FLUORSPAR57with planned output of 120,000 to 180,000 tons of fluorspar per year. Some exploration activities were ongoing,particularly in Sweden, but development or exploration work on other projects was slowed by lagging dem<strong>and</strong> <strong>and</strong>lack of investment capital.Fluorspar was included in the list of 14 raw materials labeled as “critical” by an expert group chaired by the EuropeanCommission of the European Union (EU). The EU faces a potential shortage of these materials, which have highsupply risks because a large share of the worldwide production comes from a h<strong>and</strong>ful of countries. This concentrationof production is compounded by low substitutability <strong>and</strong> low recycling rates. The list was established in the frameworkof the 2008 EU Raw Materials Initiative, <strong>and</strong> the results of the report were expected to be used to help form strategiesto ensure future access to critical raw materials. The expert group recommended updating the list of EU critical rawmaterials every 5 years <strong>and</strong> enlarging the scope for criticality assessment; policy actions improving access to primaryresources; policy actions making recycling of raw materials or raw material-containing products more efficient;encouraging substitution of certain raw materials, notably by promoting research on substitutes for critical rawmaterials; <strong>and</strong> improving the overall material efficiency of critical raw materials. 4World Mine Production <strong>and</strong> Reserves: Production estimates for individual countries were made using country orcompany specific data where available; other estimates were made based on general knowledge of end-use markets.The reserve estimate for China has been revised based on new information.Mine production Reserves 5, 62009 2010 eUnited States NA NA NABrazil 64 65 NAChina 2,900 3,000 24,000Kazakhstan 67 65 NAKenya 16 30 2,000Mexico 1,040 1,000 32,000Mongolia 460 450 12,000Morocco 75 80 NANamibia 74 110 3,000Russia 240 220 NASouth Africa 204 130 41,000Spain 140 120 6,000Other countries 180 170110,000World total (rounded) 5,460 5,400 230,000World Resources: Identified world fluorspar resources were approximately 500 million tons of contained fluorspar.The quantity of fluorine present in phosphate rock deposits is enormous. Current U.S. reserves of phosphate rock areestimated to be 1.0 billion tons, which at 3.5% fluorine would contain 35 million tons of fluorine, equivalent to about 72million tons of fluorspar. World reserves of phosphate rock are estimated to be 18 billion tons, equivalent to 630million tons of fluorine <strong>and</strong> 1.29 billion tons of fluorspar.Substitutes: Aluminum smelting dross, borax, calcium chloride, iron oxides, manganese ore, silica s<strong>and</strong>, <strong>and</strong>titanium dioxide have been used as substitutes for fluorspar fluxes. Byproduct fluorosilicic acid has been used as asubstitute in aluminum fluoride production <strong>and</strong> also has the potential to be used as a substitute in HF production.e Estimated. NA Not available. — Zero.1 Excludes fluorspar equivalent of fluorosilicic acid, hydrofluoric acid, <strong>and</strong> cryolite.2 Industry stocks for two leading consumers <strong>and</strong> fluorspar distributors.3 Defined as imports – exports + adjustments for Government <strong>and</strong> industry stock changes.4 Blamey, Andy, 2010, EU faces possible shortages of critical metals, minerals—report: Platts Metals Week, June 17. (Accessed September 24,2010, at http://www.platts.com/RSSFeedDetailedNews/RSSFeed/HeadlineNews/Metals/8823248/.)5 See Appendix C for resource/reserve definitions <strong>and</strong> information concerning data sources.6 Measured as 100% calcium fluoride.U.S. Geological Survey, <strong>Mineral</strong> <strong>Commodity</strong> <strong>Summaries</strong>, January <strong>2011</strong>

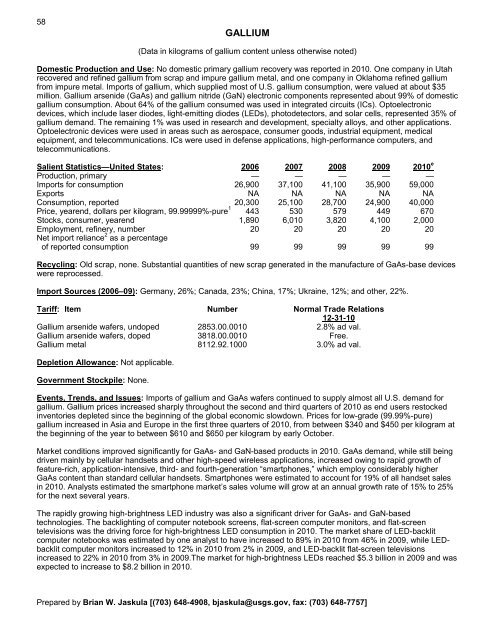

58GALLIUM(Data in kilograms of gallium content unless otherwise noted)Domestic Production <strong>and</strong> Use: No domestic primary gallium recovery was reported in 2010. One company in Utahrecovered <strong>and</strong> refined gallium from scrap <strong>and</strong> impure gallium metal, <strong>and</strong> one company in Oklahoma refined galliumfrom impure metal. Imports of gallium, which supplied most of U.S. gallium consumption, were valued at about $35million. Gallium arsenide (GaAs) <strong>and</strong> gallium nitride (GaN) electronic components represented about 99% of domesticgallium consumption. About 64% of the gallium consumed was used in integrated circuits (ICs). Optoelectronicdevices, which include laser diodes, light-emitting diodes (LEDs), photodetectors, <strong>and</strong> solar cells, represented 35% ofgallium dem<strong>and</strong>. The remaining 1% was used in research <strong>and</strong> development, specialty alloys, <strong>and</strong> other applications.Optoelectronic devices were used in areas such as aerospace, consumer goods, industrial equipment, medicalequipment, <strong>and</strong> telecommunications. ICs were used in defense applications, high-performance computers, <strong>and</strong>telecommunications.Salient Statistics—United States: 2006 2007 2008 2009 2010 eProduction, primary — — — — —Imports for consumption 26,900 37,100 41,100 35,900 59,000Exports NA NA NA NA NAConsumption, reported 20,300 25,100 28,700 24,900 40,000Price, yearend, dollars per kilogram, 99.99999%-pure 1 443 530 579 449 670Stocks, consumer, yearend 1,890 6,010 3,820 4,100 2,000Employment, refinery, number 20 20 20 20 20Net import reliance 2 as a percentageof reported consumption 99 99 99 99 99Recycling: Old scrap, none. Substantial quantities of new scrap generated in the manufacture of GaAs-base deviceswere reprocessed.Import Sources (2006–09): Germany, 26%; Canada, 23%; China, 17%; Ukraine, 12%; <strong>and</strong> other, 22%.Tariff: Item Number Normal Trade Relations12-31-10Gallium arsenide wafers, undoped 2853.00.0010 2.8% ad val.Gallium arsenide wafers, doped 3818.00.0010 Free.Gallium metal 8112.92.1000 3.0% ad val.Depletion Allowance: Not applicable.Government Stockpile: None.Events, Trends, <strong>and</strong> Issues: Imports of gallium <strong>and</strong> GaAs wafers continued to supply almost all U.S. dem<strong>and</strong> forgallium. Gallium prices increased sharply throughout the second <strong>and</strong> third quarters of 2010 as end users restockedinventories depleted since the beginning of the global economic slowdown. Prices for low-grade (99.99%-pure)gallium increased in Asia <strong>and</strong> Europe in the first three quarters of 2010, from between $340 <strong>and</strong> $450 per kilogram atthe beginning of the year to between $610 <strong>and</strong> $650 per kilogram by early October.Market conditions improved significantly for GaAs- <strong>and</strong> GaN-based products in 2010. GaAs dem<strong>and</strong>, while still beingdriven mainly by cellular h<strong>and</strong>sets <strong>and</strong> other high-speed wireless applications, increased owing to rapid growth offeature-rich, application-intensive, third- <strong>and</strong> fourth-generation “smartphones,” which employ considerably higherGaAs content than st<strong>and</strong>ard cellular h<strong>and</strong>sets. Smartphones were estimated to account for 19% of all h<strong>and</strong>set salesin 2010. Analysts estimated the smartphone market’s sales volume will grow at an annual growth rate of 15% to 25%for the next several years.The rapidly growing high-brightness LED industry was also a significant driver for GaAs- <strong>and</strong> GaN-basedtechnologies. The backlighting of computer notebook screens, flat-screen computer monitors, <strong>and</strong> flat-screentelevisions was the driving force for high-brightness LED consumption in 2010. The market share of LED-backlitcomputer notebooks was estimated by one analyst to have increased to 89% in 2010 from 46% in 2009, while LEDbacklitcomputer monitors increased to 12% in 2010 from 2% in 2009, <strong>and</strong> LED-backlit flat-screen televisionsincreased to 22% in 2010 from 3% in 2009.The market for high-brightness LEDs reached $5.3 billion in 2009 <strong>and</strong> wasexpected to increase to $8.2 billion in 2010.Prepared by Brian W. Jaskula [(703) 648-4908, bjaskula@usgs.gov, fax: (703) 648-7757]

- Page 3:

U.S. Department of the InteriorKEN

- Page 6 and 7:

INTRODUCTION3Each chapter of the 20

- Page 8 and 9:

5NET EXPORTS OF MINERALRAW MATERIAL

- Page 10 and 11: SIGNIFICANT EVENTS, TRENDS, AND ISS

- Page 12 and 13: mineral materials valued at $1.30 b

- Page 14 and 15: 11MAJOR METAL-PRODUCING AREASAuB2P1

- Page 16 and 17: 13MAJOR INDUSTRIAL MINERAL-PRODUCIN

- Page 18 and 19: ABRASIVES (MANUFACTURED)15Events, T

- Page 20 and 21: ALUMINUM17The United States continu

- Page 22 and 23: ANTIMONY19Events, Trends, and Issue

- Page 24 and 25: ARSENIC21According to university me

- Page 26 and 27: ASBESTOS23Events, Trends, and Issue

- Page 28 and 29: BARITE25Nationally, the rig count o

- Page 30 and 31: BAUXITE AND ALUMINA27Events, Trends

- Page 32 and 33: BERYLLIUM29Events, Trends, and Issu

- Page 34 and 35: BISMUTH31Events, Trends, and Issues

- Page 36 and 37: BORON33Events, Trends, and Issues:

- Page 38 and 39: BROMINE35Events, Trends, and Issues

- Page 40 and 41: CADMIUM37NiCd battery use in consum

- Page 42 and 43: CEMENT39The manufacture of clinker

- Page 44 and 45: CESIUM41Events, Trends, and Issues:

- Page 46 and 47: CHROMIUM43Stockpile Status—9-30-1

- Page 48 and 49: CLAYS45Tariff: Item Number Normal T

- Page 50 and 51: COBALT47Events, Trends, and Issues:

- Page 52 and 53: COPPER49Events, Trends, and Issues:

- Page 54 and 55: DIAMOND (INDUSTRIAL)51Events, Trend

- Page 56 and 57: DIATOMITE53Events, Trends, and Issu

- Page 58 and 59: FELDSPAR55Feldspar use in tile and

- Page 62 and 63: GALLIUM59In response to the unprece

- Page 64 and 65: GARNET (INDUSTRIAL)61Events, Trends

- Page 66 and 67: GEMSTONES63Events, Trends, and Issu

- Page 68 and 69: GERMANIUM65Events, Trends, and Issu

- Page 70 and 71: GOLD67With the increase in price of

- Page 72 and 73: GRAPHITE (NATURAL)69Events, Trends,

- Page 74 and 75: GYPSUM71Through 2010, more than 3,6

- Page 76 and 77: HELIUM73Events, Trends, and Issues:

- Page 78 and 79: INDIUM75China’s 21 indium produce

- Page 80 and 81: IODINE77Events, Trends, and Issues:

- Page 82 and 83: IRON AND STEEL79Events, Trends, and

- Page 84 and 85: IRON AND STEEL SCRAP81Tariff: Item

- Page 86 and 87: IRON AND STEEL SLAG83Events, Trends

- Page 88 and 89: IRON ORE85In 2009, China imported a

- Page 90 and 91: IRON OXIDE PIGMENTS87Events, Trends

- Page 92 and 93: KYANITE AND RELATED MATERIALS89Even

- Page 94 and 95: LEAD91caused by underground fires a

- Page 96 and 97: LIME93The lime industry is facing p

- Page 98 and 99: LITHIUM95market, and a facility at

- Page 100 and 101: MAGNESIUM COMPOUNDS97In Australia,

- Page 102 and 103: MAGNESIUM METAL99U.S. magnesium con

- Page 104 and 105: MANGANESE101Government Stockpile:St

- Page 106 and 107: MERCURY103Events, Trends, and Issue

- Page 108 and 109: MICA (NATURAL)105Depletion Allowanc

- Page 110 and 111:

MOLYBDENUM107Events, Trends, and Is

- Page 112 and 113:

NICKEL109Nickel prices were adverse

- Page 114 and 115:

NIOBIUM (COLUMBIUM)111Events, Trend

- Page 116 and 117:

NITROGEN (FIXED)—AMMONIA113Accord

- Page 118 and 119:

PEAT115Events, Trends, and Issues:

- Page 120 and 121:

PERLITE117Events, Trends, and Issue

- Page 122 and 123:

PHOSPHATE ROCK119Events, Trends, an

- Page 124 and 125:

PLATINUM-GROUP METALS121Events, Tre

- Page 126 and 127:

POTASH123Events, Trends, and Issues

- Page 128 and 129:

PUMICE AND PUMICITE125Events, Trend

- Page 130 and 131:

QUARTZ CRYSTAL (INDUSTRIAL)127Event

- Page 132 and 133:

RARE EARTHS129Events, Trends, and I

- Page 134 and 135:

RHENIUM131Events, Trends, and Issue

- Page 136 and 137:

RUBIDIUM133Events, Trends, and Issu

- Page 138 and 139:

SALT135Many chefs have advocated us

- Page 140 and 141:

SAND AND GRAVEL (CONSTRUCTION)137Ev

- Page 142 and 143:

SAND AND GRAVEL (INDUSTRIAL)139The

- Page 144 and 145:

SCANDIUM141Scandium’s use in meta

- Page 146 and 147:

SELENIUM143Events, Trends, and Issu

- Page 148 and 149:

SILICON145Events, Trends, and Issue

- Page 150 and 151:

SILVER147Silver was used as a repla

- Page 152 and 153:

SODA ASH149A Wyoming soda ash produ

- Page 154 and 155:

SODIUM SULFATE151Events, Trends, an

- Page 156 and 157:

STONE (CRUSHED)153Events, Trends, a

- Page 158 and 159:

STONE (DIMENSION)155Events, Trends,

- Page 160 and 161:

STRONTIUM157Events, Trends, and Iss

- Page 162 and 163:

SULFUR159World sulfur production in

- Page 164 and 165:

TALC AND PYROPHYLLITE161Events, Tre

- Page 166 and 167:

TANTALUM163Events, Trends, and Issu

- Page 168 and 169:

TELLURIUM165Events, Trends, and Iss

- Page 170:

THALLIUM167Beginning in 2009, there

- Page 173 and 174:

170TIN(Data in metric tons of tin c

- Page 175 and 176:

172TITANIUM AND TITANIUM DIOXIDE 1(

- Page 177 and 178:

174TITANIUM MINERAL CONCENTRATES 1(

- Page 179 and 180:

176TUNGSTEN(Data in metric tons of

- Page 181 and 182:

178VANADIUM(Data in metric tons of

- Page 183 and 184:

180VERMICULITE(Data in thousand met

- Page 185 and 186:

182WOLLASTONITE(Data in metric tons

- Page 187 and 188:

184YTTRIUM 1(Data in metric tons of

- Page 189 and 190:

186ZEOLITES (NATURAL)(Data in metri

- Page 191 and 192:

188ZINC(Data in thousand metric ton

- Page 193 and 194:

190ZIRCONIUM AND HAFNIUM(Data in me

- Page 195 and 196:

192APPENDIX AAbbreviations and Unit

- Page 197 and 198:

194Demonstrated.—A term for the s

- Page 199 and 200:

196Part B—Sources of Reserves Dat

- Page 201:

198Europe and Central Eurasia—con