Foreign Direct Investment in Latin America and the Caribbean 2017

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

This publication sets out and analyses the main foreign direct investment (FDI) trends in the countries of Latin America and the Caribbean. The 2017 edition shows that the region is at a difficult juncture. FDI inflows declined by 7.9% in 2016, to US$ 167.043 billion, representing a cumulative fall of 17.0% since the peak in 2011. The fall in commodity prices continues to affect investments in natural resources, sluggish economic growth in several countries has slowed the flow of market-seeking capital, and the global backdrop of technological sophistication and expansion of the digital economy has concentrated transnational investments in developed economies.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

122 Chapter II Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC)<br />

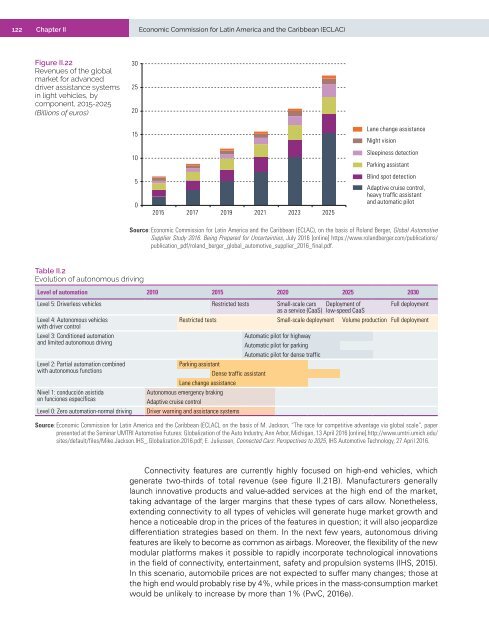

Figure II.22<br />

Revenues of <strong>the</strong> global<br />

market for advanced<br />

driver assistance systems<br />

<strong>in</strong> light vehicles, by<br />

component, 2015-2025<br />

(Billions of euros)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2015 <strong>2017</strong> 2019 2021 2023 2025<br />

Lane change assistance<br />

Night vision<br />

Sleep<strong>in</strong>ess detection<br />

Park<strong>in</strong>g assistant<br />

Bl<strong>in</strong>d spot detection<br />

Adaptive cruise control,<br />

heavy traffic assistant<br />

<strong>and</strong> automatic pilot<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of Rol<strong>and</strong> Berger, Global Automotive<br />

Supplier Study 2016. Be<strong>in</strong>g Prepared for Uncerta<strong>in</strong>ties, July 2016 [onl<strong>in</strong>e] https://www.rol<strong>and</strong>berger.com/publications/<br />

publication_pdf/rol<strong>and</strong>_berger_global_automotive_supplier_2016_f<strong>in</strong>al.pdf.<br />

Table II.2<br />

Evolution of autonomous driv<strong>in</strong>g<br />

Level of automation 2010 2015 2020 2025 2030<br />

Level 5: Driverless vehicles Restricted tests Small-scale cars<br />

as a service (CaaS)<br />

Level 4: Autonomous vehicles<br />

with driver control<br />

Level 3: Conditioned automation<br />

<strong>and</strong> limited autonomous driv<strong>in</strong>g<br />

Level 2: Partial automation comb<strong>in</strong>ed<br />

with autonomous functions<br />

Nivel 1: conducción asistida<br />

en funciones específicas<br />

Level 0: Zero automation-normal driv<strong>in</strong>g<br />

Deployment of<br />

low-speed CaaS<br />

Full deployment<br />

Restricted tests Small-scale deployment Volume production Full deployment<br />

Automatic pilot for highway<br />

Automatic pilot for park<strong>in</strong>g<br />

Automatic pilot for dense traffic<br />

Park<strong>in</strong>g assistant<br />

Dense traffic assistant<br />

Lane change assistance<br />

Autonomous emergency brak<strong>in</strong>g<br />

Adaptive cruise control<br />

Driver warn<strong>in</strong>g <strong>and</strong> assistance systems<br />

Source: Economic Commission for Lat<strong>in</strong> <strong>America</strong> <strong>and</strong> <strong>the</strong> <strong>Caribbean</strong> (ECLAC), on <strong>the</strong> basis of M. Jackson, “The race for competitive advantage via global scale”, paper<br />

presented at <strong>the</strong> Sem<strong>in</strong>ar UMTRI Automotive Futures: Globalization of <strong>the</strong> Auto Industry, Ann Arbor, Michigan, 13 April 2016 [onl<strong>in</strong>e].http://www.umtri.umich.edu/<br />

sites/default/files/Mike.Jackson.IHS_.Globalization.2016.pdf; E. Juliussen, Connected Cars: Perspectives to 2025, IHS Automotive Technology, 27 April 2016.<br />

Connectivity features are currently highly focused on high-end vehicles, which<br />

generate two-thirds of total revenue (see figure II.21B). Manufacturers generally<br />

launch <strong>in</strong>novative products <strong>and</strong> value-added services at <strong>the</strong> high end of <strong>the</strong> market,<br />

tak<strong>in</strong>g advantage of <strong>the</strong> larger marg<strong>in</strong>s that <strong>the</strong>se types of cars allow. None<strong>the</strong>less,<br />

extend<strong>in</strong>g connectivity to all types of vehicles will generate huge market growth <strong>and</strong><br />

hence a noticeable drop <strong>in</strong> <strong>the</strong> prices of <strong>the</strong> features <strong>in</strong> question; it will also jeopardize<br />

differentiation strategies based on <strong>the</strong>m. In <strong>the</strong> next few years, autonomous driv<strong>in</strong>g<br />

features are likely to become as common as airbags. Moreover, <strong>the</strong> flexibility of <strong>the</strong> new<br />

modular platforms makes it possible to rapidly <strong>in</strong>corporate technological <strong>in</strong>novations<br />

<strong>in</strong> <strong>the</strong> field of connectivity, enterta<strong>in</strong>ment, safety <strong>and</strong> propulsion systems (IHS, 2015).<br />

In this scenario, automobile prices are not expected to suffer many changes; those at<br />

<strong>the</strong> high end would probably rise by 4%, while prices <strong>in</strong> <strong>the</strong> mass-consumption market<br />

would be unlikely to <strong>in</strong>crease by more than 1% (PwC, 2016e).