</strong> brass were liquidated in 1993 <strong>and</strong> 1994, respectively.Details on inventories of beryllium-copper master alloys (4% beryllium) can be found in the section on beryllium.Prepared by Daniel L. Edelstein [(703) 648-4978, dedelste@usgs.gov, fax: (703) 648-7757]

- Page 3: U.S. Department of the InteriorKEN

- Page 6 and 7: INTRODUCTION3Each chapter of the 20

- Page 8 and 9: 5NET EXPORTS OF MINERALRAW MATERIAL

- Page 10 and 11: SIGNIFICANT EVENTS, TRENDS, AND ISS

- Page 12 and 13: mineral materials valued at $1.30 b

- Page 14 and 15: 11MAJOR METAL-PRODUCING AREASAuB2P1

- Page 16 and 17: 13MAJOR INDUSTRIAL MINERAL-PRODUCIN

- Page 18 and 19: ABRASIVES (MANUFACTURED)15Events, T

- Page 20 and 21: ALUMINUM17The United States continu

- Page 22 and 23: ANTIMONY19Events, Trends, and Issue

- Page 24 and 25: ARSENIC21According to university me

- Page 26 and 27: ASBESTOS23Events, Trends, and Issue

- Page 28 and 29: BARITE25Nationally, the rig count o

- Page 30 and 31: BAUXITE AND ALUMINA27Events, Trends

- Page 32 and 33: BERYLLIUM29Events, Trends, and Issu

- Page 34 and 35: BISMUTH31Events, Trends, and Issues

- Page 36 and 37: BORON33Events, Trends, and Issues:

- Page 38 and 39: BROMINE35Events, Trends, and Issues

- Page 40 and 41: CADMIUM37NiCd battery use in consum

- Page 42 and 43: CEMENT39The manufacture of clinker

- Page 44 and 45: CESIUM41Events, Trends, and Issues:

- Page 46 and 47: CHROMIUM43Stockpile Status—9-30-1

- Page 48 and 49: CLAYS45Tariff: Item Number Normal T

- Page 52 and 53: COPPER49Events, Trends, and Issues:

- Page 54 and 55: DIAMOND (INDUSTRIAL)51Events, Trend

- Page 56 and 57: DIATOMITE53Events, Trends, and Issu

- Page 58 and 59: FELDSPAR55Feldspar use in tile and

- Page 60 and 61: FLUORSPAR57with planned output of 1

- Page 62 and 63: GALLIUM59In response to the unprece

- Page 64 and 65: GARNET (INDUSTRIAL)61Events, Trends

- Page 66 and 67: GEMSTONES63Events, Trends, and Issu

- Page 68 and 69: GERMANIUM65Events, Trends, and Issu

- Page 70 and 71: GOLD67With the increase in price of

- Page 72 and 73: GRAPHITE (NATURAL)69Events, Trends,

- Page 74 and 75: GYPSUM71Through 2010, more than 3,6

- Page 76 and 77: HELIUM73Events, Trends, and Issues:

- Page 78 and 79: INDIUM75China’s 21 indium produce

- Page 80 and 81: IODINE77Events, Trends, and Issues:

- Page 82 and 83: IRON AND STEEL79Events, Trends, and

- Page 84 and 85: IRON AND STEEL SCRAP81Tariff: Item

- Page 86 and 87: IRON AND STEEL SLAG83Events, Trends

- Page 88 and 89: IRON ORE85In 2009, China imported a

- Page 90 and 91: IRON OXIDE PIGMENTS87Events, Trends

- Page 92 and 93: KYANITE AND RELATED MATERIALS89Even

- Page 94 and 95: LEAD91caused by underground fires a

- Page 96 and 97: LIME93The lime industry is facing p

- Page 98 and 99: LITHIUM95market, and a facility at

- Page 100 and 101:

MAGNESIUM COMPOUNDS97In Australia,

- Page 102 and 103:

MAGNESIUM METAL99U.S. magnesium con

- Page 104 and 105:

MANGANESE101Government Stockpile:St

- Page 106 and 107:

MERCURY103Events, Trends, and Issue

- Page 108 and 109:

MICA (NATURAL)105Depletion Allowanc

- Page 110 and 111:

MOLYBDENUM107Events, Trends, and Is

- Page 112 and 113:

NICKEL109Nickel prices were adverse

- Page 114 and 115:

NIOBIUM (COLUMBIUM)111Events, Trend

- Page 116 and 117:

NITROGEN (FIXED)—AMMONIA113Accord

- Page 118 and 119:

PEAT115Events, Trends, and Issues:

- Page 120 and 121:

PERLITE117Events, Trends, and Issue

- Page 122 and 123:

PHOSPHATE ROCK119Events, Trends, an

- Page 124 and 125:

PLATINUM-GROUP METALS121Events, Tre

- Page 126 and 127:

POTASH123Events, Trends, and Issues

- Page 128 and 129:

PUMICE AND PUMICITE125Events, Trend

- Page 130 and 131:

QUARTZ CRYSTAL (INDUSTRIAL)127Event

- Page 132 and 133:

RARE EARTHS129Events, Trends, and I

- Page 134 and 135:

RHENIUM131Events, Trends, and Issue

- Page 136 and 137:

RUBIDIUM133Events, Trends, and Issu

- Page 138 and 139:

SALT135Many chefs have advocated us

- Page 140 and 141:

SAND AND GRAVEL (CONSTRUCTION)137Ev

- Page 142 and 143:

SAND AND GRAVEL (INDUSTRIAL)139The

- Page 144 and 145:

SCANDIUM141Scandium’s use in meta

- Page 146 and 147:

SELENIUM143Events, Trends, and Issu

- Page 148 and 149:

SILICON145Events, Trends, and Issue

- Page 150 and 151:

SILVER147Silver was used as a repla

- Page 152 and 153:

SODA ASH149A Wyoming soda ash produ

- Page 154 and 155:

SODIUM SULFATE151Events, Trends, an

- Page 156 and 157:

STONE (CRUSHED)153Events, Trends, a

- Page 158 and 159:

STONE (DIMENSION)155Events, Trends,

- Page 160 and 161:

STRONTIUM157Events, Trends, and Iss

- Page 162 and 163:

SULFUR159World sulfur production in

- Page 164 and 165:

TALC AND PYROPHYLLITE161Events, Tre

- Page 166 and 167:

TANTALUM163Events, Trends, and Issu

- Page 168 and 169:

TELLURIUM165Events, Trends, and Iss

- Page 170:

THALLIUM167Beginning in 2009, there

- Page 173 and 174:

170TIN(Data in metric tons of tin c

- Page 175 and 176:

172TITANIUM AND TITANIUM DIOXIDE 1(

- Page 177 and 178:

174TITANIUM MINERAL CONCENTRATES 1(

- Page 179 and 180:

176TUNGSTEN(Data in metric tons of

- Page 181 and 182:

178VANADIUM(Data in metric tons of

- Page 183 and 184:

180VERMICULITE(Data in thousand met

- Page 185 and 186:

182WOLLASTONITE(Data in metric tons

- Page 187 and 188:

184YTTRIUM 1(Data in metric tons of

- Page 189 and 190:

186ZEOLITES (NATURAL)(Data in metri

- Page 191 and 192:

188ZINC(Data in thousand metric ton

- Page 193 and 194:

190ZIRCONIUM AND HAFNIUM(Data in me

- Page 195 and 196:

192APPENDIX AAbbreviations and Unit

- Page 197 and 198:

194Demonstrated.—A term for the s

- Page 199 and 200:

196Part B—Sources of Reserves Dat

- Page 201:

198Europe and Central Eurasia—con