LIME93The lime industry is facing possible future regulation of carbon dioxide emissions after the U.S. <strong>Environmental</strong> Agency(EPA) published findings that greenhouse gas emissions (GHG), including carbon dioxide, threaten the public health<strong>and</strong> welfare of current <strong>and</strong> future generations. These “endangerment” findings allow the EPA to require that anymodification to a stationary source that increases GHG emissions above the significance threshold would need to gothrough “prevention of significant deterioration” (PSD) review <strong>and</strong> install the “best available control technology.” In2010, the EPA published its “PSD <strong>and</strong> title V greenhouse gas tailoring rule” to establish the applicability criteria thatdetermine which stationary sources <strong>and</strong> modification projects become subject to permitting requirements for GHGemissions. The tailoring rule is designed to phase in regulation of GHG emissions from stationary sources bytemporarily increasing the amount of GHG emissions that would trigger PSD, so that tens of thous<strong>and</strong>s of sources arenot immediately swept into the PSD program.World Lime Production <strong>and</strong> Limestone Reserves:Production Reserves 42009 2010 eUnited States 15,800 18,000 Adequate for allAustralia 2,000 2,200 countries listed.Belgium 2,000 2,000Brazil 7,450 7,700Canada 1,600 1,800China 185,000 190,000France 3,500 3,700Germany 6,000 6,800India 13,000 14,000Iran 2,700 2,800Italy 5 6,000 6,400Japan (quicklime only) 8,400 9,400Korea, Republic of 3,600 4,000Mexico 5,500 5,700Pol<strong>and</strong> 1,950 2,000Romania 2,000 2,200Russia 7,000 7,400South Africa (sales) 1,380 1,400Spain 2,000 2,200Turkey (sales) 3,800 4,000United Kingdom 1,500 1,600Vietnam 1,700 1,800Other countries 15,500 16,000World total (rounded) 299,000 310,000World Resources: Domestic <strong>and</strong> world resources of limestone <strong>and</strong> dolomite suitable for lime manufacture areadequate.Substitutes: Limestone is a substitute for lime in many applications, such as agriculture, fluxing, <strong>and</strong> sulfur removal.Limestone, which contains less reactive material, is slower to react <strong>and</strong> may have other disadvantages compared withlime, depending on the application; however, limestone is considerably less expensive than lime. Calcined gypsum isan alternative material in industrial plasters <strong>and</strong> mortars. Cement, cement kiln dust, fly ash, <strong>and</strong> lime kiln dust arepotential substitutes for some construction uses of lime. Magnesium hydroxide is a substitute for lime in pH control,<strong>and</strong> magnesium oxide is a substitute for dolomitic lime as a flux in steelmaking.e Estimated. NA Not available.1 Data are for quicklime, hydrated lime, <strong>and</strong> refractory dead-burned dolomite. Includes Puerto Rico.2 Sold or used by producers.3 Defined as imports – exports + adjustments for Government <strong>and</strong> industry stock changes; stock changes are assumed to be zero for apparentconsumption <strong>and</strong> net import reliance calculations.4 See Appendix C for resource/reserve definitions <strong>and</strong> information concerning data sources.5 Includes hydraulic lime.U.S. Geological Survey, <strong>Mineral</strong> <strong>Commodity</strong> <strong>Summaries</strong>, January <strong>2011</strong>

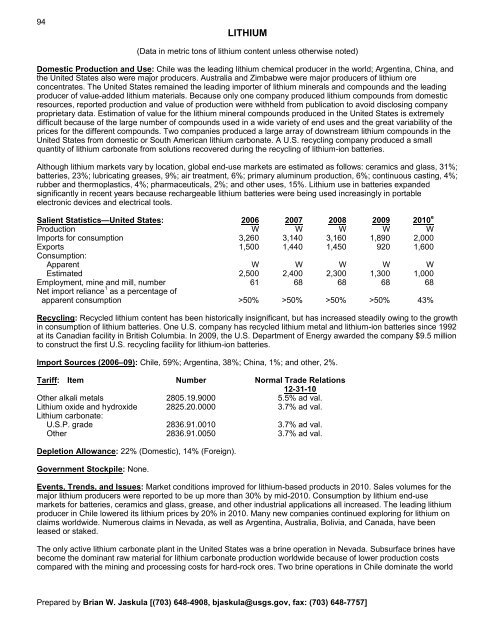

94LITHIUM(Data in metric tons of lithium content unless otherwise noted)Domestic Production <strong>and</strong> Use: Chile was the leading lithium chemical producer in the world; Argentina, China, <strong>and</strong>the United States also were major producers. Australia <strong>and</strong> Zimbabwe were major producers of lithium oreconcentrates. The United States remained the leading importer of lithium minerals <strong>and</strong> compounds <strong>and</strong> the leadingproducer of value-added lithium materials. Because only one company produced lithium compounds from domesticresources, reported production <strong>and</strong> value of production were withheld from publication to avoid disclosing companyproprietary data. Estimation of value for the lithium mineral compounds produced in the United States is extremelydifficult because of the large number of compounds used in a wide variety of end uses <strong>and</strong> the great variability of theprices for the different compounds. Two companies produced a large array of downstream lithium compounds in theUnited States from domestic or South American lithium carbonate. A U.S. recycling company produced a smallquantity of lithium carbonate from solutions recovered during the recycling of lithium-ion batteries.Although lithium markets vary by location, global end-use markets are estimated as follows: ceramics <strong>and</strong> glass, 31%;batteries, 23%; lubricating greases, 9%; air treatment, 6%; primary aluminum production, 6%; continuous casting, 4%;rubber <strong>and</strong> thermoplastics, 4%; pharmaceuticals, 2%; <strong>and</strong> other uses, 15%. Lithium use in batteries exp<strong>and</strong>edsignificantly in recent years because rechargeable lithium batteries were being used increasingly in portableelectronic devices <strong>and</strong> electrical tools.Salient Statistics—United States: 2006 2007 2008 2009 2010 eProduction W W W W WImports for consumption 3,260 3,140 3,160 1,890 2,000Exports 1,500 1,440 1,450 920 1,600Consumption:Apparent W W W W WEstimated 2,500 2,400 2,300 1,300 1,000Employment, mine <strong>and</strong> mill, number 61 68 68 68 68Net import reliance 1 as a percentage ofapparent consumption >50% >50% >50% >50% 43%Recycling: Recycled lithium content has been historically insignificant, but has increased steadily owing to the growthin consumption of lithium batteries. One U.S. company has recycled lithium metal <strong>and</strong> lithium-ion batteries since 1992at its Canadian facility in British Columbia. In 2009, the U.S. Department of <strong>Energy</strong> awarded the company $9.5 millionto construct the first U.S. recycling facility for lithium-ion batteries.Import Sources (2006–09): Chile, 59%; Argentina, 38%; China, 1%; <strong>and</strong> other, 2%.Tariff: Item Number Normal Trade Relations12-31-10Other alkali metals 2805.19.9000 5.5% ad val.Lithium oxide <strong>and</strong> hydroxide 2825.20.0000 3.7% ad val.Lithium carbonate:U.S.P. grade 2836.91.0010 3.7% ad val.Other 2836.91.0050 3.7% ad val.Depletion Allowance: 22% (Domestic), 14% (Foreign).Government Stockpile: None.Events, Trends, <strong>and</strong> Issues: Market conditions improved for lithium-based products in 2010. Sales volumes for themajor lithium producers were reported to be up more than 30% by mid-2010. Consumption by lithium end-usemarkets for batteries, ceramics <strong>and</strong> glass, grease, <strong>and</strong> other industrial applications all increased. The leading lithiumproducer in Chile lowered its lithium prices by 20% in 2010. Many new companies continued exploring for lithium onclaims worldwide. Numerous claims in Nevada, as well as Argentina, Australia, Bolivia, <strong>and</strong> Canada, have beenleased or staked.The only active lithium carbonate plant in the United States was a brine operation in Nevada. Subsurface brines havebecome the dominant raw material for lithium carbonate production worldwide because of lower production costscompared with the mining <strong>and</strong> processing costs for hard-rock ores. Two brine operations in Chile dominate the worldPrepared by Brian W. Jaskula [(703) 648-4908, bjaskula@usgs.gov, fax: (703) 648-7757]

- Page 3:

U.S. Department of the InteriorKEN

- Page 6 and 7:

INTRODUCTION3Each chapter of the 20

- Page 8 and 9:

5NET EXPORTS OF MINERALRAW MATERIAL

- Page 10 and 11:

SIGNIFICANT EVENTS, TRENDS, AND ISS

- Page 12 and 13:

mineral materials valued at $1.30 b

- Page 14 and 15:

11MAJOR METAL-PRODUCING AREASAuB2P1

- Page 16 and 17:

13MAJOR INDUSTRIAL MINERAL-PRODUCIN

- Page 18 and 19:

ABRASIVES (MANUFACTURED)15Events, T

- Page 20 and 21:

ALUMINUM17The United States continu

- Page 22 and 23:

ANTIMONY19Events, Trends, and Issue

- Page 24 and 25:

ARSENIC21According to university me

- Page 26 and 27:

ASBESTOS23Events, Trends, and Issue

- Page 28 and 29:

BARITE25Nationally, the rig count o

- Page 30 and 31:

BAUXITE AND ALUMINA27Events, Trends

- Page 32 and 33:

BERYLLIUM29Events, Trends, and Issu

- Page 34 and 35:

BISMUTH31Events, Trends, and Issues

- Page 36 and 37:

BORON33Events, Trends, and Issues:

- Page 38 and 39:

BROMINE35Events, Trends, and Issues

- Page 40 and 41:

CADMIUM37NiCd battery use in consum

- Page 42 and 43:

CEMENT39The manufacture of clinker

- Page 44 and 45:

CESIUM41Events, Trends, and Issues:

- Page 46 and 47: CHROMIUM43Stockpile Status—9-30-1

- Page 48 and 49: CLAYS45Tariff: Item Number Normal T

- Page 50 and 51: COBALT47Events, Trends, and Issues:

- Page 52 and 53: COPPER49Events, Trends, and Issues:

- Page 54 and 55: DIAMOND (INDUSTRIAL)51Events, Trend

- Page 56 and 57: DIATOMITE53Events, Trends, and Issu

- Page 58 and 59: FELDSPAR55Feldspar use in tile and

- Page 60 and 61: FLUORSPAR57with planned output of 1

- Page 62 and 63: GALLIUM59In response to the unprece

- Page 64 and 65: GARNET (INDUSTRIAL)61Events, Trends

- Page 66 and 67: GEMSTONES63Events, Trends, and Issu

- Page 68 and 69: GERMANIUM65Events, Trends, and Issu

- Page 70 and 71: GOLD67With the increase in price of

- Page 72 and 73: GRAPHITE (NATURAL)69Events, Trends,

- Page 74 and 75: GYPSUM71Through 2010, more than 3,6

- Page 76 and 77: HELIUM73Events, Trends, and Issues:

- Page 78 and 79: INDIUM75China’s 21 indium produce

- Page 80 and 81: IODINE77Events, Trends, and Issues:

- Page 82 and 83: IRON AND STEEL79Events, Trends, and

- Page 84 and 85: IRON AND STEEL SCRAP81Tariff: Item

- Page 86 and 87: IRON AND STEEL SLAG83Events, Trends

- Page 88 and 89: IRON ORE85In 2009, China imported a

- Page 90 and 91: IRON OXIDE PIGMENTS87Events, Trends

- Page 92 and 93: KYANITE AND RELATED MATERIALS89Even

- Page 94 and 95: LEAD91caused by underground fires a

- Page 98 and 99: LITHIUM95market, and a facility at

- Page 100 and 101: MAGNESIUM COMPOUNDS97In Australia,

- Page 102 and 103: MAGNESIUM METAL99U.S. magnesium con

- Page 104 and 105: MANGANESE101Government Stockpile:St

- Page 106 and 107: MERCURY103Events, Trends, and Issue

- Page 108 and 109: MICA (NATURAL)105Depletion Allowanc

- Page 110 and 111: MOLYBDENUM107Events, Trends, and Is

- Page 112 and 113: NICKEL109Nickel prices were adverse

- Page 114 and 115: NIOBIUM (COLUMBIUM)111Events, Trend

- Page 116 and 117: NITROGEN (FIXED)—AMMONIA113Accord

- Page 118 and 119: PEAT115Events, Trends, and Issues:

- Page 120 and 121: PERLITE117Events, Trends, and Issue

- Page 122 and 123: PHOSPHATE ROCK119Events, Trends, an

- Page 124 and 125: PLATINUM-GROUP METALS121Events, Tre

- Page 126 and 127: POTASH123Events, Trends, and Issues

- Page 128 and 129: PUMICE AND PUMICITE125Events, Trend

- Page 130 and 131: QUARTZ CRYSTAL (INDUSTRIAL)127Event

- Page 132 and 133: RARE EARTHS129Events, Trends, and I

- Page 134 and 135: RHENIUM131Events, Trends, and Issue

- Page 136 and 137: RUBIDIUM133Events, Trends, and Issu

- Page 138 and 139: SALT135Many chefs have advocated us

- Page 140 and 141: SAND AND GRAVEL (CONSTRUCTION)137Ev

- Page 142 and 143: SAND AND GRAVEL (INDUSTRIAL)139The

- Page 144 and 145: SCANDIUM141Scandium’s use in meta

- Page 146 and 147:

SELENIUM143Events, Trends, and Issu

- Page 148 and 149:

SILICON145Events, Trends, and Issue

- Page 150 and 151:

SILVER147Silver was used as a repla

- Page 152 and 153:

SODA ASH149A Wyoming soda ash produ

- Page 154 and 155:

SODIUM SULFATE151Events, Trends, an

- Page 156 and 157:

STONE (CRUSHED)153Events, Trends, a

- Page 158 and 159:

STONE (DIMENSION)155Events, Trends,

- Page 160 and 161:

STRONTIUM157Events, Trends, and Iss

- Page 162 and 163:

SULFUR159World sulfur production in

- Page 164 and 165:

TALC AND PYROPHYLLITE161Events, Tre

- Page 166 and 167:

TANTALUM163Events, Trends, and Issu

- Page 168 and 169:

TELLURIUM165Events, Trends, and Iss

- Page 170:

THALLIUM167Beginning in 2009, there

- Page 173 and 174:

170TIN(Data in metric tons of tin c

- Page 175 and 176:

172TITANIUM AND TITANIUM DIOXIDE 1(

- Page 177 and 178:

174TITANIUM MINERAL CONCENTRATES 1(

- Page 179 and 180:

176TUNGSTEN(Data in metric tons of

- Page 181 and 182:

178VANADIUM(Data in metric tons of

- Page 183 and 184:

180VERMICULITE(Data in thousand met

- Page 185 and 186:

182WOLLASTONITE(Data in metric tons

- Page 187 and 188:

184YTTRIUM 1(Data in metric tons of

- Page 189 and 190:

186ZEOLITES (NATURAL)(Data in metri

- Page 191 and 192:

188ZINC(Data in thousand metric ton

- Page 193 and 194:

190ZIRCONIUM AND HAFNIUM(Data in me

- Page 195 and 196:

192APPENDIX AAbbreviations and Unit

- Page 197 and 198:

194Demonstrated.—A term for the s

- Page 199 and 200:

196Part B—Sources of Reserves Dat

- Page 201:

198Europe and Central Eurasia—con